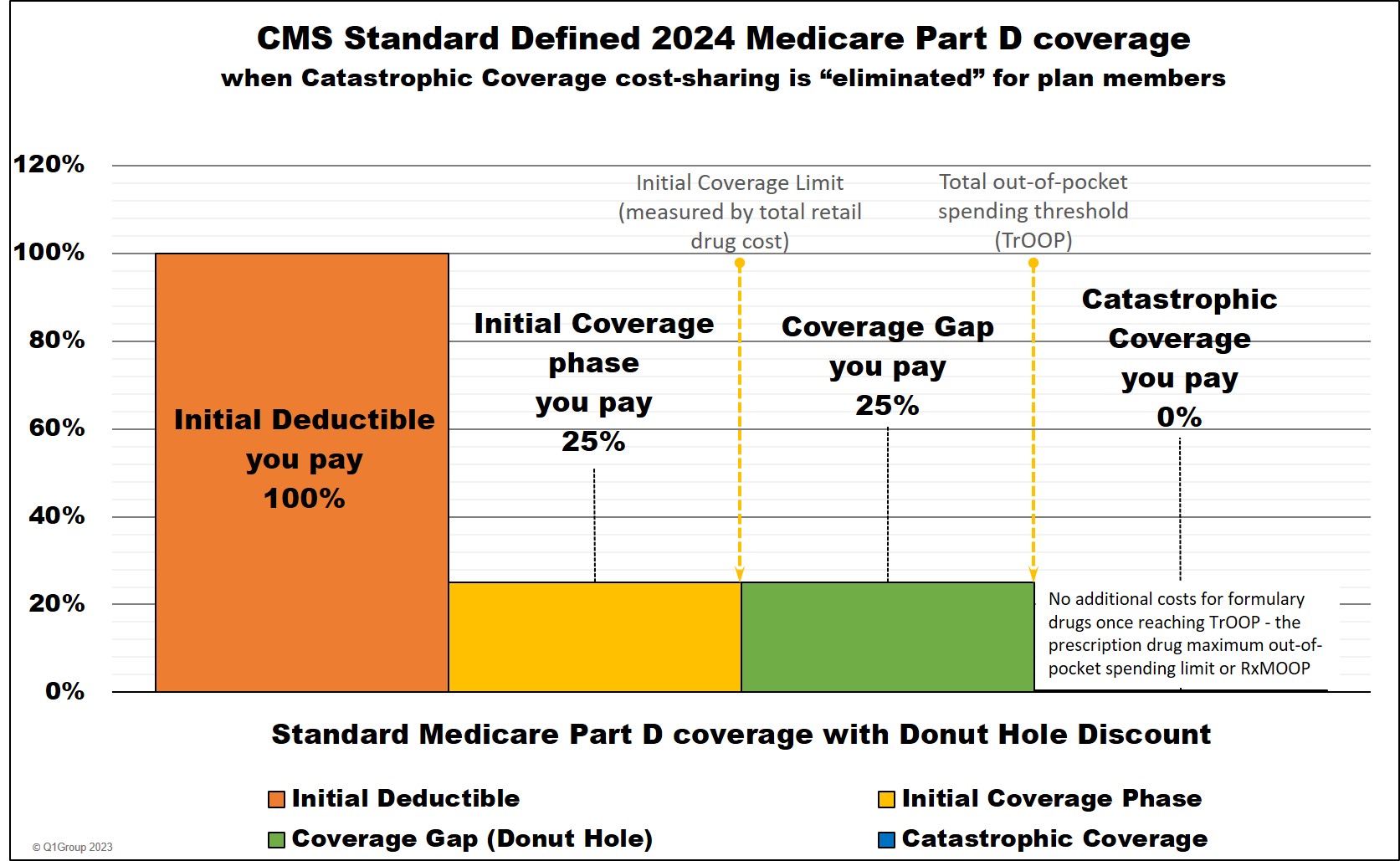

As a review, Medicare Part D prescription drug plans have four different parts of coverage: (1) the Initial Deductible (in some plans), (2) the Initial Coverage phase, (3) the Coverage Gap (Donut Hole), and (4) Catastrophic Coverage (where you will have a $0 copay for formulary drugs).

Medicare Part D prescription drug coverage can be offered by both stand-alone Medicare Part D prescription drug plans (PDPs) and Medicare Advantage plans that include drug coverage (MAPDs). As a baseline to drug coverage, the Centers for Medicare and Medicaid Services (CMS) provides a standard or model Medicare Part D coverage that includes the annual Initial Deductible, 25% cost-sharing in the Initial Coverage Phase, 25% cost-sharing in the Donut Hole, and no ($0) cost-sharing in the Catastrophic Coverage phase.

The graphic below illustrates the CMS standard or model 2024 Medicare Part D plan coverage.

Note: Read more below about the History of the Donut Hole from 2006 to 2025

- The end of the Coverage Gap in 2025

- The Donut Hole is technically "closed": 2020 through 2024

- The annual changes in the Donut Hole Discount: 2011 through 2019

- The $250 Donut Hole Rebate Check in 2010

- The Donut Hole from 2006 to 2010

You move through these four phases of your Medicare drug coverage either based on the amount of money you spend on formulary drugs or the retail value of your prescription drug purchases, depending on the coverage phase. Most people will instead remain in the Initial Coverage phase with only a small percentage of Medicare beneficiaries ever entering the Coverage Gap or Catastrophic Coverage phase.

(1) The Initial Deductible is where you pay 100% of your retail drug costs until you reach your deductible amount ($505 in 2023). Many people will enroll in a Medicare prescription drug plan with a $0 deductible and effectively skip-over this first phase.

(2) The Initial Coverage phase is the part of your drug coverage where you and your Medicare Part D plan share the cost of your formulary medications either as a fixed copay or a percentage of retail cost. Standard cost-sharing in the Initial Coverage phase is 25%, but your Medicare drug plan may have fixed copays for different formulary tiers. For example, if you purchase a mediation with a $100 retail cost, you may pay a $30 copay (and the plan pays $70) or you pay $25 co-insurance (and the plan pays $75).

Important: You enter the Donut Hole based on the retail cost of your formulary drugs - not the amount of what you paid for your drugs, but what you spend plus what your Medicare Part D plan pays. For instance, if you buy a medication with a retail value of $100 for a $30 copayment, the $100 retail value counts toward meeting your Initial Coverage Limit or Donut Hole entry point.

The Initial Coverage Limit can change each year. In 2024, the Initial Coverage Limit (ICL) or Donut Hole entry point begins when your retail drug costs exceed $5,030. Accordingly, if the retail cost of your medications is over $420 per month, you will enter the 2024 Donut Hole.

(3) The Coverage Gap or Donut Hole is the plan phase you enter once the retail cost of your formulary drug purchases exceeds the Initial Coverage Limit. Once you reach the Coverage Gap, you will receive the 25% Donut Hole discount on any formulary drug purchases

For example, if you purchase formulary drugs with a retail value of over $5,030 in 2024, you will exceed your plan's Initial Coverage Limit and enter the Coverage Gap where you will pay only 25% of the retail price for any formulary drugs.

Important: The only way to know exactly when you will enter or leave the donut hole is by watching your monthly Medicare Part D plan's Explanation of Benefits statement carefully (you received this printed form in the mail) or you can contact your Medicare Part D plan and ask the Member Services representative where you are relative to the plan's Coverage Gap.

You will stay in the Coverage Gap or Donut Hole phase until your out-of-pocket costs (also called TrOOP or total drug spend) reaches a certain limit. The TrOOP limit in 2024 is $8,000. TrOOP is the total of what you pay during the Initial Deductible (if you have one) plus what you personally pay in the Initial Coverage Phase, before the Donut Hole, plus what you pay in the Donut Hole (and plus you get credit for the 70% brand-name discount paid by the drug manufacturer in the donut hole - for instance, if in the Donut Hole you buy a brand-name drug with a $100 retail value, you pay the $25 discounted price, but actually get credit for $95 toward meeting your TrOOP limit). Your TrOOP limit can change every year: the TrOOP limit in 2023 was $7,400, in 2022 TrOOP was $7,050, in 2021 TrOOP was $6,550, in 2020 TrOOP was $6,350, and in 2019 - $5,100.

(4) The Catastrophic Coverage phase is the last part of your Medicare Part D plan and you enter once your total out-of-pocket drug costs (TrOOP) exceed a certain point (over $8,000 in 2024).

In 2024, the Catastrophic Coverage phase maximum 5% coinsurance (or any cost-sharing) was eliminated with the establishment of a maximum out-of-pocket prescription drug spending limit (RxMOOP) capping formulary drug costs at the annual 2024 total out-of-pocket cost threshold or TrOOP threshold ($8,000 in 2024 - equating to Part D formulary drugs with an estimated retail value of $12,447). This means that after reaching the TrOOP threshold or RxMOOP, you will not pay any additional costs for the remainder of the year.

Need help visualizing your annual monthly drug spending and the phases of Part D coverage?

To help you visualize how you move through the phases of your Medicare Part D prescription drug plan coverage, we have a out-of-pocket drug cost calculator or 2024 PDP-Planner that illustrates the changes in your monthly estimated costs based on the established 2024 standard Medicare Part D plan limits mentioned above.

We also have several examples online to help you get started with our 2024 PDP-Planner tool. You can click here for an example of a Medicare beneficiary with relatively high monthly prescription drug costs (retail prescription drug cost of $800 per month) and then change the monthly drug cost to whatever you wish.

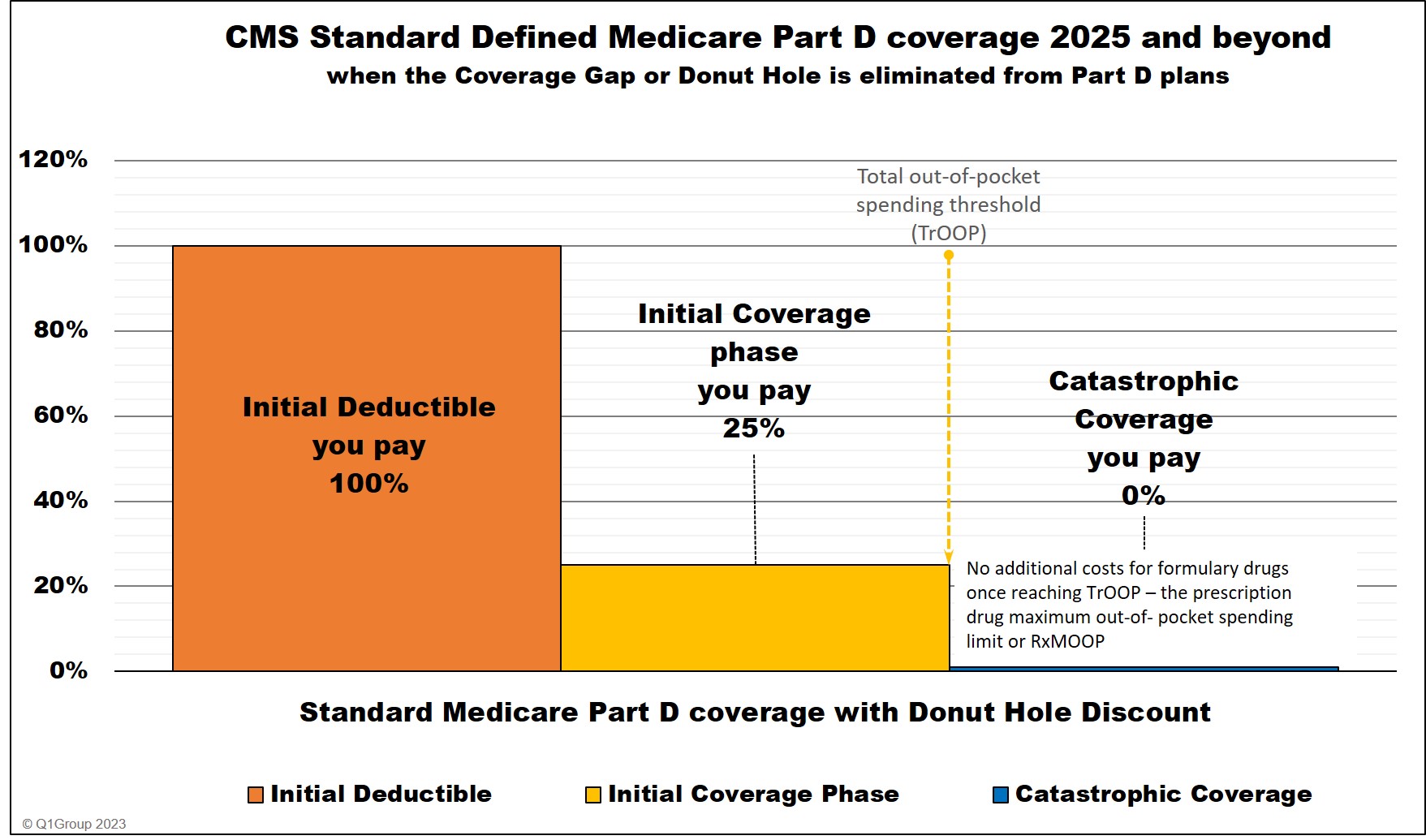

2025: The end of the Coverage Gap or Donut Hole.

In 2025, the Donut Hole or Coverage Gap will be eliminated and will be replaced with a $2,000 out-of-pocket spending limit. When a person reaches the $2,000 maximum cap or Part D maximum out-of-pocket spending limit (RxMOOP) - they will not pay any additional costs for formulary drugs for the remainder of the year.

In 2025, the $2,000 RxMOOP should be reached when a person purchases Medicare Part D formulary drugs with a retail value totaling about $6,230. (The $2,000 RxMOOP can increase every year like other Medicare Part D parameters.)

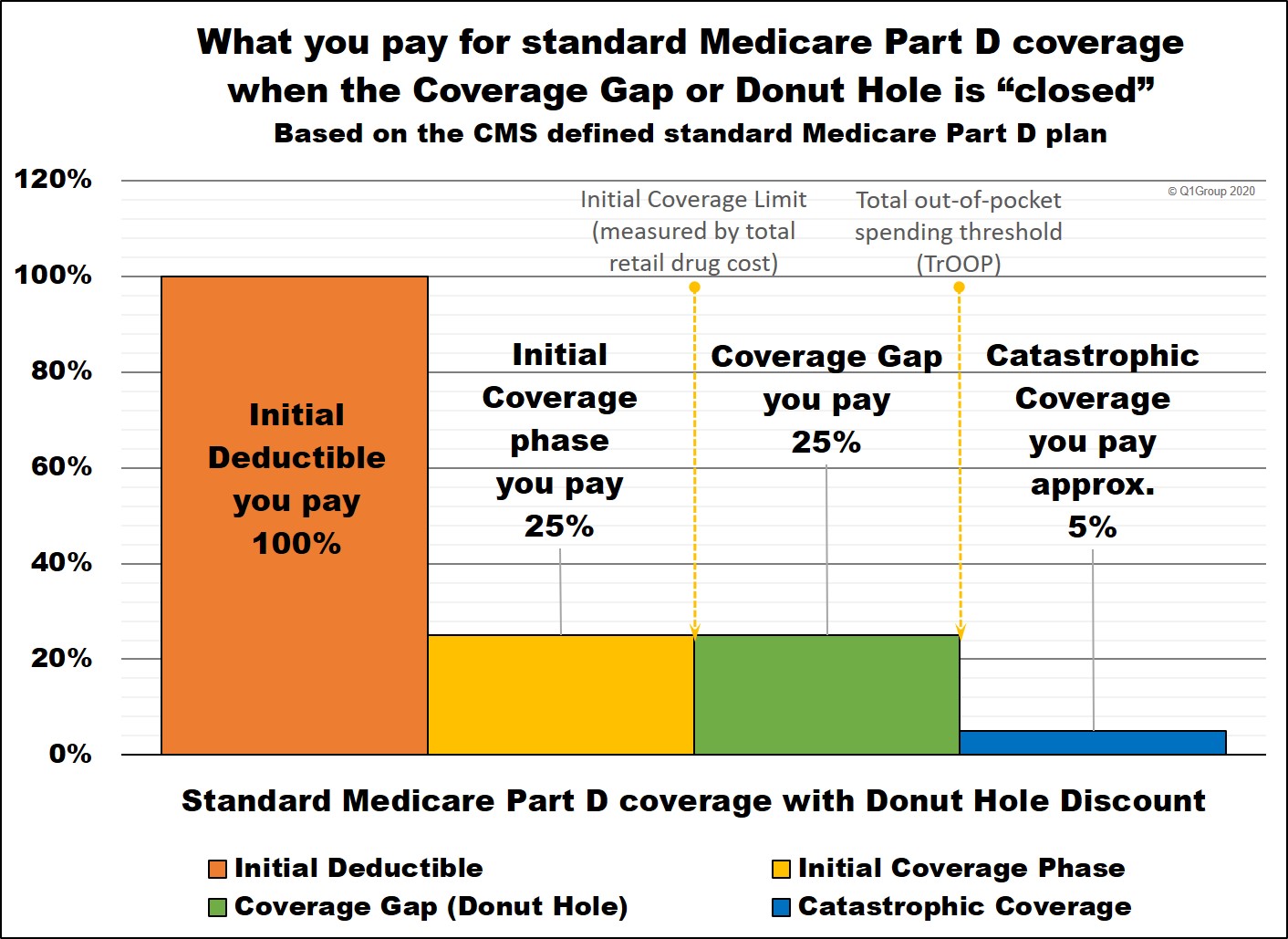

Medicare Part D coverage phases when the Donut Hole closed in 2020

After the Donut Hole was "closed" in 2020 with a fixed 25% cost-sharing (the same as the Initial Coverage phase), the standard cost-sharing through all phases of Medicare Part D coverage remained stable through 2023, with actual Medicare Part D prescription drug plan designs often varying slightly from the CMS standardized model.

Below is a chart showing how example formulary drug purchases are calculated throughout Medicare Part D plan coverage 2020 through 2023 (using the CMS defined standard benefit Medicare Part D plan as a guide).

|

When you purchase a formulary medication |

|||||||

|

Example |

You Pay |

Your |

Drug Mfg. Pays |

U.S. |

Amount counting toward your ICL |

Amount counting toward your TrOOP |

|

|

Part 1 |

$100 |

$100 |

$0 |

$0 |

$0 |

$100 |

$100 |

|

Part 2 |

$100 |

$25 |

$75 |

$0 |

$0 |

$100 |

$25 |

|

Part 3 |

$100 |

$25 |

$5 |

$70 |

$0 |

n/a |

$25+$70 |

|

Coverage Gap - generic *** |

$100 |

$25 |

$75 |

$0 |

$0 |

n/a |

$25 |

|

Part 4 |

$300 |

$15 |

$45 |

$0 |

$240 |

n/a |

n/a |

|

Catastrophic Coverage (generic drug) **** |

$100

|

$5 |

$15 |

$0 |

$80 |

n/a |

n/a |

* 25% copay or cost-sharing

** 75% Brand-name Discount

*** 75% Generic Discount

**** you pay 5% of retail or $10.35 in 2023 for brand drugs whatever is higher or 5% of retail or $4.15 in 2023 for generic or multi-source drugs whatever is higher (80% paid by Medicare, 15% paid by Medicare plan, and around 5% by plan member)

"n/a" - "not applicable" to this phase or part of your Medicare Part D plan coverage

The 2011 beginning of the Donut Hole Discount to the 2020 "closing" of the Donut Hole

Starting in 2011, Medicare Part D prescription drug plans and the brand-name pharmaceutical drug manufacturers began to share a portion of your medication expenses while you are in the Donut Hole (giving you what we now call the Donut Hole discount). Back in 2011, the discount you received when you reached the Donut Hole was only 7% off the price of generics and 50% off the cost of brand-name drugs. Each year, the discount increased saving you more money in the Donut Hole.

Then in 2020, the Donut Hole discount increased to 75% so that you only pay 25% of the retail cost for any of your formulary drugs. At this time, we began to say that the Donut Hole was "closed" because you (theoretically) pay the same as you would during the Initial Coverage phase (assuming a standard Medicare drug plan coverage of 25% of the retail cost). However, although we say this phase is "closed", the Coverage Gap still remains the third phase of your Medicare Part D coverage - and if you enter the Coverage Gap (Donut Hole), the cost of your formulary medications can actually increase, decrease, or stay the same - depending on your Medicare plan, your cost-sharing, and the drug's retail price.

The Donut Hole from 2006 to 2010

From 2006 through 2010, the "Donut Hole" was a term used to describe a gap in Medicare Part D prescription drug plan coverage or Medicare Advantage plan coverage during which the Medicare plan member was 100% responsible for the cost of their prescription drugs — unless their Medicare plan provided some brand-name or generic drug coverage through the Donut Hole.

So, before 2011, the Medicare Part D Coverage Gap or Donut Hole was actually similar to a second deductible in an insurance policy where, after receiving a certain level of coverage, you were, once again, 100% responsible for paying your own drug coverage until you reached the Catastrophic Coverage portion of your Medicare Part D plan or Medicare Advantage plan that included drug coverage (MAPD).

However, with the introduction of the Donut Hole discount in 2011, you are now responsible for only a portion of your own drug coverage in the Donut Hole.

Before the Donut Hole Discount: The $250 Donut Hole rebate check in 2010

All seniors and Medicare beneficiaries enrolled in a 2010 Medicare Part D prescription drug plan- and who do not receive any financial Extra-Help automatically received a tax-free $250 rebate check if they reach the 2010 Doughnut Hole portion of their prescription drug coverage. We have more questions about the 2010 Donut Hole rebate in our FAQ Archive.

- No enrollment fee and no limits on usage

- Everyone in your household can use the same card, including your pets

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service