How 2024 Medicare Part D drug coverage is changing and will help save on prescription costs.

The Centers for Medicare and

Medicaid Services (CMS) released the "Announcement of Calendar Year (CY) 2024 Medicare Advantage (MA) Capitation Rates and Part C and Part D Payment Policies" (Rate Announcement) on March 31, 2023 that includes the finalized defined standard Part D benefit increases for 2024 Medicare drug plan coverage - and, together with new-for-2024 provisions in the Inflation Reduction Act, here are the key changes to your 2024 Medicare Part D plan coverage.

The Big News . . .

(1) No cost-sharing in the 2024 Catastrophic Coverage phase.

The most important 2024 change may be the introduction of a maximum limit or cap on out-of-pocket drug spending (RxMOOP) for people who exceed the $8,000 out-of-pocket spending threshold (TrOOP). This means that a person with high prescription drug costs will not have any additional cost-sharing for formulary drugs once the 2024 TrOOP threshold is exceeded.

Additionally, people using expensive brand-name formulary drugs will not actually spend the full $8,000.

Because of the credit applied by the drug manufacturer's 70% contribution to the brand-name Donut Hole Discount, a person who uses 100% brand-name drugs will reach their RxMOOP and pay nothing more for formulary drugs when their personal spending totals around $3,333. And based on the CMS estimated mix of brand-name and generic drugs, most people should expect to actually pay no more than $3,429 before reaching the RxMOOP.

(2) 2024 brings an expansion of Medicare Part D Extra Help benefits.

In 2024, qualifications for full Low-Income Subsidy (LIS) benefits will be expanded from 135% of the Federal Poverty Level (FPL) to 150% of FPL (financial resource limits will also apply). In essence, people who would otherwise qualify for only partial 2024 LIS status will qualify for full LIS benefits and the partial LIS benefit level will be eliminated.

(3) Premium Stabilization: The annual increases in the Base Medicare Part D premium will be capped at 6%.

As noted by Medicare: "[b]eginning in [calendar year] 2024, the annual growth in the Base Beneficiary Premium will be capped at 6 percent. The Base Beneficiary Premium for Part D is limited to the lesser of a 6 percent annual increase, or the amount that would otherwise apply under the prior methodology had the IRA not been enacted."

The Part D Base Beneficiary Premium (BBP) is calculated every year by CMS using, in part, the Part D national average monthly premium bid which is weighted by Medicare plan enrollment and is "used to calculate a plan-specific monthly premium for the basic benefit offered by each Part D plan, called the basic Part D premium".

Question: Does the Base Beneficiary Premium tend to increase more than 6% each year?

Historically, no. In practice, only once since 2006 has the annual Medicare Part D Base Beneficiary Premium (BBP) increased over 6%. The 2009 Base premium increased 8.70% to $30.36, over the 2008 BBP of $27.93. As reference the 2023 BBP was calculated as $32.74. However, this new 6% premium cap may reduce sharp premium increases otherwise caused by inflation or drug costs being shifted back on the Medicare Part D plans.

However, as noted by CMS in their July 31, 2023 Fact Sheet "CMS Releases 2024 Projected Medicare Part D Premium and Bid Information":

Question: How does the Part D Base Beneficiary Premium correspond to your actual monthly Medicare Part D plan premium?

In practice, the Part D Base Beneficiary premium may not be reflective of any actual monthly Part D plan premium. As explained by Medicare, "the actual Part D premiums paid by individual beneficiaries equal the base beneficiary premium adjusted by a number of factors. In practice, premiums vary significantly from one Part D plan to another and seldom equal the base beneficiary premium."

The relation of the Base Beneficiary Premium to actual Medicare Part D premiums was explained in more detail by Medicare:

Please note that the Part D Base Beneficiary Premium is not the same as the average basic Medicare Part D premium that CMS reports each year. The 2024 basic Part D premium was estimated in July 2023 as $34.50.

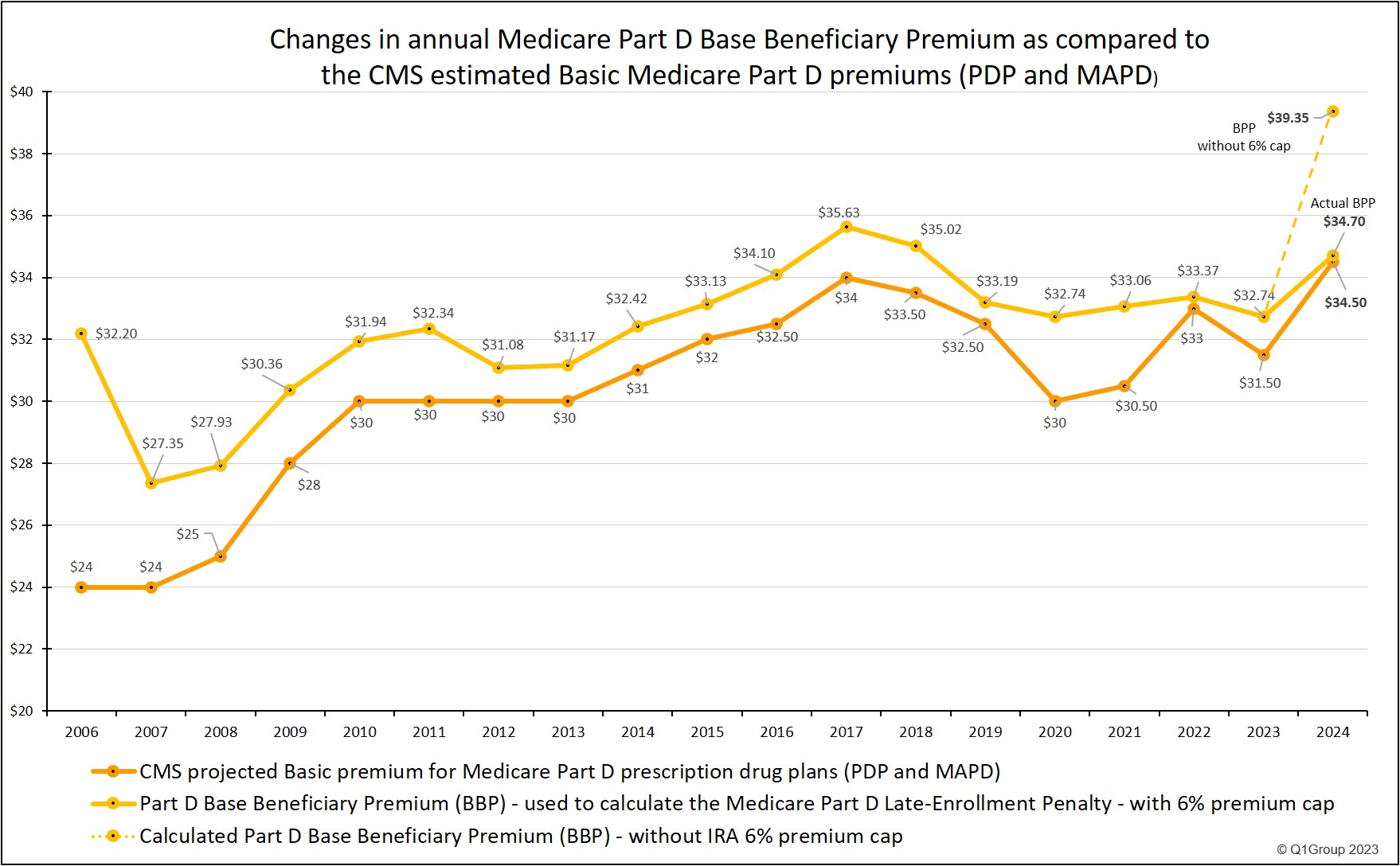

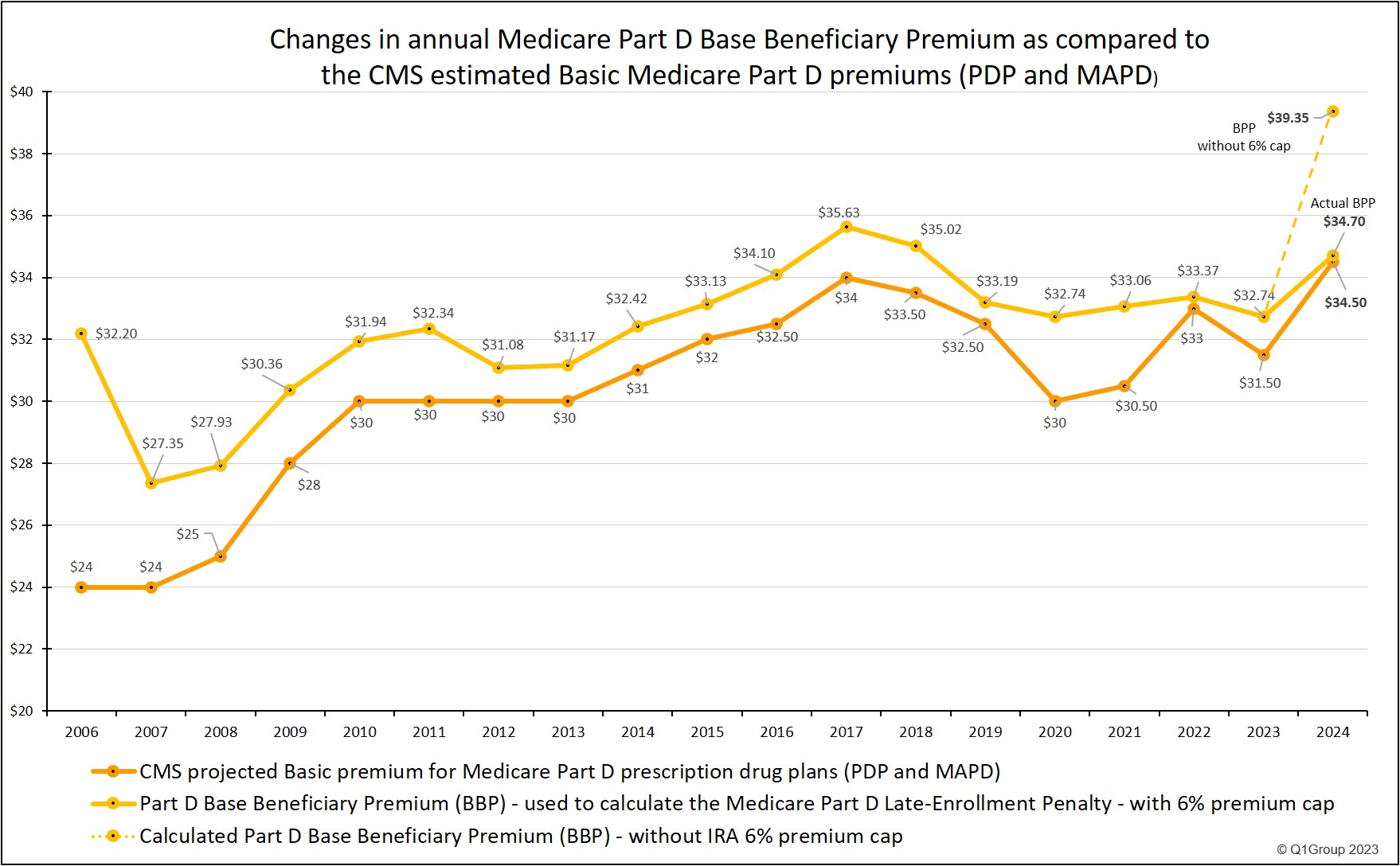

The following chart shows how the estimated monthly Basic Part D premium has changed in comparison with the Medicare Part D Base Beneficiary Premium and how the BBP would have increase in 2024 if the value was not capped at an annual 6% increase.

You can read more about the 2024 projected average basic Medicare Part D premium in our article, "CMS projects a 1.8% decrease in 2024 Medicare prescription drug plan premiums" found at Q1News.com/1007.

(5) Maximum $35 copay for Insulin. Insulin products covered by your 2024 Medicare drug plan will remain at a $35 (or less) copay for a 30-day supply throughout all phases of your Part D coverage.

(6) $0 copay for approved vaccines. Adult vaccines recommended by the Advisory Committee on Immunization Practices (ACIP) will continue to be available at no cost throughout all phases of your Part D coverage.

(7) Increases in all Medicare Part D parameters. The following are the details of the increases in standard 2024 Medicare Part D prescription drug coverage as compared to the current 2023 Part D plan coverage.

-- The standard 2024 Initial Deductible will increase almost 8%.

The 2024 standard deductible will increase $40 to $545 from the current 2023 standard deductible of $505. As reference, the 2022 standard initial deductible was $480.

What this means to you.

The initial deductible is the first phase of your Medicare Part D coverage and is the amount you must pay before your Medicare Part D plan begins to share in the cost of coverage. Although not all Medicare Part D plans have an initial deductible ($0 deductible plans), if you enroll in a Medicare Part D prescription drug plan with a standard deductible, you will spend slightly more out-of-pocket in 2024 before your plan begins to share the cost of your formulary drug purchases.

However, although the majority of Medicare Part D plans in past years have an initial deductible (usually the CMS standard deductible), many popular Medicare Part D plans exclude lower-costing Tier 1 and Tier 2 drugs from the initial deductible, providing plan Members with immediate coverage for lower-costing medications. In addition, all 2024 Medicare drug plans (PDP and MAPD) will cover all formulary insulin products for a maximum copay of $35 per month and approved vaccines for a $0 copay during all phases of Part D coverage (including the plan's deductible).

-- The Initial Coverage Limit will increase almost 8%.

The 2024 Initial Coverage Limit (ICL) will increase $370 to $5,030 from the current 2023 ICL of $4,660 (as reference, the 2022 ICL was 4,430). The Initial Coverage Limit marks the point where you enter the Donut Hole or Coverage Gap and is based on the total negotiated retail value of prescription drug purchases. For example, if you purchase a formulary medication in 2024 with a retail cost of $100, and you pay a $20 copay, the $100 retail drug value counts toward reaching the plan's $5,030 Initial Coverage Limit.

What this means to you.

You may find that you purchase slightly more formulary medications before reaching the 2024 Donut Hole or Coverage Gap (assuming that the retail price of your medications does not increase over time). Again, once you exceed the ICL, you will enter the Coverage Gap.

-- The 2024 Coverage Gap or Donut Hole

Will you enter the 2024 Donut Hole?

If you purchase medications with an average retail value of over $420 per month (based on your current retail drug prices remaining stable), then you will enter the 2024 Donut Hole at some point during the year and receive the 75% Donut Hole discount on all formulary drugs.

The 2024 Donut Hole discount for generic drugs remains at 75%.

If you reach the 2024 Donut Hole or Coverage Gap phase of your Medicare Part D plan coverage, the generic drug discount is 75%. So, your generic formulary drug costs in the Donut Hole will be 25% of your plan's negotiated retail prices and you will receive the cost of the purchase toward exiting the Donut Hole.

What this means to you.

If you are in the 2024 Donut Hole and your generic medication has a retail cost of $100, you will pay only $25 for a refill. And the $25 that you spend for a formulary drug will count toward your 2024 out-of-pocket spending limit (TrOOP) of $8,000.

The Donut Hole discount for brand-name drugs remains at 75%.

The 2024 brand-name drug Donut Hole discount also remains at 75% (you pay 25% of retail costs). The pharmaceutical industry will be responsible for 70% of the cost of medications in the Coverage Gap, therefore you will receive credit for 95% of the retail drug cost toward meeting your 2024 total out-of-pocket maximum or Donut Hole exit point (the 25% of retail costs you pay plus the 70% drug manufacturer discount).

What this means to you.

If you reach the 2024 Donut Hole and purchase a brand-name medication with a retail cost of $100, you will pay $25 for the formulary medication, and receive $95 credit toward meeting your 2024 out-of-pocket spending limit – or Donut Hole exit point.

For more information about how your formulary drug purchases affect your Medicare Part D drug coverage, please see our 2024 Donut Hole calculator to estimate when (or if) you will enter (or exit) the Donut Hole: PDP-Planner.com/2024.

Our Donut Hole Calculator or PDP-Planner is based on the 2024 Medicare Part D standard plan with 25% cost-sharing, and a standard Initial Coverage Limit - you can choose to adjust the plan's deductible and enter your estimated retail drug cost.

-- The amount you need to spend to exit the 2024 Donut Hole (TrOOP) will increase 8%.

Your 2024 Total Out-of-Pocket Cost (TrOOP ) threshold will increase by $600 to $8,000 from the current 2023 TrOOP limit of $7,400.

New for 2024, once you leave the Donut Hole you have no additional formulary drug costs for the remainder of the year.

TrOOP is the actual dollar figure you must spend (or someone else spends on your behalf) to get out of the Donut Hole or Coverage Gap - and in 2024 - once you leave the Donut Hole, you have no additional costs for formulary drugs - for the remainder of 2024.

In short, the 2024 out-of-pocket spending threshold (TrOOP) of $8,000 is the 2024 maximum out-of-pocket spending limit for your formulary drugs (RxMOOP).

What this means to you.

If you reach the 2024 Coverage Gap (exceed your Initial Coverage Limit), you will need to spend slightly more money before exiting the Donut Hole but- once you leave the Donut Hole - you will pay no additional costs ($0) for formulary drugs for the remainder of 2024.

Question: How much will you actually spend to reach the $8,000 out-of-pocket threshold and have no additional formulary drug costs for the remainder of the year?

Between about $3,333 and $8,000. What you actually pay before reaching your Medicare Part D plan's $8,000 out-of-pocket threshold will depend on the mix of generic and brand-name prescriptions you use each year and here are three examples of how your actual costs will vary depending on your prescriptions:

(1) Exiting the Donut Hole when your formulary drug mix is the predicted 92.59% brand drugs and 7.41% generic drugs

Your actual out-of-pocket costs should be around $3,429 if you purchase the predicted mix of generics and brand-name drugs.

Using Medicare's past drug usage estimate*, the average person will have purchases of 92.59% brand drugs and 7.41% generic drugs while in the 2024 Donut Hole.

So, assuming your 2024 Part D plan has a standard $545 deductible and the retail cost of your drugs is about $1,038 per month, you can estimate your actual annual out-of-pocket drug costs to be around $3,429 before meeting the $8,000 TrOOP and exiting the 2024 Donut Hole (this example is not considering the extra 3% added to adjust for vaccines and insulin coverage). CMS estimates that the total retail value of your drug purchases needed to exit the Donut Hole would be around $12,447 (not adjusting for dispensing and vaccine fees).

*Based on past drug purchasing data, CMS estimates that a person will use a mix of 92.59% brand drugs and 7.41% generic drugs while in the 2024 Donut Hole (an increase in estimated brand-name drug use as compared to the 2023 estimated Donut Hole mix of 92.13% brand drugs and 7.87%).

(2) Exiting the Donut Hole when your formulary drug purchases are 100% brand drugs.

Your actual costs should be around $3,333 if you only use brand-name formulary drugs.

Your actual costs should be $8,000 (or equal to the 2024 out-of-pocket threshold) if you only purchase generic formulary drugs.

What this means to you.

You will spend more out-of-pocket to exit the 2024 Donut Hole as compared to 2023. However, unlike past years, you would exit the Donut Hole and have no additional formulary drug costs for the remainder of the year.

Example: Reaching the 2024 prescription maximum out-of-pocket spending limit (RxMOOP) when using only a single, expensive brand-name drug.

If you are using the expensive medication IMBRUVICA 140 MG CAPSULE (90 EA) (NDC: 57962014009), your monthly retail drug costs for just this drug may be over $5,600, so you would exit your Donut Hole or Coverage Gap during your third purchase - and have no additional costs ($0) for the remainder of the year.

In this example of purchasing only one brand-name medication (where you receive 95% of the retail drug price in the Donut Hole toward your $8,000 out-of-pocket threshold), you will reach the $8,000 threshold by spending $3,333 yourself and receiving credit for $4,667 from the drug manufacturer's contribution to the 75% brand-name Donut Hole Discount.

What this means to you.

2024 will bring big savings for anyone purchasing brand-name formulary drugs with a total monthly retail value of over $1,004. Please use our 2024 Donut Hole Calculator or PDP-Planner to check how the 2024 Medicare Part D plan changes will affect you.

Question: Does the new law eliminate the 2024 Catastrophic Coverage phase?

No. The fourth phase of Medicare Part D coverage remains the Catastrophic Coverage phase. However, anyone reaching this last phase of coverage will have no additional costs for formulary drugs - for the remainder of the year. Instead, the cost of any drug purchases during the Catastrophic Coverage phase will be covered by the Medicare Part D plan (20%) and the federal government (80%).

Below is a chart showing how example formulary drug purchases are paid throughout your Medicare Part D plan coverage -- using the CMS defined standard benefit Medicare Part D plan with a fixed 25% co-insurance for calculating cost-sharing.

* 25% co-pay or cost-sharing

** 75% Brand-name Discount

*** 75% Generic Discount

**** In 2024, the Catastrophic Coverage phase will still exist, but a plan member will not have any out-of-pocket costs for formulary drugs after reaching the plan's $8,000 total out-of-pocket threshold (TrOOP).

The Big News . . .

(1) No cost-sharing in the 2024 Catastrophic Coverage phase.

The most important 2024 change may be the introduction of a maximum limit or cap on out-of-pocket drug spending (RxMOOP) for people who exceed the $8,000 out-of-pocket spending threshold (TrOOP). This means that a person with high prescription drug costs will not have any additional cost-sharing for formulary drugs once the 2024 TrOOP threshold is exceeded.

Additionally, people using expensive brand-name formulary drugs will not actually spend the full $8,000.

Because of the credit applied by the drug manufacturer's 70% contribution to the brand-name Donut Hole Discount, a person who uses 100% brand-name drugs will reach their RxMOOP and pay nothing more for formulary drugs when their personal spending totals around $3,333. And based on the CMS estimated mix of brand-name and generic drugs, most people should expect to actually pay no more than $3,429 before reaching the RxMOOP.

(2) 2024 brings an expansion of Medicare Part D Extra Help benefits.

In 2024, qualifications for full Low-Income Subsidy (LIS) benefits will be expanded from 135% of the Federal Poverty Level (FPL) to 150% of FPL (financial resource limits will also apply). In essence, people who would otherwise qualify for only partial 2024 LIS status will qualify for full LIS benefits and the partial LIS benefit level will be eliminated.

(3) Premium Stabilization: The annual increases in the Base Medicare Part D premium will be capped at 6%.

As noted by Medicare: "[b]eginning in [calendar year] 2024, the annual growth in the Base Beneficiary Premium will be capped at 6 percent. The Base Beneficiary Premium for Part D is limited to the lesser of a 6 percent annual increase, or the amount that would otherwise apply under the prior methodology had the IRA not been enacted."

The Part D Base Beneficiary Premium (BBP) is calculated every year by CMS using, in part, the Part D national average monthly premium bid which is weighted by Medicare plan enrollment and is "used to calculate a plan-specific monthly premium for the basic benefit offered by each Part D plan, called the basic Part D premium".

Question: Does the Base Beneficiary Premium tend to increase more than 6% each year?

Historically, no. In practice, only once since 2006 has the annual Medicare Part D Base Beneficiary Premium (BBP) increased over 6%. The 2009 Base premium increased 8.70% to $30.36, over the 2008 BBP of $27.93. As reference the 2023 BBP was calculated as $32.74. However, this new 6% premium cap may reduce sharp premium increases otherwise caused by inflation or drug costs being shifted back on the Medicare Part D plans.

However, as noted by CMS in their July 31, 2023 Fact Sheet "CMS Releases 2024 Projected Medicare Part D Premium and Bid Information":

"In 2024, the premium stabilization provision [of the IRA] reduced the increase in the base beneficiary premium by 14 percentage points; the base beneficiary premium will increase by 6% in 2024 to $34.70 [from the 2023 base premium of $32.74]. Without premium stabilization, the 2024 base beneficiary premium would have been $39.35, or $4.65 higher."(see: https://www.cms.gov/newsroom/fact-sheets/ cms-releases-2024-projected-medicare-part-d-premium- and-bid-information)

Question: How does the Part D Base Beneficiary Premium correspond to your actual monthly Medicare Part D plan premium?

In practice, the Part D Base Beneficiary premium may not be reflective of any actual monthly Part D plan premium. As explained by Medicare, "the actual Part D premiums paid by individual beneficiaries equal the base beneficiary premium adjusted by a number of factors. In practice, premiums vary significantly from one Part D plan to another and seldom equal the base beneficiary premium."

The relation of the Base Beneficiary Premium to actual Medicare Part D premiums was explained in more detail by Medicare:

"In accordance with section 1860D-13(a) of the [Social Security Act], codified in [federal regulations at] 42 CFR §423.286, beneficiary [Part D] premiums are calculated from the following adjustments made to the base beneficiary premium [BBP]:Base (BBP) v. Basic Part D premium and the IRA premium stabilization 6% cap on annual BPP increases

1) the difference between the plan’s standardized bid amount and the national average monthly bid amount;

2) an increase for any supplemental premium;

3) an increase for any late enrollment penalty;

4) a decrease for Medicare Advantage Prescription Drug Plans (MA-PDs) that apply MA A/B rebates to buy down the Part D premium; and elimination or decrease with the application of the low-income premium subsidy." [formatting added]

Please note that the Part D Base Beneficiary Premium is not the same as the average basic Medicare Part D premium that CMS reports each year. The 2024 basic Part D premium was estimated in July 2023 as $34.50.

The following chart shows how the estimated monthly Basic Part D premium has changed in comparison with the Medicare Part D Base Beneficiary Premium and how the BBP would have increase in 2024 if the value was not capped at an annual 6% increase.

You can read more about the 2024 projected average basic Medicare Part D premium in our article, "CMS projects a 1.8% decrease in 2024 Medicare prescription drug plan premiums" found at Q1News.com/1007.

(5) Maximum $35 copay for Insulin. Insulin products covered by your 2024 Medicare drug plan will remain at a $35 (or less) copay for a 30-day supply throughout all phases of your Part D coverage.

(6) $0 copay for approved vaccines. Adult vaccines recommended by the Advisory Committee on Immunization Practices (ACIP) will continue to be available at no cost throughout all phases of your Part D coverage.

(7) Increases in all Medicare Part D parameters. The following are the details of the increases in standard 2024 Medicare Part D prescription drug coverage as compared to the current 2023 Part D plan coverage.

-- The standard 2024 Initial Deductible will increase almost 8%.

The 2024 standard deductible will increase $40 to $545 from the current 2023 standard deductible of $505. As reference, the 2022 standard initial deductible was $480.

What this means to you.

The initial deductible is the first phase of your Medicare Part D coverage and is the amount you must pay before your Medicare Part D plan begins to share in the cost of coverage. Although not all Medicare Part D plans have an initial deductible ($0 deductible plans), if you enroll in a Medicare Part D prescription drug plan with a standard deductible, you will spend slightly more out-of-pocket in 2024 before your plan begins to share the cost of your formulary drug purchases.

However, although the majority of Medicare Part D plans in past years have an initial deductible (usually the CMS standard deductible), many popular Medicare Part D plans exclude lower-costing Tier 1 and Tier 2 drugs from the initial deductible, providing plan Members with immediate coverage for lower-costing medications. In addition, all 2024 Medicare drug plans (PDP and MAPD) will cover all formulary insulin products for a maximum copay of $35 per month and approved vaccines for a $0 copay during all phases of Part D coverage (including the plan's deductible).

-- The Initial Coverage Limit will increase almost 8%.

The 2024 Initial Coverage Limit (ICL) will increase $370 to $5,030 from the current 2023 ICL of $4,660 (as reference, the 2022 ICL was 4,430). The Initial Coverage Limit marks the point where you enter the Donut Hole or Coverage Gap and is based on the total negotiated retail value of prescription drug purchases. For example, if you purchase a formulary medication in 2024 with a retail cost of $100, and you pay a $20 copay, the $100 retail drug value counts toward reaching the plan's $5,030 Initial Coverage Limit.

What this means to you.

You may find that you purchase slightly more formulary medications before reaching the 2024 Donut Hole or Coverage Gap (assuming that the retail price of your medications does not increase over time). Again, once you exceed the ICL, you will enter the Coverage Gap.

-- The 2024 Coverage Gap or Donut Hole

Will you enter the 2024 Donut Hole?

If you purchase medications with an average retail value of over $420 per month (based on your current retail drug prices remaining stable), then you will enter the 2024 Donut Hole at some point during the year and receive the 75% Donut Hole discount on all formulary drugs.

The 2024 Donut Hole discount for generic drugs remains at 75%.

If you reach the 2024 Donut Hole or Coverage Gap phase of your Medicare Part D plan coverage, the generic drug discount is 75%. So, your generic formulary drug costs in the Donut Hole will be 25% of your plan's negotiated retail prices and you will receive the cost of the purchase toward exiting the Donut Hole.

What this means to you.

If you are in the 2024 Donut Hole and your generic medication has a retail cost of $100, you will pay only $25 for a refill. And the $25 that you spend for a formulary drug will count toward your 2024 out-of-pocket spending limit (TrOOP) of $8,000.

The Donut Hole discount for brand-name drugs remains at 75%.

The 2024 brand-name drug Donut Hole discount also remains at 75% (you pay 25% of retail costs). The pharmaceutical industry will be responsible for 70% of the cost of medications in the Coverage Gap, therefore you will receive credit for 95% of the retail drug cost toward meeting your 2024 total out-of-pocket maximum or Donut Hole exit point (the 25% of retail costs you pay plus the 70% drug manufacturer discount).

What this means to you.

If you reach the 2024 Donut Hole and purchase a brand-name medication with a retail cost of $100, you will pay $25 for the formulary medication, and receive $95 credit toward meeting your 2024 out-of-pocket spending limit – or Donut Hole exit point.

For more information about how your formulary drug purchases affect your Medicare Part D drug coverage, please see our 2024 Donut Hole calculator to estimate when (or if) you will enter (or exit) the Donut Hole: PDP-Planner.com/2024.

Our Donut Hole Calculator or PDP-Planner is based on the 2024 Medicare Part D standard plan with 25% cost-sharing, and a standard Initial Coverage Limit - you can choose to adjust the plan's deductible and enter your estimated retail drug cost.

-- The amount you need to spend to exit the 2024 Donut Hole (TrOOP) will increase 8%.

Your 2024 Total Out-of-Pocket Cost (TrOOP ) threshold will increase by $600 to $8,000 from the current 2023 TrOOP limit of $7,400.

New for 2024, once you leave the Donut Hole you have no additional formulary drug costs for the remainder of the year.

TrOOP is the actual dollar figure you must spend (or someone else spends on your behalf) to get out of the Donut Hole or Coverage Gap - and in 2024 - once you leave the Donut Hole, you have no additional costs for formulary drugs - for the remainder of 2024.

In short, the 2024 out-of-pocket spending threshold (TrOOP) of $8,000 is the 2024 maximum out-of-pocket spending limit for your formulary drugs (RxMOOP).

What this means to you.

If you reach the 2024 Coverage Gap (exceed your Initial Coverage Limit), you will need to spend slightly more money before exiting the Donut Hole but- once you leave the Donut Hole - you will pay no additional costs ($0) for formulary drugs for the remainder of 2024.

Question: How much will you actually spend to reach the $8,000 out-of-pocket threshold and have no additional formulary drug costs for the remainder of the year?

Between about $3,333 and $8,000. What you actually pay before reaching your Medicare Part D plan's $8,000 out-of-pocket threshold will depend on the mix of generic and brand-name prescriptions you use each year and here are three examples of how your actual costs will vary depending on your prescriptions:

(1) Exiting the Donut Hole when your formulary drug mix is the predicted 92.59% brand drugs and 7.41% generic drugs

Your actual out-of-pocket costs should be around $3,429 if you purchase the predicted mix of generics and brand-name drugs.

Using Medicare's past drug usage estimate*, the average person will have purchases of 92.59% brand drugs and 7.41% generic drugs while in the 2024 Donut Hole.

So, assuming your 2024 Part D plan has a standard $545 deductible and the retail cost of your drugs is about $1,038 per month, you can estimate your actual annual out-of-pocket drug costs to be around $3,429 before meeting the $8,000 TrOOP and exiting the 2024 Donut Hole (this example is not considering the extra 3% added to adjust for vaccines and insulin coverage). CMS estimates that the total retail value of your drug purchases needed to exit the Donut Hole would be around $12,447 (not adjusting for dispensing and vaccine fees).

*Based on past drug purchasing data, CMS estimates that a person will use a mix of 92.59% brand drugs and 7.41% generic drugs while in the 2024 Donut Hole (an increase in estimated brand-name drug use as compared to the 2023 estimated Donut Hole mix of 92.13% brand drugs and 7.87%).

(2) Exiting the Donut Hole when your formulary drug purchases are 100% brand drugs.

Your actual costs should be around $3,333 if you only use brand-name formulary drugs.

(3) Exiting the Donut Hole when your formulary drug purchases are 100% generic drugs.

Your actual costs should be $8,000 (or equal to the 2024 out-of-pocket threshold) if you only purchase generic formulary drugs.

What this means to you.

You will spend more out-of-pocket to exit the 2024 Donut Hole as compared to 2023. However, unlike past years, you would exit the Donut Hole and have no additional formulary drug costs for the remainder of the year.

Example: Reaching the 2024 prescription maximum out-of-pocket spending limit (RxMOOP) when using only a single, expensive brand-name drug.

If you are using the expensive medication IMBRUVICA 140 MG CAPSULE (90 EA) (NDC: 57962014009), your monthly retail drug costs for just this drug may be over $5,600, so you would exit your Donut Hole or Coverage Gap during your third purchase - and have no additional costs ($0) for the remainder of the year.

In this example of purchasing only one brand-name medication (where you receive 95% of the retail drug price in the Donut Hole toward your $8,000 out-of-pocket threshold), you will reach the $8,000 threshold by spending $3,333 yourself and receiving credit for $4,667 from the drug manufacturer's contribution to the 75% brand-name Donut Hole Discount.

What this means to you.

2024 will bring big savings for anyone purchasing brand-name formulary drugs with a total monthly retail value of over $1,004. Please use our 2024 Donut Hole Calculator or PDP-Planner to check how the 2024 Medicare Part D plan changes will affect you.

Question: Does the new law eliminate the 2024 Catastrophic Coverage phase?

No. The fourth phase of Medicare Part D coverage remains the Catastrophic Coverage phase. However, anyone reaching this last phase of coverage will have no additional costs for formulary drugs - for the remainder of the year. Instead, the cost of any drug purchases during the Catastrophic Coverage phase will be covered by the Medicare Part D plan (20%) and the federal government (80%).

Below is a chart showing how example formulary drug purchases are paid throughout your Medicare Part D plan coverage -- using the CMS defined standard benefit Medicare Part D plan with a fixed 25% co-insurance for calculating cost-sharing.

|

Beginning January 1, 2024 When you purchase a Part D formulary medication with a $100 retail cost |

||||||

| Retail Cost | You Pay | Your Medicare drug plan pays |

Pharma Mfgr. pays |

Federal Govern. pays |

Amount counting toward your TrOOP Threshold |

|

| Initial Deductible | $100 | $100 | $0 | $0 | $0 | $100 |

| Initial Coverage phase * | $100 | $25 | $75 | $0 | $0 | $25 |

| Coverage Gap - brand-name ** | $100 | $25 | $5 | $70 | $0 | $95 |

| Coverage Gap - generic *** | $100 | $25 | $75 | $0 | $0 | $25 |

| Catastrophic Coverage (brand drug) **** | $100 | $0 | $20 | $0 | $80 | n/a |

| Catastrophic Coverage (generic drug) **** | $100 | $0 | $20 | $0 | $80 | n/a |

* 25% co-pay or cost-sharing

** 75% Brand-name Discount

*** 75% Generic Discount

**** In 2024, the Catastrophic Coverage phase will still exist, but a plan member will not have any out-of-pocket costs for formulary drugs after reaching the plan's $8,000 total out-of-pocket threshold (TrOOP).

How Medicare Part D plan coverage has changed over the years

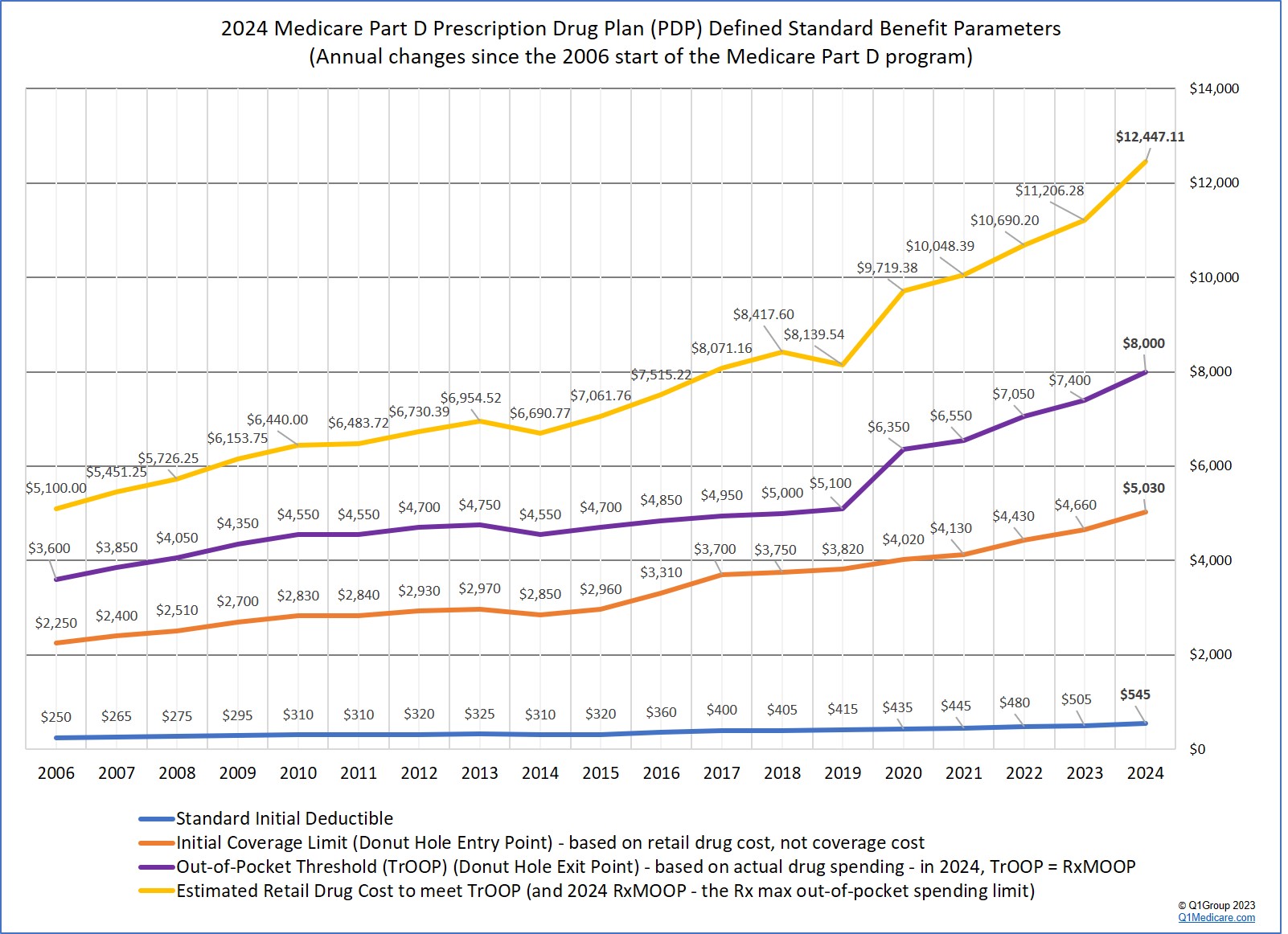

As an overview, the following graph shows the 2024 Medicare Part D plan parameters and how standard Medicare Part D plan coverage has changed since the 2006 beginning of the Medicare Part D program.

Please note: the "Estimated Retail Drug Cost to meet TrOOP" value of $12,447.11 is estimated on the purchase of formulary drugs made up of 92.59% brand-name drugs and 7.41% generic drugs (based on historical purchasing trends). In addition, as noted by CMS in the 2024 Announcement, "[t]here is a 3 percent adjustment for the estimated total covered Part D spending at catastrophic for applicable beneficiaries. This adjustment . . . [is] to account for the fact that beneficiaries take a longer time to reach the catastrophic phase threshold when they pay less cost sharing for insulins and vaccines (no more than a $35 copay per month’s supply of each covered insulin product and a $0 copay on ACIP-recommended adult vaccines) under the 2024 defined standard benefit."

In other words, the $12,447.11 estimate retail value of the formulary drug purchases needed for reaching the $8,000 TrOOP has been slightly inflated by 3%.

The Medicare Part D parameters shown in the chart above is for people who are not eligible for the Medicare Part D Low-Income Subsidy (LIS) or Extra Help program.

Question: Why is the Medicare Part D Defined Standard Benefit important?

Each year, CMS publishes the Medicare Part D benefit parameters for the "Defined Standard Benefit" and Medicare Part D plans use this information to determine minimum Part D drug plan coverage for the up-coming plan year.

You can use these same CMS parameters as a preview of how your Medicare Part D prescription drug plan coverage may change in January 2024 (for example, if you currently pay a $505 deductible, your deductible in 2024 may be $545).

Actual 2024 Medicare Part D plan options and benefit details will be available for your review beginning October 1, 2023 and you can make 2024 plan changes during the fall annual Open Enrollment Period (AEP) (October 15th through December 7th).

Question: Will all 2024 Medicare Part D prescription drug plans follow these new plan limits?

No. The Medicare Part D defined standard benefit parameters only set minimum standards for next year’s Medicare Part D prescription drug plan coverage. And although some Medicare Part D plans exactly mirror the CMS standard defined benefits, Medicare Part D plans are allowed to deviate from the defined standard benefits and offer Medicare Part D prescription drug plans with more enhanced features such as offering: a lower or $0 initial deductible (instead of the standard $545 deductible), fixed copays for different drug tiers (instead of a fixed 25% co-insurance), lower Initial Coverage Limits, or supplemental drug coverage in the Coverage Gap (in addition to the Donut Hole discount).

So your actual 2024 Medicare Part D plan may include all - or part of the plan parameters as published in the CMS defined standard benefit - but all Medicare Part D plans are approved by CMS and should provide coverage at least as good, if not better, than the annual defined standard benefits.

Question: How will these changes in 2024 Medicare Part D plan coverage affect you?

Although 2024 Medicare Part D plans are permitted to deviate in structure from the CMS proposed standards and provide even more enhanced coverage, you can still use these proposed CMS figures to approximate your 2024 prescription drug budget - and how your spending will change throughout the plan year. And to assist you with your calculations, you can use our 2024 Donut Hole calculator (found at PDP-Planner.com/2024) to estimate your out-of-pocket spending based on the CMS standard defined Medicare Part D parameters and your current percentage mix of generic and brand-name drugs. (As a note, based on historical information, CMS is estimating that in 2024, people will use a personal mix of 7.41% generics and 92.59% brand drugs.)

Still not sure how your drug spending will impact your 2024 Medicare Part D plan coverage?

As noted above, to help you visualize how your current drug spending relates to your Medicare Part D plan coverage, we have our updated 2024 Donut Hole calculator online at: PDP-Planner.com/2024.

Our Donut Hole calculator helps you estimate what you can expect to pay throughout the different phases of your 2024 Medicare Part D plan coverage. We have several options for you to choose the percentage of generic and brand drugs you use and you can even change your mix of prescriptions to be 100% generic or 100% brand.

To get you started, you can click here to see an example of the 2024 Medicare prescription drug plan phases for someone with $800 per month brand drug retail cost and has the standard $545 deductible.

(Spoiler alert: If the retail cost of your formulary brand-name medications is $800 per month, you can expect to spend about $2,809 out-of-pocket in 2024 - assuming a $545 deductible and an average brand-name cost-sharing of 25% of retail and the CMS estimated mix of brand and generic drugs - and not including monthly premiums).

Note: Our Donut Hole calculations vs. the CMS cost estimate:

Please note, as shown in the examples above, our estimated cost using our Donut Hole Calculator is slightly different than the CMS total retail drug cost estimate. The variation between our calculations and CMS is because of rounding differences and the consideration of small "dispensing" and "vaccine administration fees" that are being used in the CMS calculation - and also the newly introduced insulin and vaccine adjustments. As noted in the CMS 2024 Announcement:

References:

https://www.cms.gov/files/document/2023-advance-notice.pdf

https://www.cms.gov/files/document/2023-announcement.pdf

https://www.cms.gov/files/document/2024-advance-notice.pdf

https://www.cms.gov/files/document/2024-advance-notice-faq.pdf

https://www.cms.gov/oact/tr

https://www.cms.gov/newsroom/news-alert/ cms-releases-2023-projected-medicare-basic-part-d-average-premium

https://www.cms.gov/files/document/july-29-2022-parts-c-d-announcement.pdf

https://www.cms.gov/Medicare/Health-Plans/MedicareAdvtgSpecRateStats/downloads/ ptcd2006_20050809.pdf

Each year, CMS publishes the Medicare Part D benefit parameters for the "Defined Standard Benefit" and Medicare Part D plans use this information to determine minimum Part D drug plan coverage for the up-coming plan year.

You can use these same CMS parameters as a preview of how your Medicare Part D prescription drug plan coverage may change in January 2024 (for example, if you currently pay a $505 deductible, your deductible in 2024 may be $545).

Actual 2024 Medicare Part D plan options and benefit details will be available for your review beginning October 1, 2023 and you can make 2024 plan changes during the fall annual Open Enrollment Period (AEP) (October 15th through December 7th).

Question: Will all 2024 Medicare Part D prescription drug plans follow these new plan limits?

No. The Medicare Part D defined standard benefit parameters only set minimum standards for next year’s Medicare Part D prescription drug plan coverage. And although some Medicare Part D plans exactly mirror the CMS standard defined benefits, Medicare Part D plans are allowed to deviate from the defined standard benefits and offer Medicare Part D prescription drug plans with more enhanced features such as offering: a lower or $0 initial deductible (instead of the standard $545 deductible), fixed copays for different drug tiers (instead of a fixed 25% co-insurance), lower Initial Coverage Limits, or supplemental drug coverage in the Coverage Gap (in addition to the Donut Hole discount).

So your actual 2024 Medicare Part D plan may include all - or part of the plan parameters as published in the CMS defined standard benefit - but all Medicare Part D plans are approved by CMS and should provide coverage at least as good, if not better, than the annual defined standard benefits.

Question: How will these changes in 2024 Medicare Part D plan coverage affect you?

Although 2024 Medicare Part D plans are permitted to deviate in structure from the CMS proposed standards and provide even more enhanced coverage, you can still use these proposed CMS figures to approximate your 2024 prescription drug budget - and how your spending will change throughout the plan year. And to assist you with your calculations, you can use our 2024 Donut Hole calculator (found at PDP-Planner.com/2024) to estimate your out-of-pocket spending based on the CMS standard defined Medicare Part D parameters and your current percentage mix of generic and brand-name drugs. (As a note, based on historical information, CMS is estimating that in 2024, people will use a personal mix of 7.41% generics and 92.59% brand drugs.)

Still not sure how your drug spending will impact your 2024 Medicare Part D plan coverage?

As noted above, to help you visualize how your current drug spending relates to your Medicare Part D plan coverage, we have our updated 2024 Donut Hole calculator online at: PDP-Planner.com/2024.

Our Donut Hole calculator helps you estimate what you can expect to pay throughout the different phases of your 2024 Medicare Part D plan coverage. We have several options for you to choose the percentage of generic and brand drugs you use and you can even change your mix of prescriptions to be 100% generic or 100% brand.

To get you started, you can click here to see an example of the 2024 Medicare prescription drug plan phases for someone with $800 per month brand drug retail cost and has the standard $545 deductible.

(Spoiler alert: If the retail cost of your formulary brand-name medications is $800 per month, you can expect to spend about $2,809 out-of-pocket in 2024 - assuming a $545 deductible and an average brand-name cost-sharing of 25% of retail and the CMS estimated mix of brand and generic drugs - and not including monthly premiums).

Note: Our Donut Hole calculations vs. the CMS cost estimate:

Please note, as shown in the examples above, our estimated cost using our Donut Hole Calculator is slightly different than the CMS total retail drug cost estimate. The variation between our calculations and CMS is because of rounding differences and the consideration of small "dispensing" and "vaccine administration fees" that are being used in the CMS calculation - and also the newly introduced insulin and vaccine adjustments. As noted in the CMS 2024 Announcement:

"There is a 3 percent adjustment for the estimated total covered Part D spending at catastrophic for applicable beneficiaries. This adjustment has been updated from the 9 percent adjustment in the CY 2024 Advance Notice to account for the fact that beneficiaries take a longer time to reach the catastrophic phase threshold when they pay less cost sharing for insulins and vaccines (no more than a $35 copay per month’s supply of each covered insulin product and a $0 copay on ACIP-recommended adult vaccines) under the 2024 defined standard benefit."

References:

https://www.cms.gov/files/document/2023-advance-notice.pdf

https://www.cms.gov/files/document/2023-announcement.pdf

https://www.cms.gov/files/document/2024-advance-notice.pdf

https://www.cms.gov/files/document/2024-advance-notice-faq.pdf

https://www.cms.gov/oact/tr

https://www.cms.gov/newsroom/news-alert/ cms-releases-2023-projected-medicare-basic-part-d-average-premium

https://www.cms.gov/files/document/july-29-2022-parts-c-d-announcement.pdf

https://www.cms.gov/Medicare/Health-Plans/MedicareAdvtgSpecRateStats/downloads/ ptcd2006_20050809.pdf

News Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service