A Private Fee-for-Service (or PFFS) plan is a type of Medicare Advantage plan that may have no established network of healthcare providers allowing you to visit any Medicare-approved doctor or hospital that accepts both Medicare and the Medicare Advantage plan’s terms and conditions.

However, if you join a PFFS plan that has an established healthcare network, you can also see any of the

network providers who have agreed to always treat plan members.

Like other Medicare Advantage plans, your plan may provide you with extra or supplemental benefits that Original Medicare doesn’t cover such as dental, vision, health club memberships, or hearing aid coverage. The insurance company that operates the PFFS Medicare Advantage plan determines what it will pay - rather than Medicare making the decision. You may pay more or less for Medicare-covered benefits.

The key is that a PFFS plan may not have an established healthcare network or have an established network and allow you to visit providers outside the network, if the provider accepts the plan's terms and conditions.

On the positive side, members of a PFFS can visit any doctor or hospital that accepts Medicare and the terms and conditions of the Medicare PFFS plan. However, a non-network doctor or hospital can decide on a visit-by-visit or patient-by-patient basis, whether they wish to accept your PFFS plan coverage.

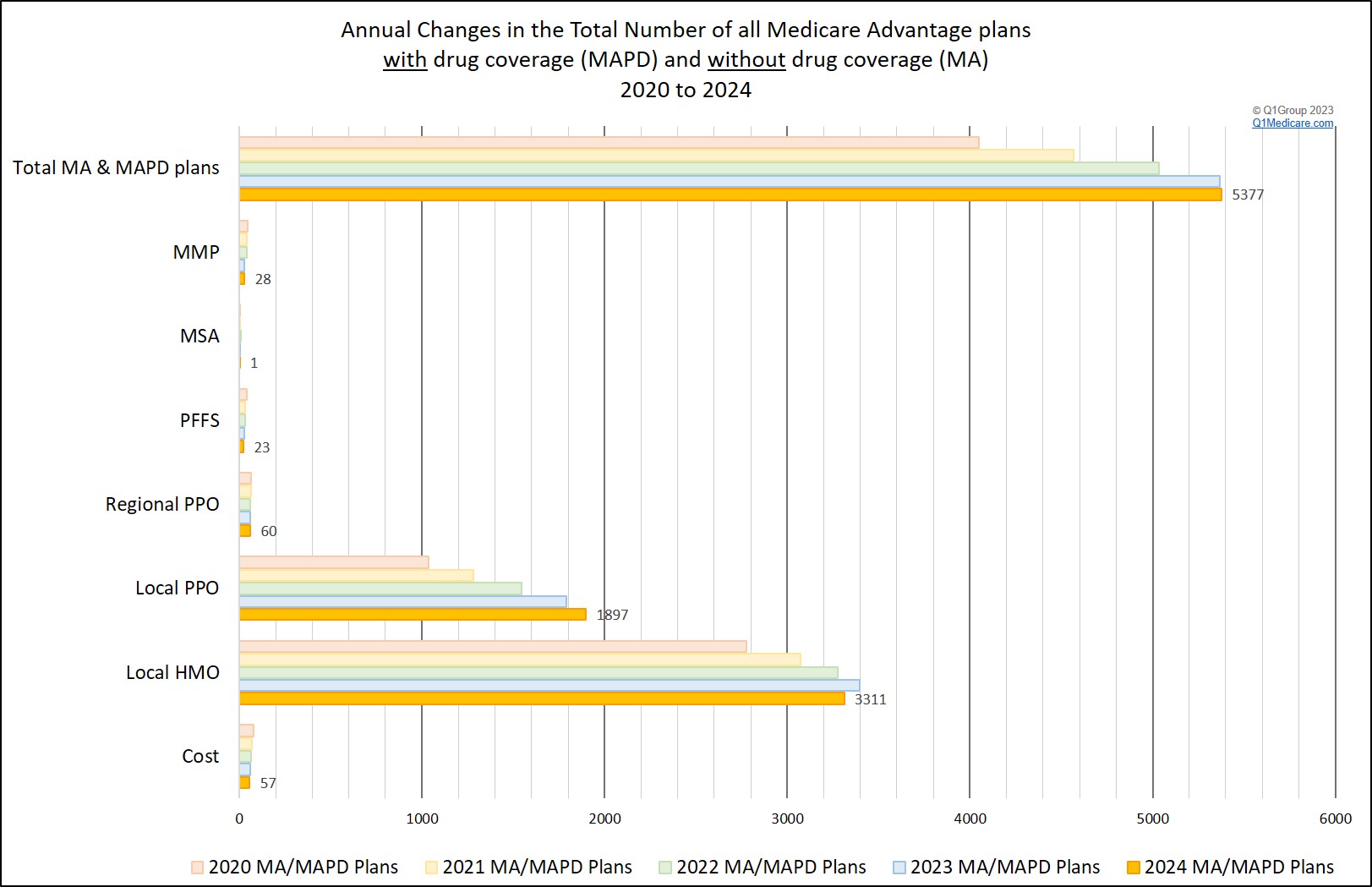

The continued decrease of PFFS plans.

Since first introduced, the number of PFFS plans has shrunk as Medicare requires a Medicare Advantage plan to use the plan's existing healthcare network whenever it is available. So, in counties where a company offered both Medicare Advantage HMO and PFFS Medicare Advantage plans, the company may have merged the two plans into the existing HMO network.

For example, in 2024, there are only 23 PFFS plans available across the country out of a nationwide total of 5,377 Medicare Advantage plans - as compared to 41 PFFS plans in 2020 out of 4,047 Medicare Advantage plans.

If I join a Medicare Advantage Private-Fee-For-Service plan . . .

Question: Can I get my health care from any doctor, other health care provider, or hospital?

Yes. You can go to any Medicare-approved doctor, other health care provider, or hospital that accepts the plan's payment terms and agrees to treat you. Not all providers will. If you join a PFFS plan that has a network, you can also see any of the network providers who have agreed to always treat plan members. You can also choose an out-of-network doctor, hospital, or other provider, who accepts the plan's terms, but you may pay more.

Question: Are prescription drugs covered?

Sometimes. Your PFFS Medicare Advantage plan can be a Medicare Advantage plan that includes Part D drug coverage (MAPD) - or a Medicare Advantage plan without drug coverage (MA). If you PFFS MA plan does not offer drug coverage, you are permitted to join a stand-alone Medicare Part D prescription drug plan (PDP) to get coverage. To see all Medicare Part D plans in your state you can use our Medicare Part D Plan Finder (PDP-Finder.com) - to start, just click on your state.

Question: Do I need to choose a primary care doctor?

No. You can visit any doctor that accepts Medicare and the PFFS plan's terms and conditions.

Question: Do I have to get a referral to see a specialist?

No.

Question: Can a healthcare provider accept my PFFS plan on one visit and not accept the same plan on another visit?

Maybe. As noted above, a (non-network) doctor or hospital can decide on a visit-by-visit or patient-by-patient basis, whether they wish to accept your PFFS plan coverage. So, it is possible that your Medicare Advantage PFFS plan is accepted during one visit and not accepted for a subsequent visit. However, the PFFS plan may have an established healthcare network with healthcare providers who "have agreed to treat the plan members". (See p. 65, 2021 Medicare & You Handbook.)

- PFFS plans are not the same as your Original Medicare Part A and Part B coverage or a Medigap plan (Medicare Supplement).

- The PFFS plan decides how much you must pay for services.

- Some PFFS plans may contract with a network of providers who agree to always treat you, even if you have never seen them before.

- Doctors, hospitals, and other providers may decide not to treat you, even if you have seen them before.

- For each visit or service you get, you must make sure your

doctors, hospitals, and other providers agree to accept tour PFFS plan

and accept the plan's payment terms.

- In a medical emergency, doctors, hospitals, and other providers must treat you.

- If you need more information about the PFFS Medicare Advantage

plan coverage, please check with the plan and review the plan

documentation. You can find the plan's member services telephone number

by clicking on the "benefits & contact info" button without

Medicare Advantage Plan Finder located at MA-Finder.com - to begin, just enter your Zip Code and click the green button or choose your state and then country.

references include: annual Medicare & You Handbook

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service