What you pay for your Medicare drugs can change throughout the year.

What you pay for your Medicare drugs can change throughout the year depending on changes in retail drug prices and where you are within the phases or parts of your Medicare Part D prescription drug coverage. And this applies to both stand-alone Medicare Part D plans (PDPs) and Medicare Advantage plans that also include drug coverage (MAPDs).

Changing costs as you move through your Medicare drug coverage.

All Medicare drug plans have phases or parts and you move through these parts of coverage based on your formulary drug purchases.

The parts of Medicare drug coverage include: (1) An initial deductible (some drug plans have a $0 deductible and skip this phase) (2) Initial Coverage (3) Coverage Gap (or Donut Hole) and (4) Catastrophic Coverage (most people do not reach this last phase).

As you move between these parts of your Medicare Part D drug coverage, the cost-sharing for a single formulary drug purchase will also change.

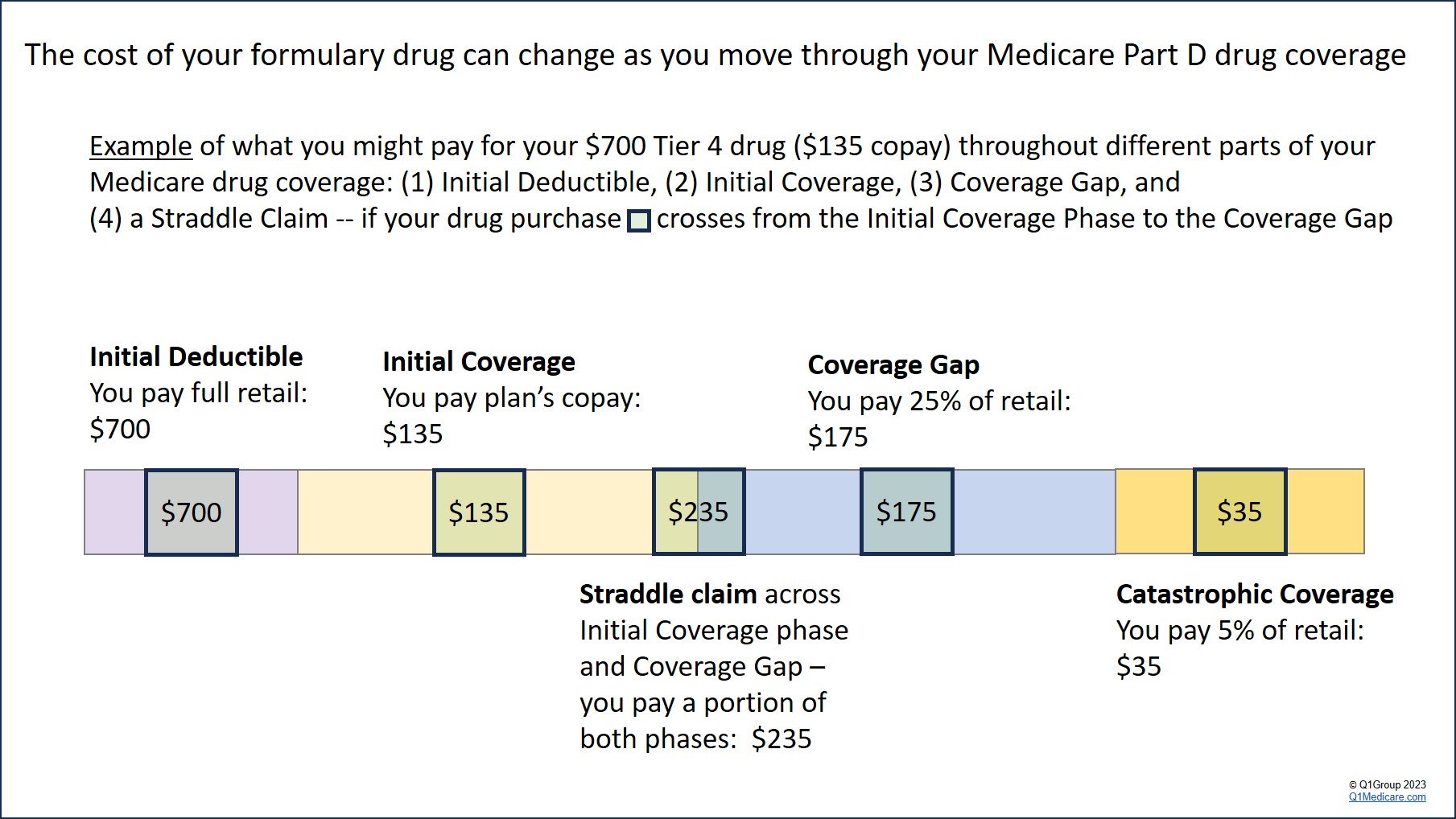

As an example, Imagine you are purchasing a brand-name drug with a normal $700 retail cost and your plan's copay of $135. Here is how your drugs costs will change as you move through your Medicare drug coverage:

(1) Initial Deductible (you pay 100%): $700

(2) Initial Coverage (you pay plan's copay): $135

(3) Coverage Gap (or Donut Hole) (you pay 25% of retail): $175

(4) Catastrophic Coverage (you pay 5% of retail): $35

But wait . . . there is even more uncertainty when your formulary drug purchase crosses between parts of your drug coverage.

As you move across or between parts of your Medicare Part D plan coverage, the cost-sharing for a single formulary drug purchase will be calculated as a “straddle claim” where your cost can be higher than any of the individual stages of coverage.

Changing costs as you move through your Medicare drug coverage.

All Medicare drug plans have phases or parts and you move through these parts of coverage based on your formulary drug purchases.

The parts of Medicare drug coverage include: (1) An initial deductible (some drug plans have a $0 deductible and skip this phase) (2) Initial Coverage (3) Coverage Gap (or Donut Hole) and (4) Catastrophic Coverage (most people do not reach this last phase).

As you move between these parts of your Medicare Part D drug coverage, the cost-sharing for a single formulary drug purchase will also change.

As an example, Imagine you are purchasing a brand-name drug with a normal $700 retail cost and your plan's copay of $135. Here is how your drugs costs will change as you move through your Medicare drug coverage:

(1) Initial Deductible (you pay 100%): $700

(2) Initial Coverage (you pay plan's copay): $135

(3) Coverage Gap (or Donut Hole) (you pay 25% of retail): $175

(4) Catastrophic Coverage (you pay 5% of retail): $35

But wait . . . there is even more uncertainty when your formulary drug purchase crosses between parts of your drug coverage.

As you move across or between parts of your Medicare Part D plan coverage, the cost-sharing for a single formulary drug purchase will be calculated as a “straddle claim” where your cost can be higher than any of the individual stages of coverage.

Some good news: No matter what, your drug cost-sharing will never be more than the full negotiated retail cost of the drug.

The following graphic illustrates how the cost for the same drug can change throughout the plan year - and this is not considering that the retail price of your drug can change at any time.

In this example, assume you are in your Initial Coverage phase, but are close to your Initial Coverage Limit (the point where you cross into the Coverage Gap), you will first pay the Initial Coverage phase cost-sharing for the drug - plus - you will pay 25% of the retail drug price that carries into the Coverage Gap (75% Donut Hole discount).

Using our same example drug, if you are purchasing a brand-name drug with a $135 copay (the drug has a $700 retail cost) – and this year you have already purchased drugs with a retail cost totaling $4,360 – and your plan’s retail coverage limit is $4,660 (you have only $300 until reaching the Coverage Gap) – your cost-sharing will be calculated as adding your copay ($135 in our example) and 25% of the drug’s retail cost that is carrying over into the Coverage Gap.

So, in our example, $300 of the drug’s $700 retail price will meet the

plan’s $4,660 limit with the remaining retail drug cost of $400 ($700 -

$300) carrying over into the Coverage Gap where you get the 75% Donut

Hole discount on this retail balance for an added cost of $100 (25% of

$400).

This means that your total drug cost-sharing for this straddle claim is $235 ($135 + $100).

After this “straddle claim”, your next drug purchase will fall only in the Coverage Gap where you will pay 25% of the full $700 retail drug price or $175 ($700 x 25%).

If you have high prescription drug spending (exceeding the total out-of-pocket spending limit (TrOOP), you will exit the Coverage Gap and enter Catastrophic Coverage where you will pay a maximum of 5% of the retail drug price for any formulary drug. You will stay in this last part of your Medicare drug coverage for the remainder of the year.

Bottom Line: Plan for changing prescription drug costs throughout the year. Your formulary drug costs can change (increase or decrease) as retail drug prices change and as you move through your Medicare drug plan coverage phases:

In our example:

(1) Your drug cost in the Initial Deductible: $700

(2) Your drug cost in the Initial Coverage phase: $135

(3) Your drug cost of with our Straddle Claim example: $235 ($135 + $100)

(4) Your drug cost in the Coverage Gap (Donut Hole): $175

(5) Your drug cost in Catastrophic Coverage: $35

In our example, the example drug retail price of $700 remained the same throughout the year, however, retail drug prices can change at any time (unpredictably) and any increases (or decreases) in retail price will affect our example cost-sharing. For instance, if the price of our drug increases from $700 to $800, your cost in the Initial Deductible, straddle claim, Coverage Gap, and Catastrophic Coverage will all increase.

This means that your total drug cost-sharing for this straddle claim is $235 ($135 + $100).

After this “straddle claim”, your next drug purchase will fall only in the Coverage Gap where you will pay 25% of the full $700 retail drug price or $175 ($700 x 25%).

If you have high prescription drug spending (exceeding the total out-of-pocket spending limit (TrOOP), you will exit the Coverage Gap and enter Catastrophic Coverage where you will pay a maximum of 5% of the retail drug price for any formulary drug. You will stay in this last part of your Medicare drug coverage for the remainder of the year.

Bottom Line: Plan for changing prescription drug costs throughout the year. Your formulary drug costs can change (increase or decrease) as retail drug prices change and as you move through your Medicare drug plan coverage phases:

In our example:

(1) Your drug cost in the Initial Deductible: $700

(2) Your drug cost in the Initial Coverage phase: $135

(3) Your drug cost of with our Straddle Claim example: $235 ($135 + $100)

(4) Your drug cost in the Coverage Gap (Donut Hole): $175

(5) Your drug cost in Catastrophic Coverage: $35

In our example, the example drug retail price of $700 remained the same throughout the year, however, retail drug prices can change at any time (unpredictably) and any increases (or decreases) in retail price will affect our example cost-sharing. For instance, if the price of our drug increases from $700 to $800, your cost in the Initial Deductible, straddle claim, Coverage Gap, and Catastrophic Coverage will all increase.

News Categories

Ask a Pharmacist*

Have questions about your medication?

» Answers to Your Medication Questions, Free!

Available Monday - Friday

8am to 5pm MST

8am to 5pm MST

*A free service included with your no cost drug discount card.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service