Q1Medicare.com - Latest Medicare News

Latest News

-

Apr, 29 2024 — The April 2024 Medicare Part D plan drug list updates include ten (10) newly-introduced generics and eight (8) newly-introduced brand-name drugs. There are a total of 67 new ndcs representing 47 different drugs.

-

Apr, 29 2024 — The April 2024 Medicare Part D formulary updates included 67 new drug codes or NDCs representing 47 different medications. The NDC uniquely identifies a particular manufacturer, drug-strength, a . . .

-

Apr, 28 2024 — In some cases you can change Medicare plans outside of the annual Open Enrollment Period (AEP) and the Medicare Advantage OEP (MAOEP) if you can find a Special Enrollment Period.

-

Jan, 27 2024 — If you are eligible for Medicare and having difficulties paying for your prescription drugs, you may want to learn more about the Medicare Part D Extra-Help program by calling or visiting a local stat . . .

-

Jan, 13 2024 — The 2024 Federal Poverty Level (FPL) Guidelines determine the income level requirements for people applying for the Medicare Part D Low-Income Subsidy (LIS) program, also known as the "Extra Help" program that helps pay Medicare prescription drug costs.

-

Jan, 10 2024 — The Centers for Medicare & Medicaid Services (CMS) released a compilation of the BIN and PCN values for each 2024 Medicare Part D plan sponsor. Please note, the data below is Part 1 of 6 (E3 . . .

-

Jan, 10 2024 — The Centers for Medicare & Medicaid Services (CMS) released a compilation of the BIN and PCN values for each 2024 Medicare Part D plan sponsor. Please note, the data below is Part 2 of 6 (H2 . . .

-

Jan, 10 2024 — The Centers for Medicare & Medicaid Services (CMS) released a compilation of the BIN and PCN values for each 2024 Medicare Part D plan sponsor. Please note, the data below is Part 3 of 6 (H3 . . .

-

Jan, 10 2024 — The Centers for Medicare & Medicaid Services (CMS) released a compilation of the BIN and PCN values for each 2024 Medicare Part D plan sponsor. Please note, the data below is Part 4 of 6 (H5 . . .

-

Jan, 10 2024 — The Centers for Medicare & Medicaid Services (CMS) released a compilation of the BIN and PCN values for each 2024 Medicare Part D plan sponsor. Please note, the data below is Part 5 of 6 (H6 . . .

-

Jan, 10 2024 — The Centers for Medicare & Medicaid Services (CMS) released a compilation of the BIN and PCN values for each 2024 Medicare Part D plan sponsor. Please note, the data below is Part 6 of 6 (H9 . . .

-

Jan, 05 2024 — A number of provision included in the “Inflation Reduction Act” (IRA) will continue to positively impact 2024 Medicare Part D prescription drug plan coverage including: No cost f . . .

-

Dec, 14 2023 — The Centers for Medicare and Medicaid Services (CMS) released the 2024 Rate Announcement with the finalized 2024 defined standard benefits for Medicare Part D plans along with highlights of cost-saving measures especially for Medicare beneficiaries with high prescription costs.

Dec, 14 2023 — The Centers for Medicare and Medicaid Services (CMS) released the 2024 Rate Announcement with the finalized 2024 defined standard benefits for Medicare Part D plans along with highlights of cost-saving measures especially for Medicare beneficiaries with high prescription costs. -

Nov, 27 2023 — The 2024 annual Medicare Open Enrollment Period (AEP) ends December 7th. After December 7th, most people will only have a limited opportunity to change their 2024 Medicare prescription drug plan coverage before next year’s 2025 AEP.

Nov, 27 2023 — The 2024 annual Medicare Open Enrollment Period (AEP) ends December 7th. After December 7th, most people will only have a limited opportunity to change their 2024 Medicare prescription drug plan coverage before next year’s 2025 AEP. -

Nov, 07 2023 — (1) Question: How do I change my Medicare Part D or Medicare Advantage plan? You simply enroll in your selected 2024 Medicare plan. Your current 2023 Medicare plan will be automaticall . . .

Most Viewed News

-

Aug, 16 2023 — A number of changes are included in the Inflation Reduction Act of 2022 impacting future Medicare Part D prescription drug plan coverage.

-

Jan, 14 2023 — The 2023 Federal Poverty Level (FPL) Guidelines determine the income level requirements for people applying for the Medicare Part D Low-Income Subsidy (LIS) program, also known as the "Extra Help" program that helps pay Medicare prescription drug costs

-

Jul, 29 2022 — CMS released the 2023 low-income subsidy (LIS) Benchmark premiums for Medicare Part D plans on July 29, 2022. In 2023, seven regions will lower their LIS benchmark premium, one will remain the same, and 26 regions will increase their benchmark premium.

-

Sep, 28 2022 — Most people will see a slight decrease in their 2023 IRMAA payments. However, due to the annual inflation adjustments, people with MAGI at the bottom of a bracket last year will now be at the to . . .

Sep, 28 2022 — Most people will see a slight decrease in their 2023 IRMAA payments. However, due to the annual inflation adjustments, people with MAGI at the bottom of a bracket last year will now be at the to . . . -

Apr, 04 2022 — On April 4, 2022, the Centers for Medicare and Medicaid Services (CMS) released the 2023 Rate Announcement with the 2023 defined standard benefits for Medicare Part D providing an insight into next year's basic Medicare prescription drug plan coverage.

Apr, 04 2022 — On April 4, 2022, the Centers for Medicare and Medicaid Services (CMS) released the 2023 Rate Announcement with the 2023 defined standard benefits for Medicare Part D providing an insight into next year's basic Medicare prescription drug plan coverage. -

Jan, 27 2024 — If you are eligible for Medicare and having difficulties paying for your prescription drugs, you may want to learn more about the Medicare Part D Extra-Help program by calling or visiting a local stat . . .

-

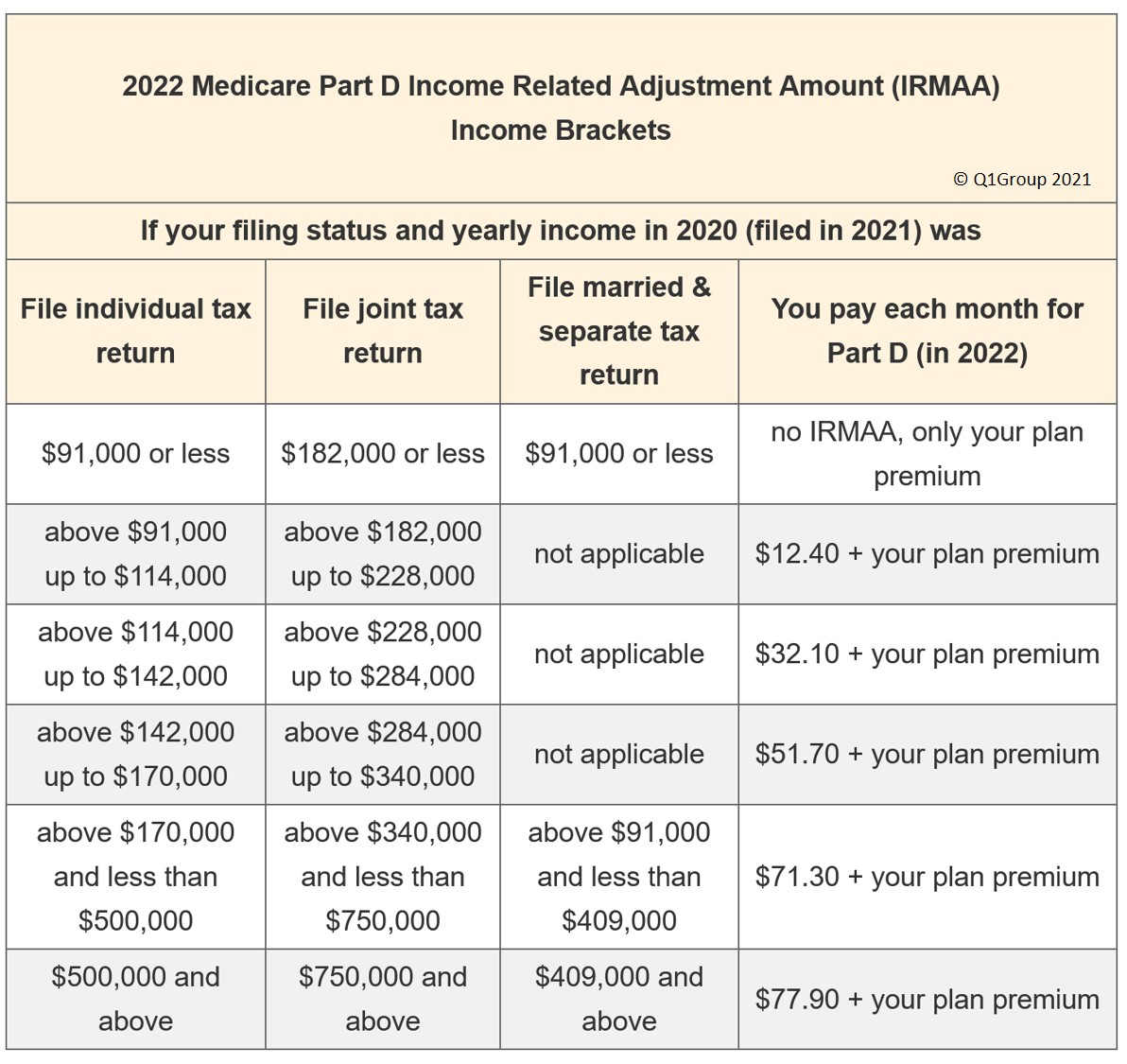

Nov, 13 2021 — Since 2020, the Income-Related Monthly Adjustment

Amount (IRMAA) income brackets are inflation adjusted. Consequently, people with an annual income under $170,000 who are at the low end of thei . . .

Nov, 13 2021 — Since 2020, the Income-Related Monthly Adjustment

Amount (IRMAA) income brackets are inflation adjusted. Consequently, people with an annual income under $170,000 who are at the low end of thei . . . -

Jul, 29 2021 — CMS released the 2022 low-income premium subsidy amounts (or Benchmark premiums) for Medicare Part D plans on July 29, 2021. In 2022, two regions will lower their Medicare Part D Low-Income Subsidy (LIS) benchmark premiums and 32 regions will increase their benchmark premium.

Jul, 29 2021 — CMS released the 2022 low-income premium subsidy amounts (or Benchmark premiums) for Medicare Part D plans on July 29, 2021. In 2022, two regions will lower their Medicare Part D Low-Income Subsidy (LIS) benchmark premiums and 32 regions will increase their benchmark premium. -

Jan, 16 2022 — The 2022 Federal Poverty Level (FPL) Guidelines determine the income level requirements for people applying for the Medicare Part D Low-Income Subsidy (LIS) program, also known as the "Extra Help" program that helps pay Medicare prescription drug costs

-

Jan, 16 2021 — On January 15, 2021, the Centers for Medicare and Medicaid Services (CMS) released the final 2022 Announcement that included the 2022 defined standard benefits for Medicare Part D prescription drug plan coverage.

Jan, 16 2021 — On January 15, 2021, the Centers for Medicare and Medicaid Services (CMS) released the final 2022 Announcement that included the 2022 defined standard benefits for Medicare Part D prescription drug plan coverage. -

Jul, 30 2020 — CMS released the 2021 low-income premium subsidy amounts (or Benchmark premiums) for Medicare Part D plans on July 29, 2020. In 2021, four regions will lower their Medicare Part D Low-Income Subsidy (LIS) benchmark premiums and 30 regions will increase their benchmark premium.

Jul, 30 2020 — CMS released the 2021 low-income premium subsidy amounts (or Benchmark premiums) for Medicare Part D plans on July 29, 2020. In 2021, four regions will lower their Medicare Part D Low-Income Subsidy (LIS) benchmark premiums and 30 regions will increase their benchmark premium. -

Nov, 06 2020 — The Income-Related Monthly Adjustment Amount (IRMAA) income brackets became inflation adjusted in 2020. Consequently, people with an annual income under $165,000 who are at the low end of their . . .

-

Mar, 07 2022 — Update 12/24/2022: 2023 BIN and PCN available at Q1News.com/989 -- see first page (E0654 - H2134), second page (H2161 - H3655), third page (H3660 - H5355), fourth page (H5372 - H7220), fifth page . . .

-

Jan, 15 2021 — The 2021 Federal Poverty Level (FPL) Guidelines determine the income level requirements for people applying for the Medicare Part D Low-Income Subsidy (LIS) program, also known as the "Extra Help" program that helps pay Medicare prescription drug costs.

News Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service