The availability of Part B "Giveback" Medicare Advantage plans has been increasing over the past years and in 2024, over 3,000 counties (or ZIP code areas) include at least one Medicare Advantage plan with a Part B premium “Giveback” with the amount of the give-backs ranging from $0.10 up to $164.90.

In comparison, in 2021, about 2,600 counties (or ZIP code areas) include at least one Medicare Advantage plan with a Part B “Give Back” or refund (equating to about 9,500 unique plan/county combinations of different 2021 Medicare Advantage plans) with the amount of the give-backs ranging from $0.10 up to $144.60.

Reminders about the availability of Medicare Advantage "Giveback" plans:

-

Plans can vary ZIP-to-ZIP - Even with the same-named Medicare Advantage plan, your Part B give back will depend on

where you live. This means that you may find that

the same-named Medicare Advantage plan in one county (or ZIP) will rebate a

higher amount of the Medicare Part B premium or offer no Part B premium

rebate at all.

For example, if you enroll in the 2024 WellCare Giveback (HMO) as a residents of Brevard County, Florida, you will receive a $131 rebate toward your 2024 Medicare Part B premium (or a Part B premium reduction of $131). However, if you live further north in St. Johns County, Florida, you will find the same named 2024 WellCare Giveback (HMO), but the Part B "give back" or premium reduction is $116 instead of the $131 as found in Brevard County.

- Plans can vary year-to-year - A Medicare Advantage plan located in a specific county may keep the same Part B rebate year-to-year or change the amount of the rebate. For example, some plans give back the full Part B premium.

Question: How to find a Part B Giveback Medicare Advantage plan in my area?

Our Medicare Advantage Plan Finder "Giveback Filter" Our Medicare Advantage Plan Finder (MA-Finder.com/Giveback/32903) shows all Medicare Advantage plans across the country and includes the Medicare Part B premium rebate information for all participating Medicare Advantage plans.

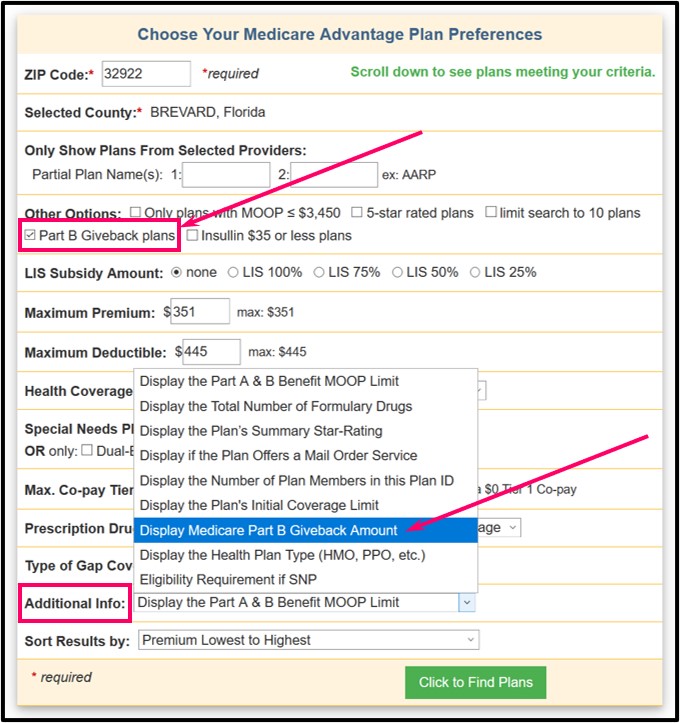

To help you review any Medicare plans in your area with a "Part B Giveback", we have added a "filter" to our Medicare Advantage plan search fields so that you can select "Part B Giveback plans" - and you can also select: "Display Medicare Part B Giveback Amount" in the "Additional Info" or right column of the search results chart -- or you can just use the shortcut link by change the ZIP code to your ZIP code (MA-Finder.com/Giveback/32903).

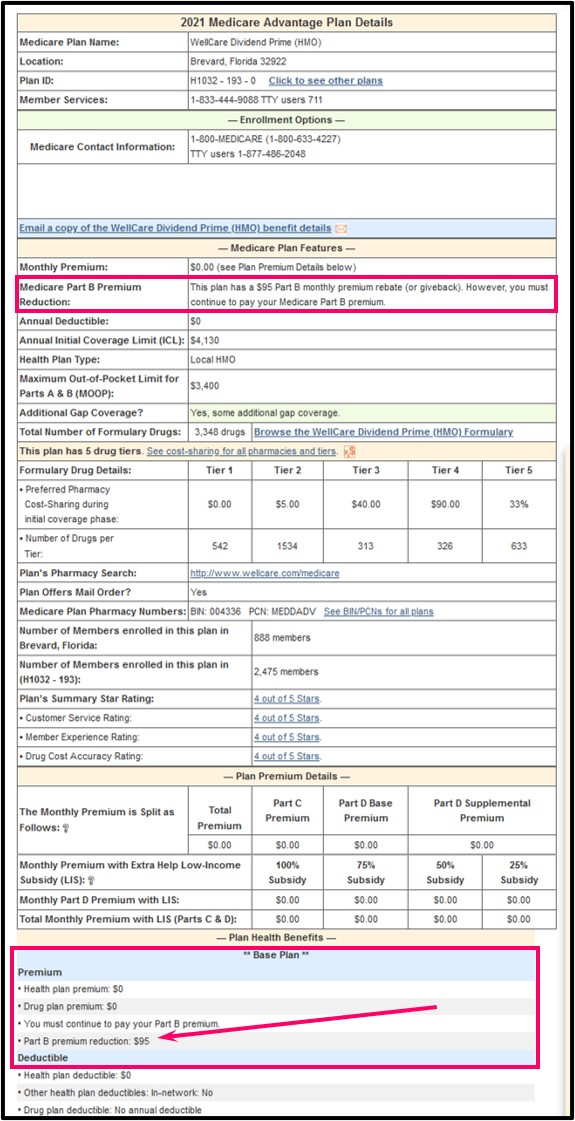

Then once you choose a Medicare Advantage plan, you can click on the plan name to review the plan coverage benefits and see more information on plan coverage, including the Medicare Part B Giveback amount. such as "Part B premium reduction: . . . $95".

Should you need more information, we include (at the top of the page) the plan's toll-free Member Services number so you can telephone the plan and speak with a representative about the plan.

To get you started, you can click here to see a Brevard County, Florida example of the 2024 WellCare Giveback (HMO) plan that has a $0 premium, $545 drug deductible, $0 co-pay for some generics – and “gives back” $131 of your Medicare Part B premium each month (or a $95 Part B Premium Reduction).

In your plan's documentation. You can call your Medicare Advantage plan's Member Services department to have a printed copy of the Annual Notice of Change (ANOC) or Summary of Benefits or Evidence of Coverage (EOC) document mailed to you - or ask a Member Services representative how you can download an electronic copy (PDF) of the documents from the plan's website.

For example, in the "WellCare Dividend (HMO) Annual Notice of Changes [ANOC] for 2020", you can find a chart stating:

"Monthly premium (You must also continue to pay your Medicare Part B premium.)" with "$0.00 and WellCare will reduce your Medicare Part B premium by $40.00 each month".

Please note that this example is for the Part B rebate specifically for the WellCare Dividend (HMO) H1032 223003 FL (H1032, Plan 223) - as noted above, if you have the same WellCare Dividend plan in a different county, you may have a different Part B rebate or giveback depending on your plan or where you live.

(As reference, see: https://wellcare.com/en/florida/members/medicare-plans-2020/wellcare-dividend-hmo-223-003 and for 2021, please see: https://wellcare.com/en/florida/members/medicare-plans-2021/wellcare-dividend-prime-hmo-193)

Question: How long will Social Security need to adjust my Medicare Part B premium with the "give back"?

1-3 months. It may take your Medicare Advantage plan (and Social Security Administration) a few months to begin the Part B premium rebate.

But after the first Medicare Part B premium rebate payment, then your

monthly Social Security checks should then show a regular increase

reflecting the monthly Medicare Part B premium ($144.60 in 2020 or

whatever premium or portion of premium you paid in that year).

Question: How will I get my Part B rebate or "give back" if I do not collect Social Security benefits?

Your Medicare Part B refund, give-back, or "Dividend" repayment

depends on how your Medicare Part B premium is paid: whether premiums

are withheld from your Social Security check or whether you pay Part B

premiums directly. As you may find something noted in your Medicare

Advantage plan literature such as:

"For 202[x], [Your Medicare plan] will reduce your monthly Medicare Part B Premium by [$xx.00]. The reduction is set up by Medicare and administered through the Social Security Administration (SSA). Depending on how you pay your Medicare Part B premium, your reduction may be credited to your Social Security check or credited on your Medicare Part B premium statement. Reductions may take several months to be issued; however, you will receive a full credit."So, if you pay your Part B premium directly (not by automatic Social Security check deduction), you will see that your Part B premium statement has been updated with the rebate or "give back" amount credited to what you owe.

- No enrollment fee and no limits on usage

- Everyone in your household can use the same card, including your pets

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service