What is the Medicare Part D Initial Coverage Limit (ICL)?

Most Medicare Part D prescription drug plans have four different parts

of coverage: (1) the Initial Deductible (in some plans), (2) the Initial

Coverage phase, (3) the Coverage Gap (Donut Hole), and (4) Catastrophic

Coverage.

Depending on the phase of coverage, you move through these four parts of your Medicare Part D prescription drug coverage based on either the amount of money you spend or the retail value of your prescription drug purchases.

Most Medicare beneficiaries never leave their drug plan's Initial Coverage phase (Part 2).

In fact, only about 10% of all Medicare beneficiaries enrolled in a Medicare drug plan will purchase formulary drugs with a high retail value that will push them into the Coverage Gap (Part 3) and maybe into Catastrophic Coverage (Part 4).

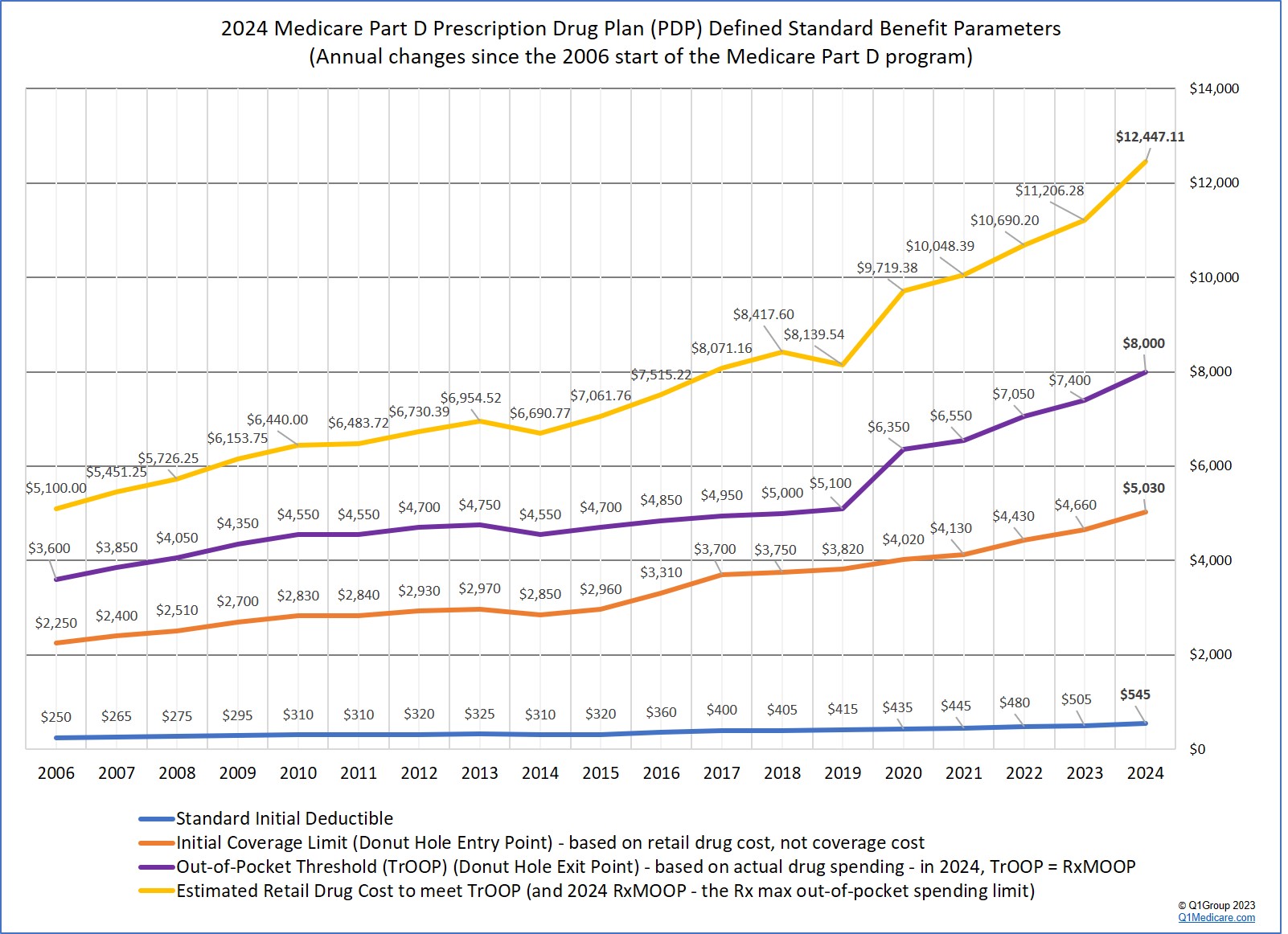

The Initial Coverage Limit is a fixed dollar amount $4,660 in 2023 ($5,030 in 2024) that acts as the "boundary" between the second part of your Medicare Part D plan or the Initial Coverage phase (where you and your drug plan share the cost of your drug purchases) and the third part of your plan, the Coverage Gap (where you receive a 75% Donut Hole discount on all formulary drugs). Please keep in mind that your monthly premiums do not count toward reaching your Initial Coverage Limit.

Although the Initial Coverage Limit (ICL) has a standard amount, drug plans can offer a variation on the standard ICL - and the ICL changes (usually increases) every year.

The Initial Coverage Limit is not met based on what you spend, but rather, the actual retail value of the formulary drugs you purchase.

So let's say you purchase a brand-name drug with a retail cost of $1,000, but only pay the $47 copay, the $1,000 counts toward meeting your plan's ICL, not your flat fee of $47.

Therefore, the Initial Coverage Limit is the total retail value of formulary drugs (generic drugs or brand-name drugs) you can buy before leaving your plan's Initial Coverage phase and entering your Medicare Part D plan's Donut Hole or Coverage Gap - and is shown in the graphic below of the four phases of Medicare Part D coverage. Again, when your total retail drug costs exceed the ICL, you cross into the Coverage Gap (Donut Hole).

The Good News: You do not need to calculate or track your total spending (TrOOP) or how close you are to your plan's ICL.

Your Medicare Part D plan will keep track of your formulary drug purchases via their network pharmacies. Pharmacies are in real-time communication with your drug plan and can calculate the cost-sharing for your purchase based on your total spending. You can also see your total retail drug costs on your monthly Explanation of Benefits letter or statement.

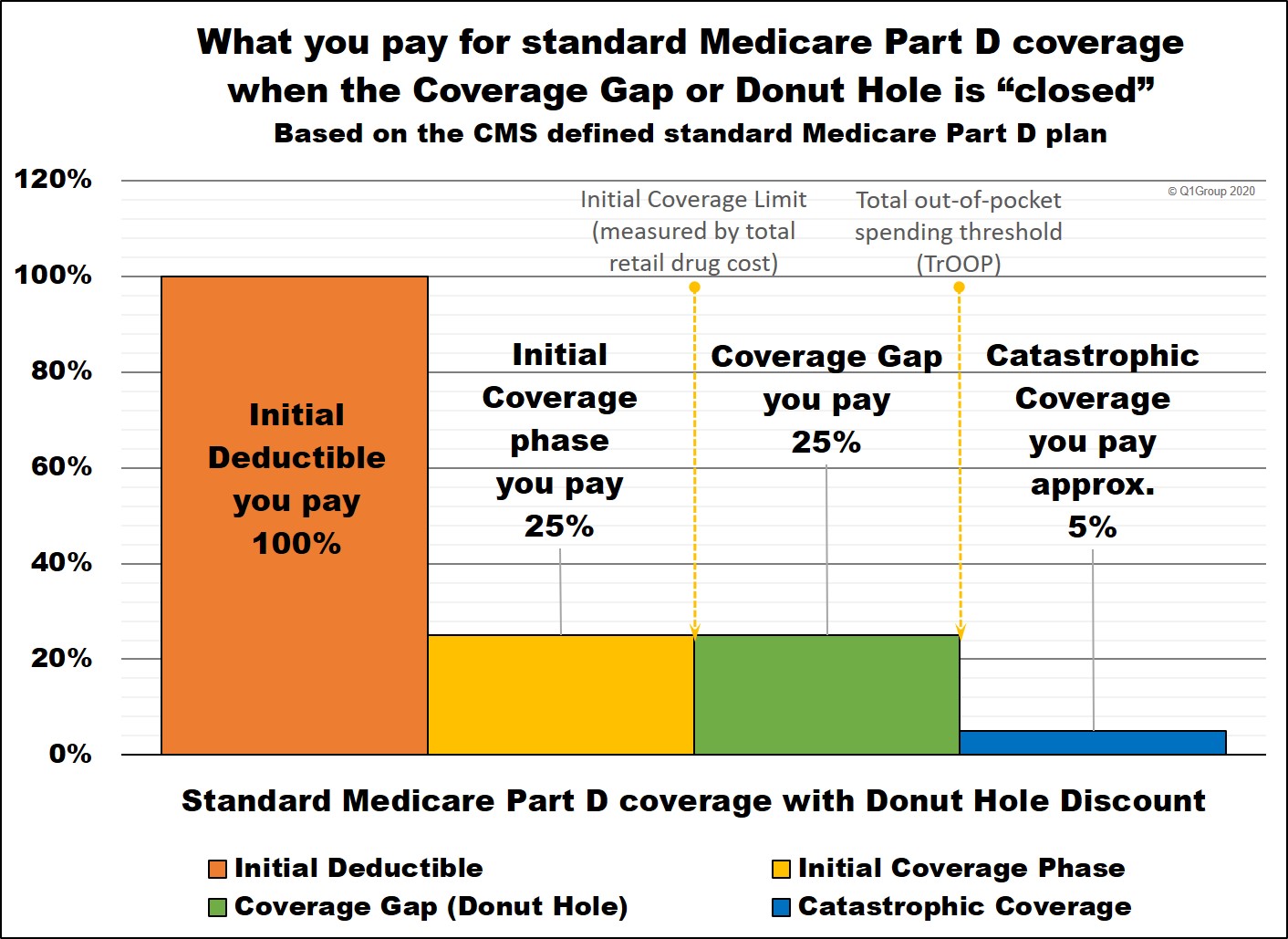

2023 Medicare Part D coverage

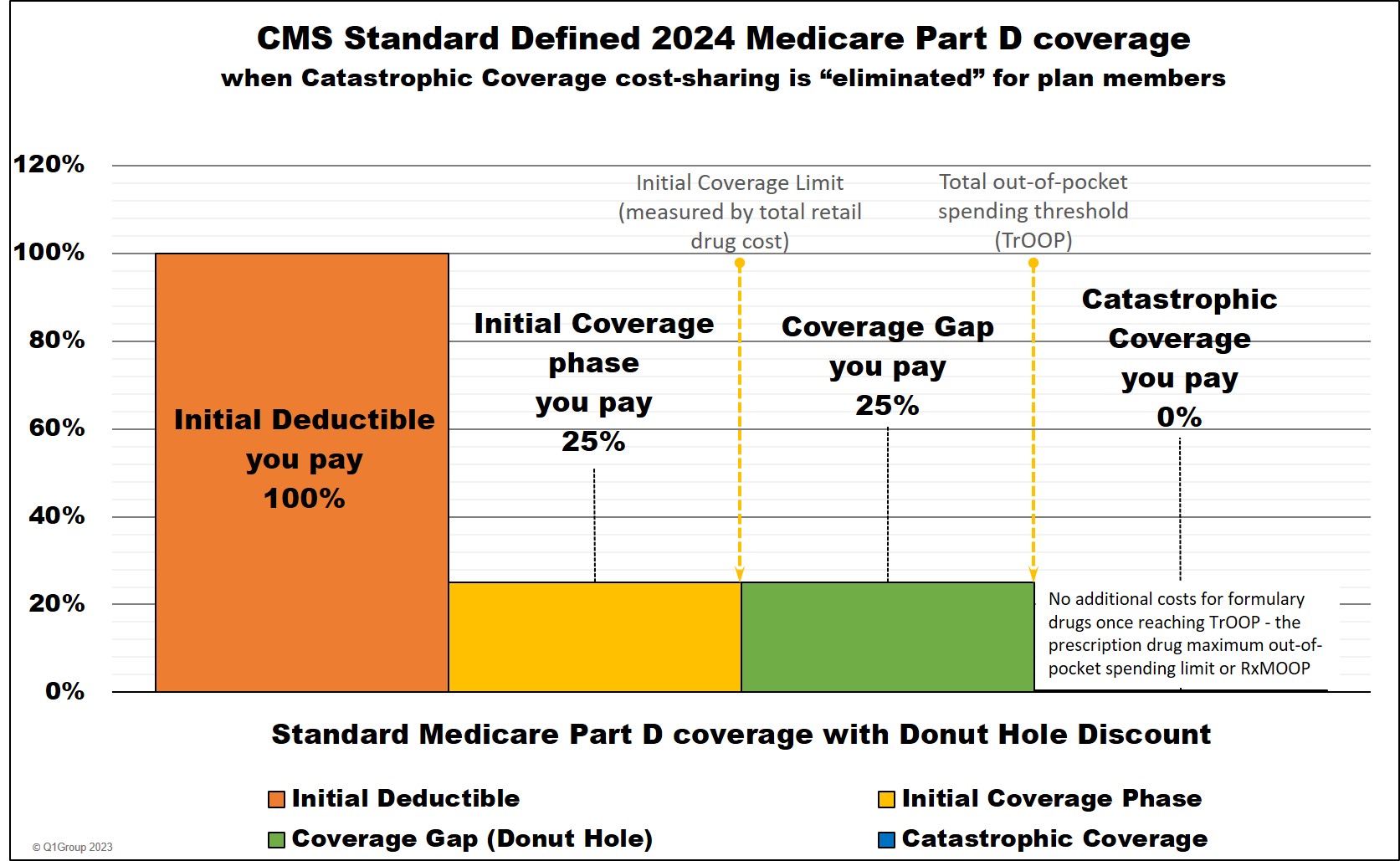

2024 Medicare Part D coverage

Depending on the phase of coverage, you move through these four parts of your Medicare Part D prescription drug coverage based on either the amount of money you spend or the retail value of your prescription drug purchases.

Most Medicare beneficiaries never leave their drug plan's Initial Coverage phase (Part 2).

In fact, only about 10% of all Medicare beneficiaries enrolled in a Medicare drug plan will purchase formulary drugs with a high retail value that will push them into the Coverage Gap (Part 3) and maybe into Catastrophic Coverage (Part 4).

The Initial Coverage Limit is a fixed dollar amount $4,660 in 2023 ($5,030 in 2024) that acts as the "boundary" between the second part of your Medicare Part D plan or the Initial Coverage phase (where you and your drug plan share the cost of your drug purchases) and the third part of your plan, the Coverage Gap (where you receive a 75% Donut Hole discount on all formulary drugs). Please keep in mind that your monthly premiums do not count toward reaching your Initial Coverage Limit.

Although the Initial Coverage Limit (ICL) has a standard amount, drug plans can offer a variation on the standard ICL - and the ICL changes (usually increases) every year.

The Initial Coverage Limit is not met based on what you spend, but rather, the actual retail value of the formulary drugs you purchase.

So let's say you purchase a brand-name drug with a retail cost of $1,000, but only pay the $47 copay, the $1,000 counts toward meeting your plan's ICL, not your flat fee of $47.

Therefore, the Initial Coverage Limit is the total retail value of formulary drugs (generic drugs or brand-name drugs) you can buy before leaving your plan's Initial Coverage phase and entering your Medicare Part D plan's Donut Hole or Coverage Gap - and is shown in the graphic below of the four phases of Medicare Part D coverage. Again, when your total retail drug costs exceed the ICL, you cross into the Coverage Gap (Donut Hole).

The Good News: You do not need to calculate or track your total spending (TrOOP) or how close you are to your plan's ICL.

Your Medicare Part D plan will keep track of your formulary drug purchases via their network pharmacies. Pharmacies are in real-time communication with your drug plan and can calculate the cost-sharing for your purchase based on your total spending. You can also see your total retail drug costs on your monthly Explanation of Benefits letter or statement.

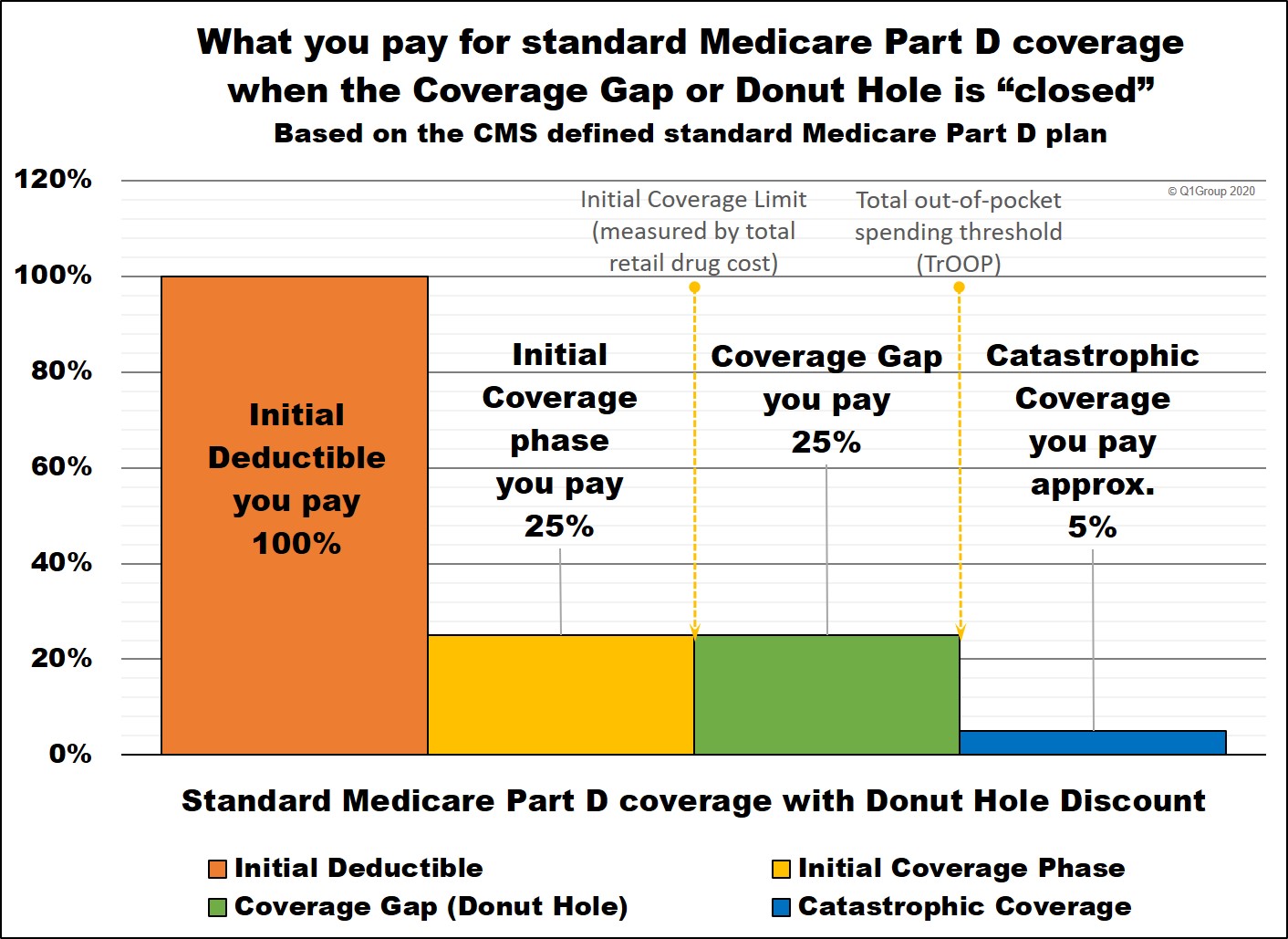

2023 Medicare Part D coverage

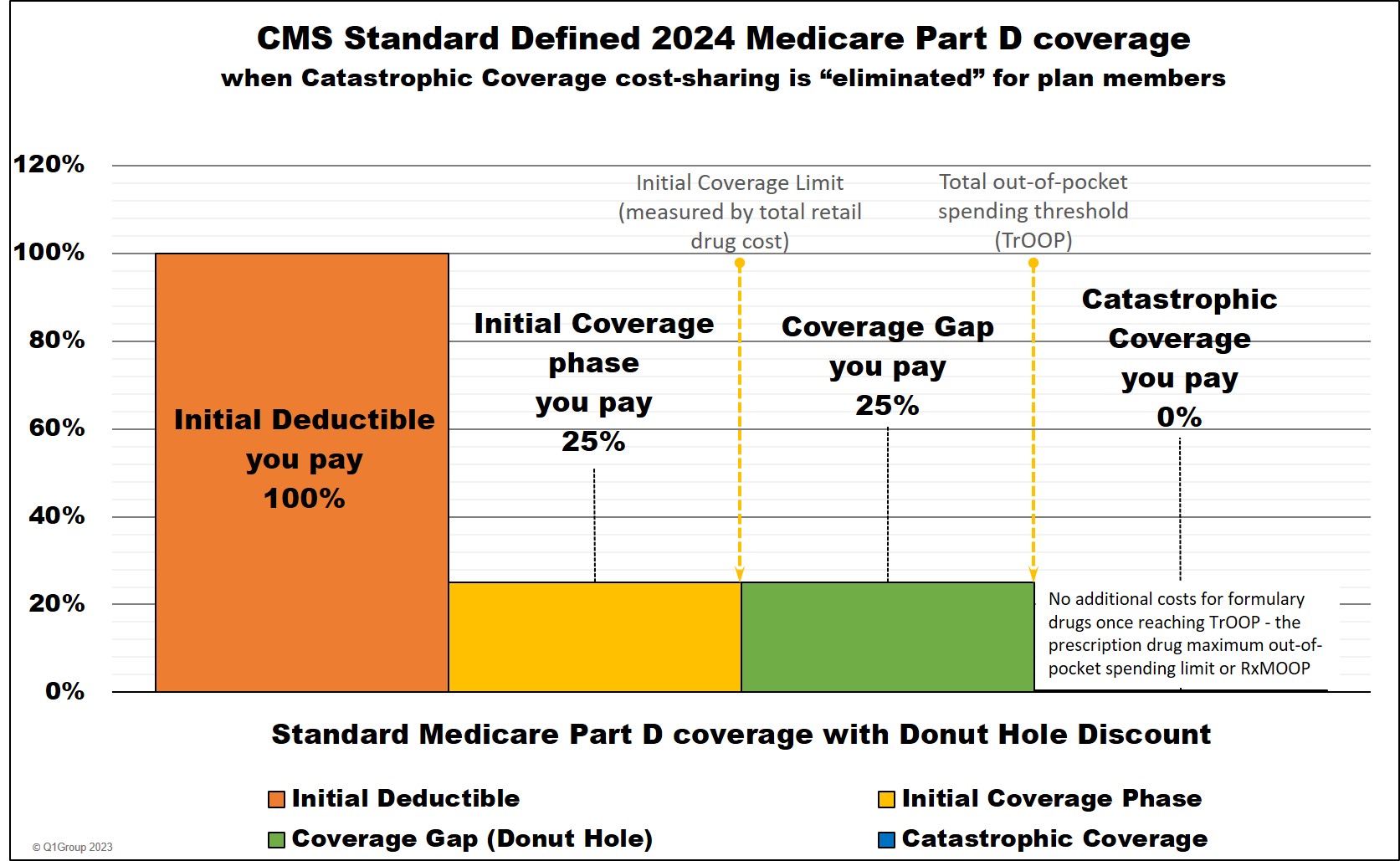

2024 Medicare Part D coverage

Question: But I thought the Donut Hole closed and no longer exists?

Although we say that the Donut Hole "closed" in 2020 -- because you receive a 75% discount on all formulary drugs purchased in the Donut Hole (paying the same 25% coinsurance as the standard Medicare Part D plan coverage before the Donut Hole) -- the Donut Hole did not go away and the Coverage Gap remains the third phase of your Medicare Part D coverage.

So you still leave the second phase of your Medicare Part D plan or Initial Coverage Phase once your retail drug costs exceed the Initial Coverage Limit (ICL). And when you leave your Initial Coverage phase, you will enter the Coverage Gap (Donut Hole) where the cost of your formulary medications can actually increase, decrease, or stay the same - depending on your Medicare plan, your cost-sharing, and the drug's retail price (see the examples below for more information).

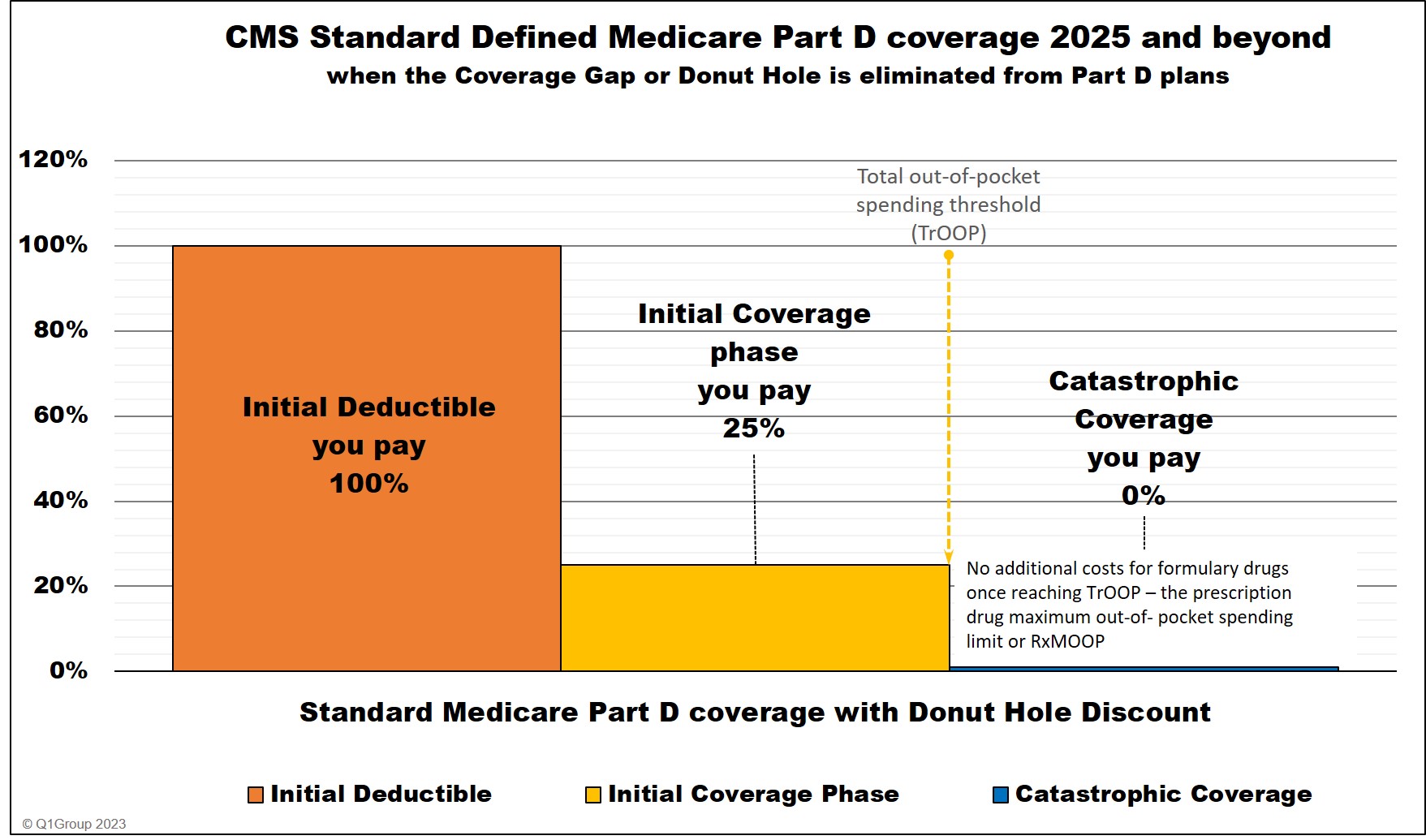

Important Update: The Donut Hole or Coverage Gap phase will be eliminated in 2025.

As shown in the chart above, beneficiary cost-sharing in the Catastrophic Coverage phase is eliminated in 2024. And in 2025, the Inflation Reduction Act (IRA) further eliminates the Coverage Gap, therefore extending the Initial Coverage Limit until a person has spent $2,000 out-of-pocket for Part D formulary drugs.

The $2,000 will represent the prescription drug maximum out-of-pocket spending limit (RxMOOP) which is the same as the total out-of-pocket spending limit (TrOOP). When a person reaches the RxMOOP (that can change from the $2,000 each year), the plan member will not have any additional costs for Part D formulary drugs for the remainder of the year.

Medicare Part D coverage 2025 and beyond

Question: Does the Initial Coverage Limit change each year and can Medicare Part D plans have different ICLs?

Yes. As noted above, each year the Centers for Medicare and Medicaid Services (CMS) releases a standard defined Medicare Part D Initial Coverage Limit and, in most cases, stand-alone Medicare Part D prescription drug plans adopt the CMS standard.

However, stand-alone Medicare Part D prescription drug plans (PDPs) can offer a variation to the standard ICL. For example, in 2021, the standard Initial Coverage Limit is $4,130, but the 2021 New York EmblemHealth VIP Rx Plus (PDP) had a lower ICL of $3,970. (Meaning, you entered the Donut Hole slightly faster with this plan as compared to a Medicare plan with a standard ICL). All 2024 stand-alone Medicare Part D plans use the standard ICL $5,030 in 2024.

In 2024, only 6 MAPDs have an ICL below the standard ICL of $5,030, and 18 MAPDs have an ICL above the 2024 CMS defined standard ICL - with the highest ICL at $11,000 (meaning MAPD plan members can buy formulary drugs with a retail value of up to $11,000 before reaching their plan's 2024 Coverage Gap).

While in 2023, only 3 MAPDs have an ICL below the standard ICL of $4,660, and 21 MAPDs have an ICL above the 2023 CMS defined standard ICL - with the highest ICL at $11,000 (meaning MAPD plan members can buy formulary drugs with a retail value of up to $11,000 before reaching their plan's 2023 Coverage Gap).

Question: How do formulary drug purchases affect my ICL?While in 2023, only 3 MAPDs have an ICL below the standard ICL of $4,660, and 21 MAPDs have an ICL above the 2023 CMS defined standard ICL - with the highest ICL at $11,000 (meaning MAPD plan members can buy formulary drugs with a retail value of up to $11,000 before reaching their plan's 2023 Coverage Gap).

If your Medicare drug plan has an Initial Coverage Limit of $4,660 in 2023 ($5,030 in 2024), you can purchase Medicare Part D prescriptions up to the ICL amount before entering the Donut Hole portion of your Medicare Part D plan. Note that your medication must be on your drug plan's formulary to count toward your total spending.

So, if you are in your Initial Coverage phase (after the Initial Deductible) and buy a formulary medication with a retail value of $100 and pay a $30 copayment, the $100 retail cost counts toward meeting your Initial Coverage Limit or Donut Hole entry point -- and the $30 you pay will count toward your Total out-of-pocket costs (TrOOP). When your TrOOP exceeds the out-of-pocket threshold -- Donut Hole exit point $7,400 in 2023 ($8,000 in 2024) -- you will exit the Donut Hole and enter the Catastrophic Coverage phase.

Please note that the single purchase of an expensive medication (for example, a brand-name drug with a retail cost of over $4,800), will push you through the Initial Coverage phase and into the Coverage Gap - and maybe even beyond and into Catastrophic Coverage.

Also, remember that your Medicare Part D plan's Initial Coverage Limit can (and probably will) change each year. For example, the standard Initial Coverage Limit first started at $2,250 in 2006 and has now increased to $4,660 in 2023 and will be $5,030 in 2024. You can view the changes in the standard Initial Coverage Limits over the years here:

q1medicare.com/PartD-The-MedicarePartDOutlookAllYears.php

Question: Since the standard ICL increases almost every year, does this mean I can buy more prescriptions each year before entering the Donut Hole?

Not exactly. Although the Medicare standard Initial Coverage Limit has increased almost every year - and you would, therefore, expect to buy more medications each year before entering the Coverage Gap - in reality, with the regular increases in retail drug pricing, many people find that they actually can buy fewer formulary drugs each year before entering the Donut Hole (unless they switch prescriptions to lower-costing generics or more-economical brand drug alternatives).

As background, here is how the Initial Coverage Limit fits into your drug coverage

Your Medicare Part D prescription drug plan includes four different phases:

(1) The Initial Deductible is where you pay 100% of your retail drug costs before you and your plan share the cost of your formulary drugs. Some people will enroll in a Medicare prescription drug plan with a $0 deductible and effectively skip-over this first phase. Some Medicare Part D plans will also have an initial deductible, but exclude low-costing drugs from the deductible and this means you will receive coverage for your inexpensive generics even before meeting your annual deductible.

(2) The Initial Coverage phase (also known as the Initial Coverage stage) begins after you meet your deductible (if any) and you and your Medicare Part D plan will share in the cost of your medication purchases. When the retail cost of your drug purchases exceeds your Initial Coverage Limit (or Donut Hole entry point), you will leave your Initial Coverage phase and enter the Coverage Gap or Donut Hole.

Please note: the Initial Coverage Limit is met based on the total retail cost of your prescription drug purchases. This is the amount that you pay plus what the Part D plan is paying. As noted above, this means that if you buy a $100 medication and you pay a $30 copay (your Medicare Part D plan pays $70). The $100 retail cost is credited toward your Initial Coverage Limit.

Please see the related question:

What costs count toward entering the Donut Hole or Coverage Gap?

As noted, the Initial Coverage Limit can vary between Medicare Part D plan providers. With the approval of Medicare (or CMS) Medicare Part D plans are allowed to deviate from the annual standard Initial Coverage Limit value and a few companies may offer Part D plans with lower Initial Coverage Limits.

In other words, with some Medicare Part D plans you will enter the Donut Hole or Coverage Gap earlier or faster than with other Part D plans. Be sure to understand the benefits before enrolling or ask questions during the Annual Enrollment Period (October 15th through December 7th). If you wait until January to learn about your plan, you may be "locked-in" to your new Medicare Part D plan coverage for the entire year.

(3) The Coverage Gap or Donut Hole begins once you exceed the Initial Coverage Limit you enter the Donut Hole and you will receive the 75% Donut Hole discount for both generic and brand-name formulary drugs (70% manufacturer’s discount and 5% paid by your Medicare Part D plan). This means any formulary drugs you purchase while in the Donut Hole will cost you 25% of the drug's retail price. You can read more about the current Donut Hole Discount here: Q1FAQ.com/470. Note: if you qualify for the Low-Income Subsidy (LIS), you skip the Donut Hole. Keep in mind that any Medicare Beneficiary who qualifies for Medicare & Medicaid automatically qualifies for the LIS and those with limited income and resources may also qualify.

(4) The Catastrophic Coverage phase begins once your total out-of-pocket drug costs exceed Out-of-Pocket Threshold (for instance, over $7,400 in 2023 ($8,000 in 2024), you will exit the Donut Hole or Coverage Gap. Please keep in mind that your monthly premiums do not count toward total out-of-pocket drug costs. In the Catastrophic Coverage phase you will receive your medications at a low-fixed price, paying around 5% of the retail price for brand drugs for the remainder of the year.

Not exactly. Although the Medicare standard Initial Coverage Limit has increased almost every year - and you would, therefore, expect to buy more medications each year before entering the Coverage Gap - in reality, with the regular increases in retail drug pricing, many people find that they actually can buy fewer formulary drugs each year before entering the Donut Hole (unless they switch prescriptions to lower-costing generics or more-economical brand drug alternatives).

As background, here is how the Initial Coverage Limit fits into your drug coverage

Your Medicare Part D prescription drug plan includes four different phases:

(1) The Initial Deductible is where you pay 100% of your retail drug costs before you and your plan share the cost of your formulary drugs. Some people will enroll in a Medicare prescription drug plan with a $0 deductible and effectively skip-over this first phase. Some Medicare Part D plans will also have an initial deductible, but exclude low-costing drugs from the deductible and this means you will receive coverage for your inexpensive generics even before meeting your annual deductible.

(2) The Initial Coverage phase (also known as the Initial Coverage stage) begins after you meet your deductible (if any) and you and your Medicare Part D plan will share in the cost of your medication purchases. When the retail cost of your drug purchases exceeds your Initial Coverage Limit (or Donut Hole entry point), you will leave your Initial Coverage phase and enter the Coverage Gap or Donut Hole.

Please note: the Initial Coverage Limit is met based on the total retail cost of your prescription drug purchases. This is the amount that you pay plus what the Part D plan is paying. As noted above, this means that if you buy a $100 medication and you pay a $30 copay (your Medicare Part D plan pays $70). The $100 retail cost is credited toward your Initial Coverage Limit.

Please see the related question:

What costs count toward entering the Donut Hole or Coverage Gap?

As noted, the Initial Coverage Limit can vary between Medicare Part D plan providers. With the approval of Medicare (or CMS) Medicare Part D plans are allowed to deviate from the annual standard Initial Coverage Limit value and a few companies may offer Part D plans with lower Initial Coverage Limits.

In other words, with some Medicare Part D plans you will enter the Donut Hole or Coverage Gap earlier or faster than with other Part D plans. Be sure to understand the benefits before enrolling or ask questions during the Annual Enrollment Period (October 15th through December 7th). If you wait until January to learn about your plan, you may be "locked-in" to your new Medicare Part D plan coverage for the entire year.

(3) The Coverage Gap or Donut Hole begins once you exceed the Initial Coverage Limit you enter the Donut Hole and you will receive the 75% Donut Hole discount for both generic and brand-name formulary drugs (70% manufacturer’s discount and 5% paid by your Medicare Part D plan). This means any formulary drugs you purchase while in the Donut Hole will cost you 25% of the drug's retail price. You can read more about the current Donut Hole Discount here: Q1FAQ.com/470. Note: if you qualify for the Low-Income Subsidy (LIS), you skip the Donut Hole. Keep in mind that any Medicare Beneficiary who qualifies for Medicare & Medicaid automatically qualifies for the LIS and those with limited income and resources may also qualify.

(4) The Catastrophic Coverage phase begins once your total out-of-pocket drug costs exceed Out-of-Pocket Threshold (for instance, over $7,400 in 2023 ($8,000 in 2024), you will exit the Donut Hole or Coverage Gap. Please keep in mind that your monthly premiums do not count toward total out-of-pocket drug costs. In the Catastrophic Coverage phase you will receive your medications at a low-fixed price, paying around 5% of the retail price for brand drugs for the remainder of the year.

Important update:

2023 is the last year that Medicare Part D beneficiaries will pay cost-sharing in the Catastrophic Coverage phase.

Beginning in 2024, the Inflation Reduction Act (IRA) eliminates beneficiary cost-sharing in the Catastrophic Coverage phase.

Browse FAQ Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service