2024 Medicare Part D PDP Outlook: Fewer 2024 Medicare Part D PDP options and most people in 2023 plans may pay higher 2024 Part D premiums

An initial review of the stand-alone 2024

Medicare Part D prescription drug plans (PDPs) recently

released by the Centers for

Medicare and Medicaid Services (CMS), shows that Medicare beneficiaries will

have fewer 2024 stand-alone Medicare Part D options and most current plan members will pay

higher 2024 monthly PDP premiums

(unless they enroll in a lower-premium 2024 Medicare Part D or Medicare

Advantage plan).

Here are highlights of the 2024 stand-alone Medicare Part D PDP landscape from our PDP-Facts.com analysis:

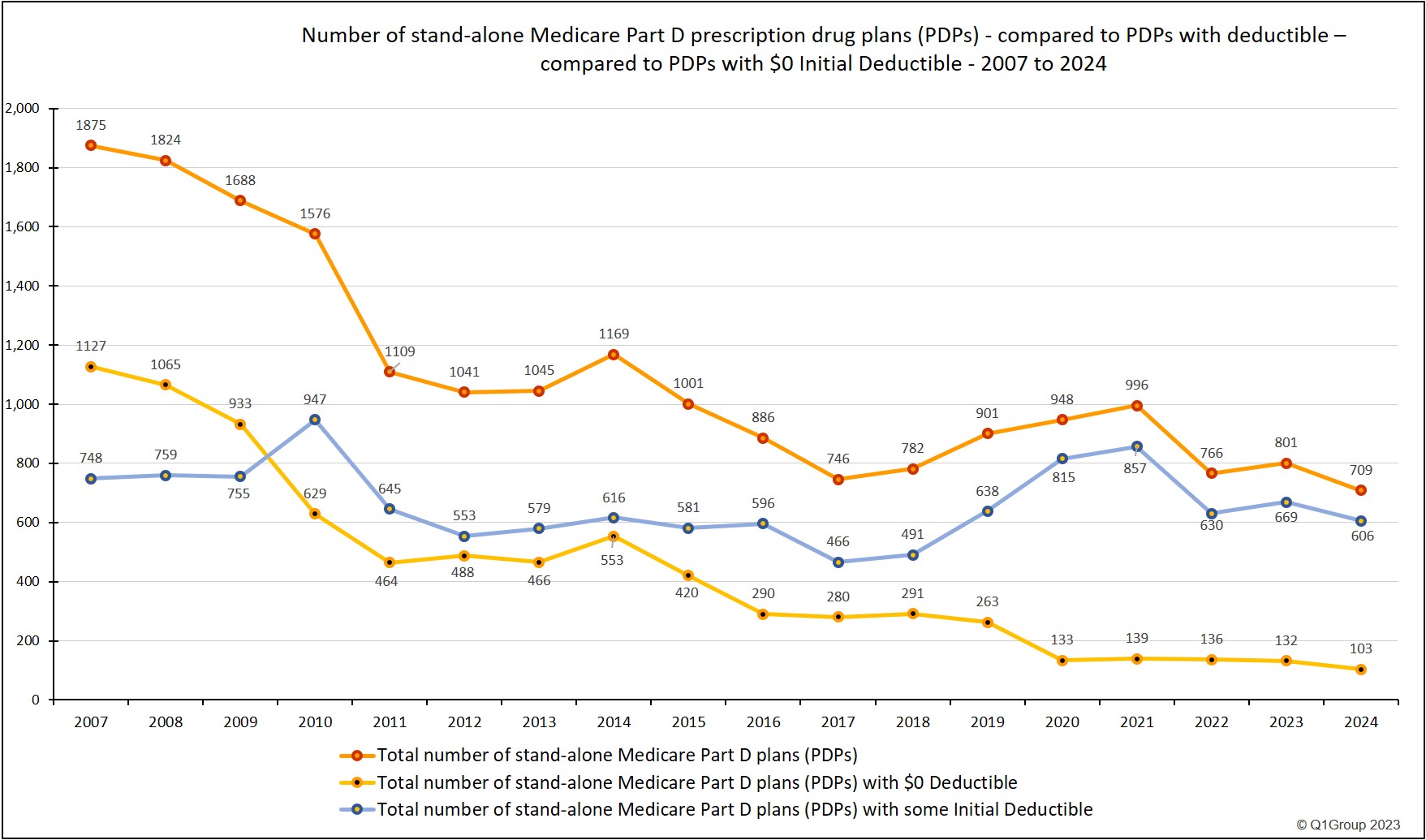

(1) There will be 11.5% fewer 2024 stand-alone Medicare Part D plan options.

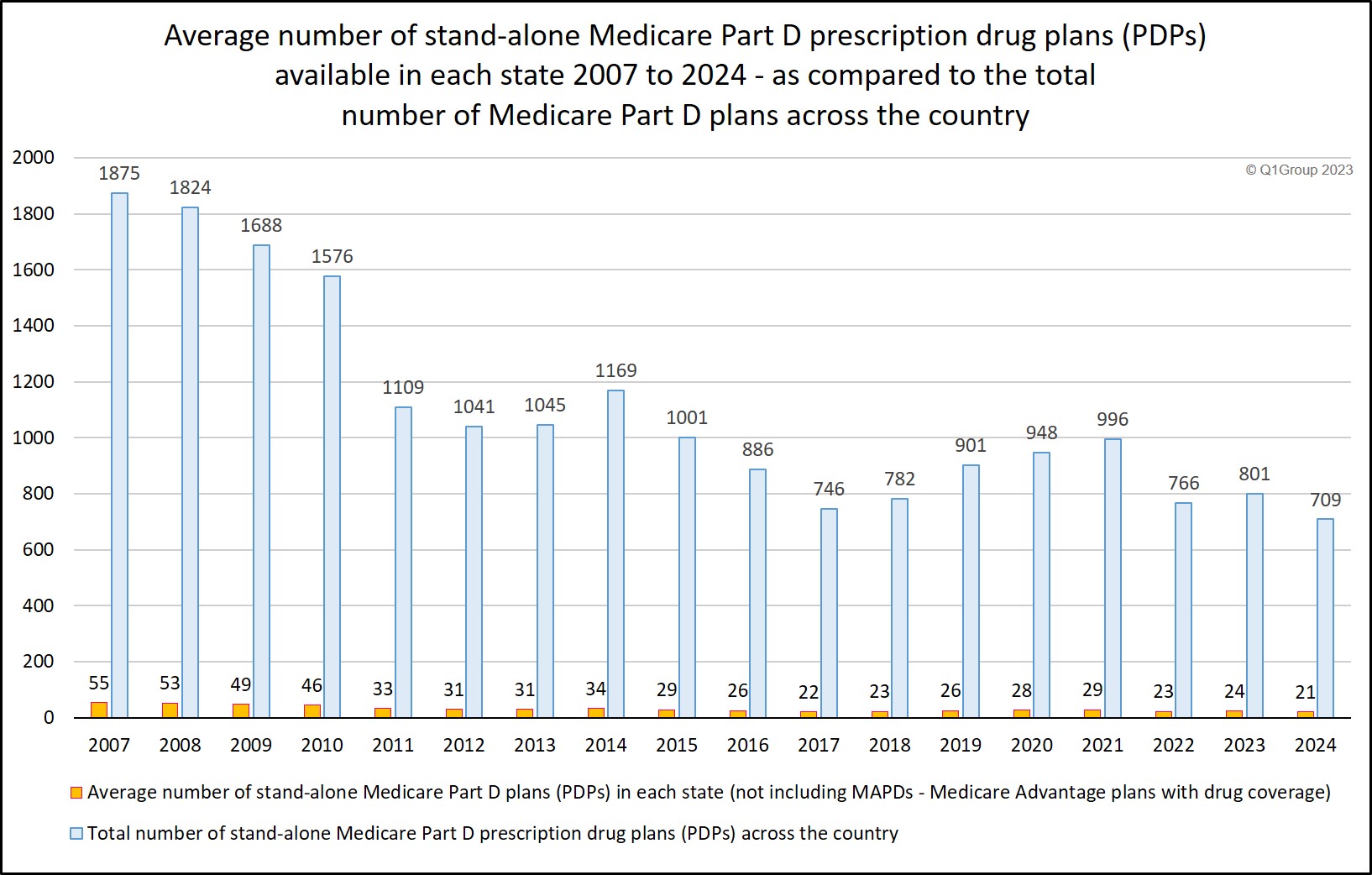

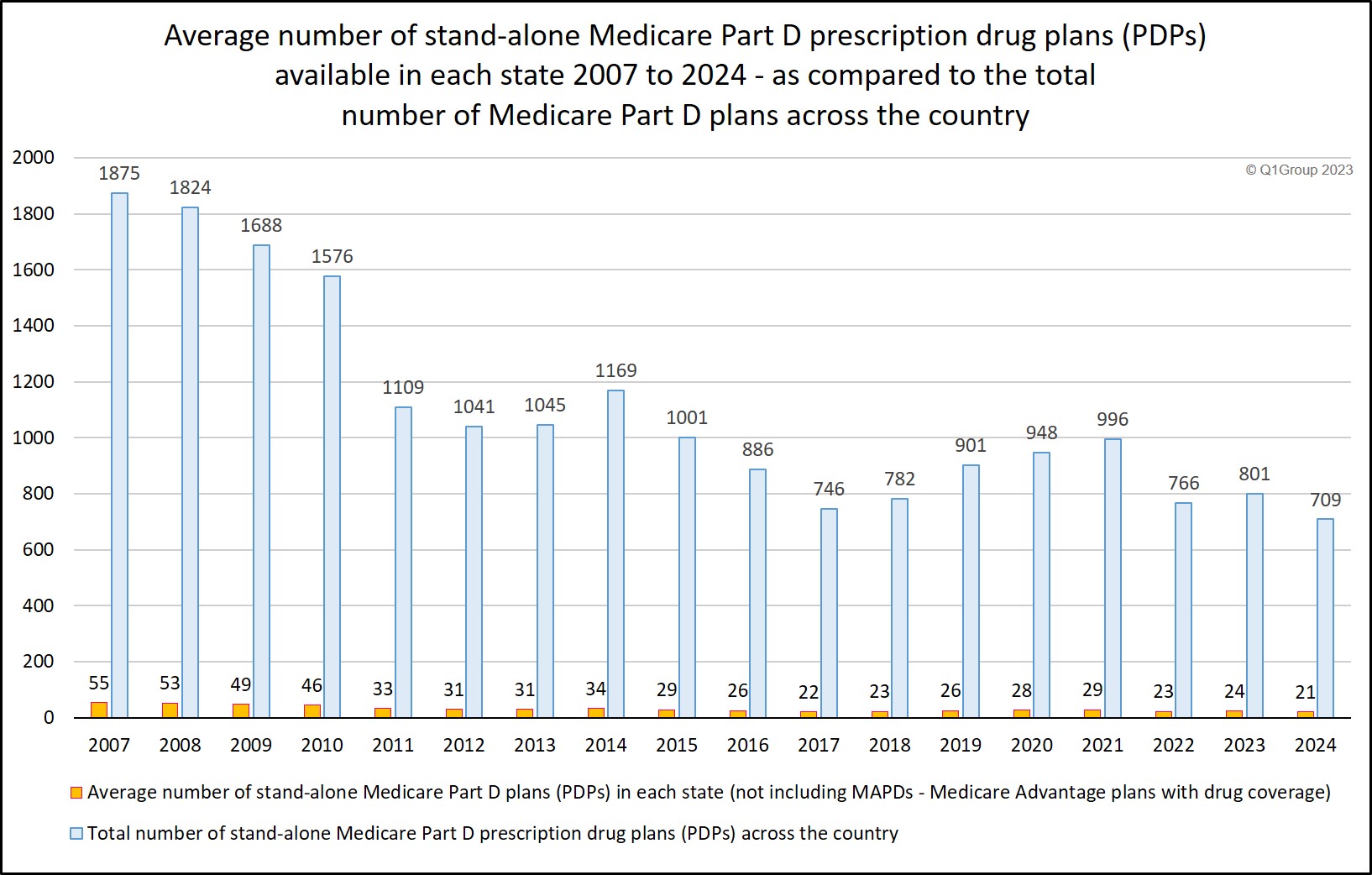

The total number of stand-alone 2024 Medicare Part D prescription drug plans across the country will decrease 11.5% to 709 plans from 801 PDPs currently offered in 2023 -- a loss of 92 plans. The average number of stand-alone 2024 Part D plans offered in each state is decreasing to 21 plans down from 24 plans per state in 2023.

Alabama and Tennessee will offer the most stand-alone 2024 Medicare Part D plan choices (24), the same number as offered in 2023.

New York will offer the smallest number of 2024 PDPs at 15 Medicare Part D plans.

Arizona will see the largest PDP decrease – losing seven (7) PDP options in 2024.

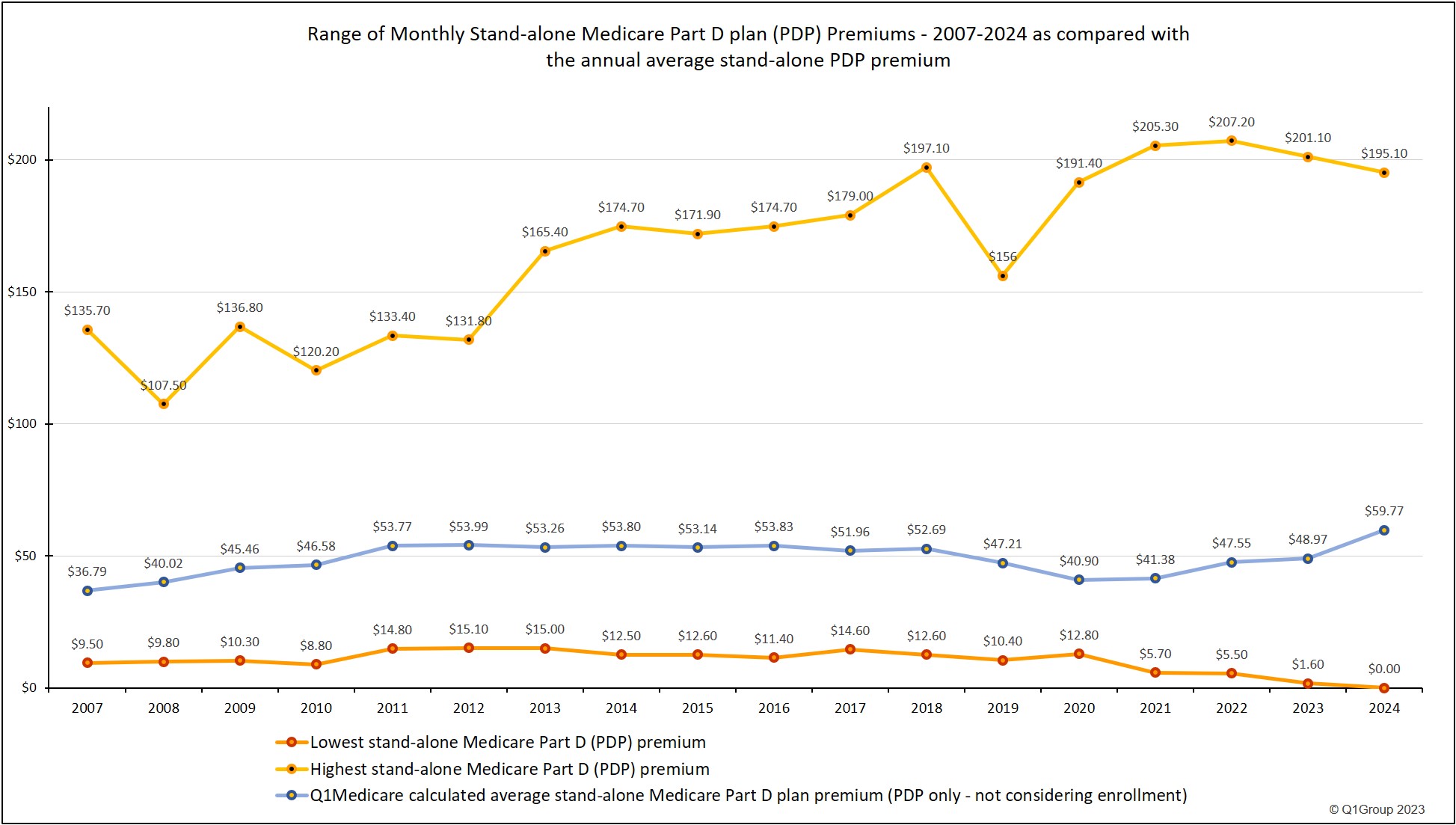

(2) The average 2024 stand-alone Medicare Part D premium will increase 21%.

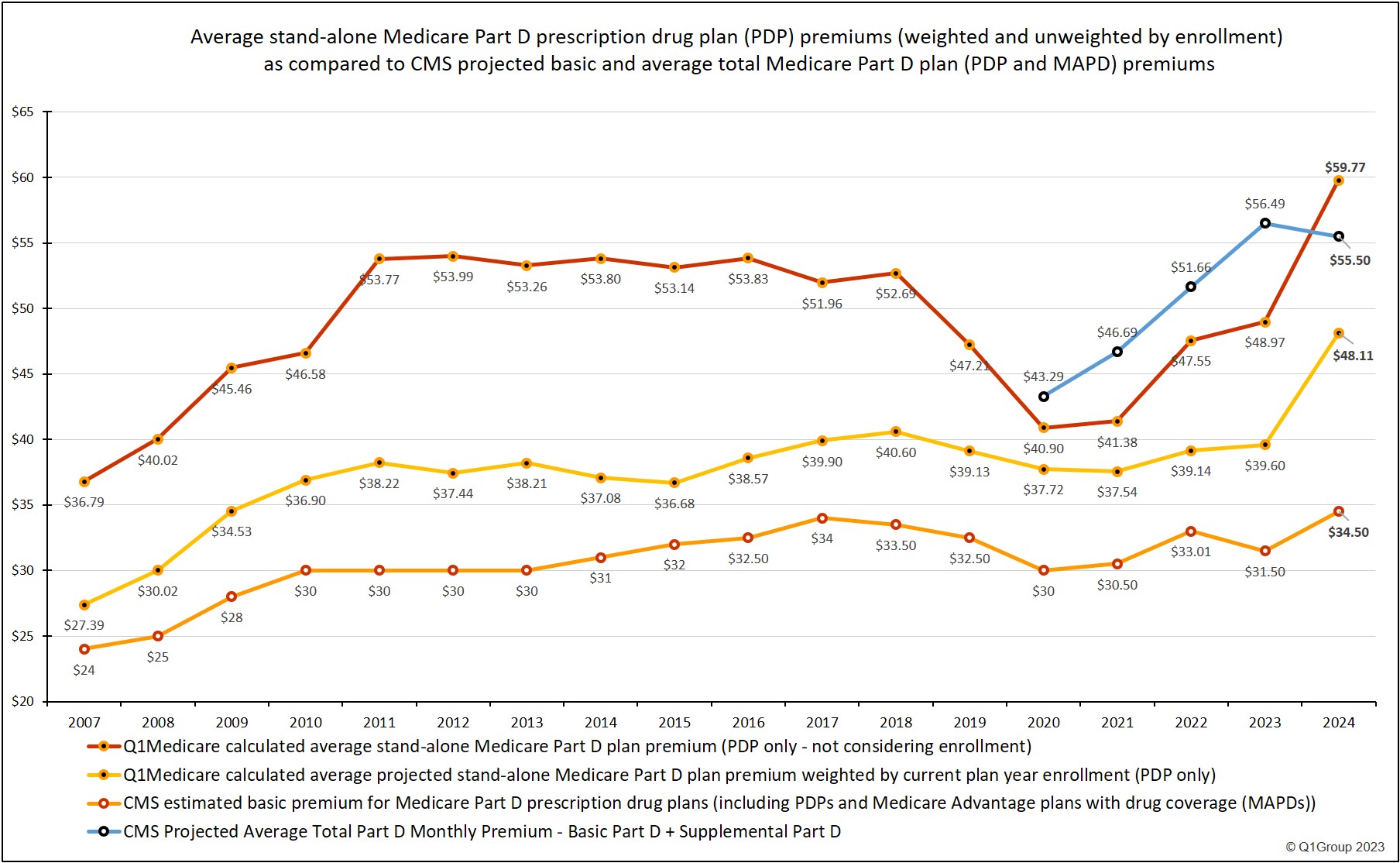

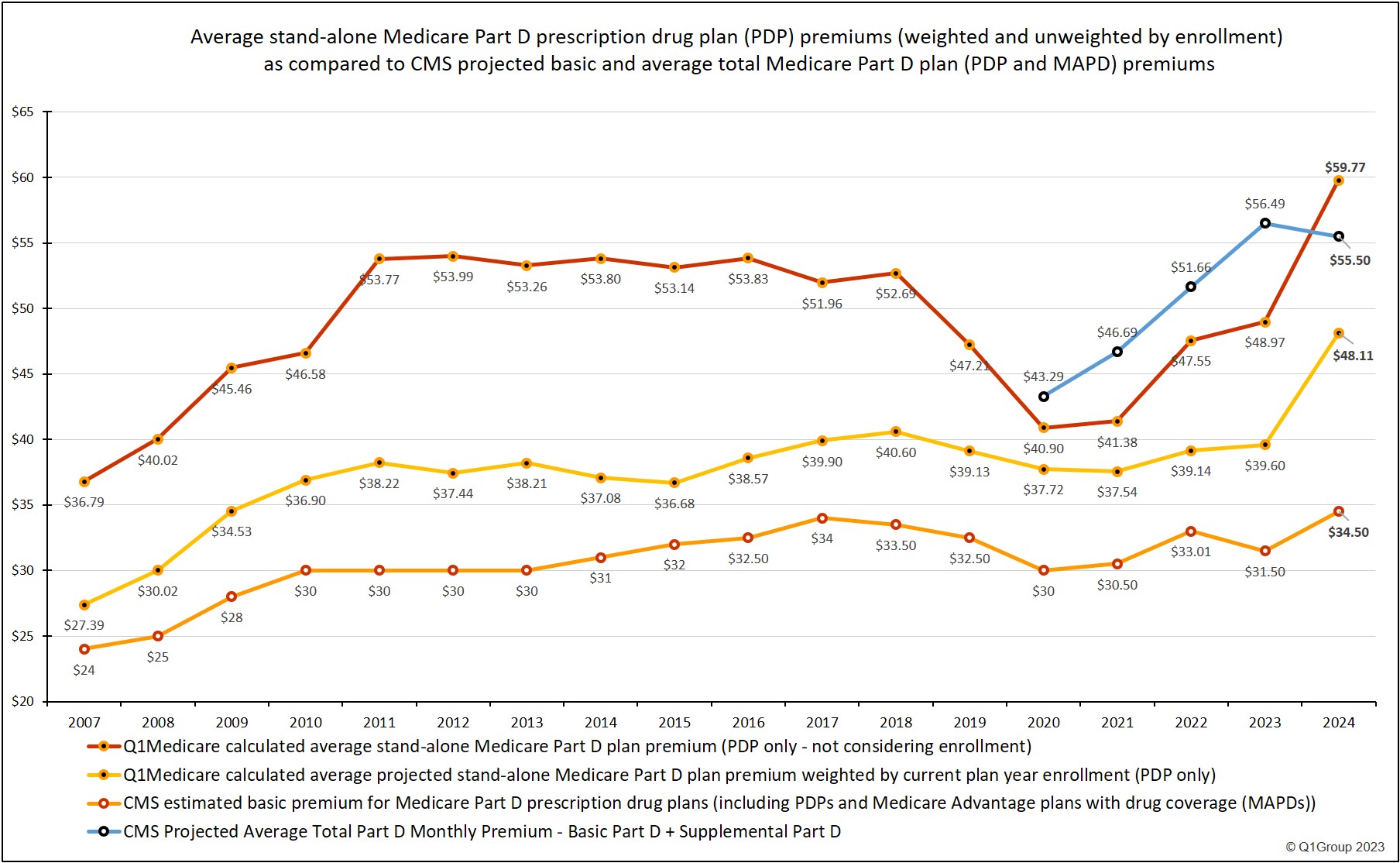

In late-July, CMS forecasted a 1.8% decrease in the average Medicare Part D premium. CMS based their calculation on both stand-alone Medicare Part D PDPs and Medicare Advantage plans with drug coverage (MAPDs). Our preliminary analysis of only the stand-alone 2024 Medicare Part D PDPs indicates a 21% premium increase across all PDPs, based on current plan enrollment.

(3) As many as 73% of current 2023 Medicare Part D plan members (not considering LIS eligibility) may have increases in 2024 monthly premiums.

When the 2024 Part D PDP premiums are weighted by current 2023 Part D plan enrollment, we estimate that up to 73% of all Medicare Part D beneficiaries currently enrolled in a stand-alone 2023 Medicare Part D plan will see an average increase of $14.34 in their 2024 monthly premium -- unless they change coverage to a more affordable 2024 Medicare Part D or Medicare Advantage plan that includes prescription drug coverage (MAPD).

You can read more about changes to the Medicare Part D PDP premiums.

Important Extra Help reminder: If you are eligible for the Medicare Part D Low-Income Subsidy (LIS) and chose your own Part D plan in the past, you will receive a tan-colored notice from Medicare in early-November, informing you about your upcoming premium increase.

(4) Expect slightly fewer low-premium 2024 Medicare Part D plan options.

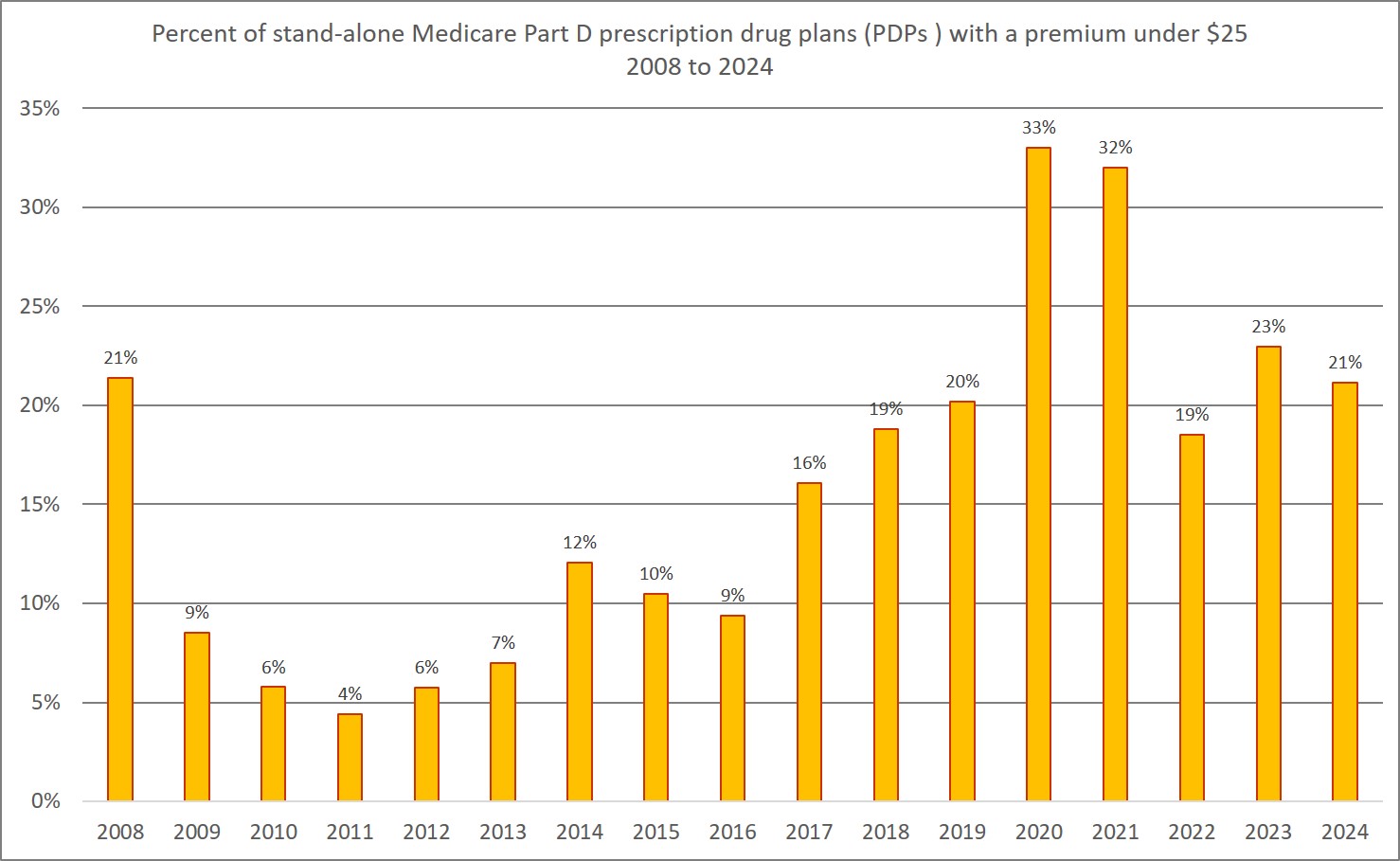

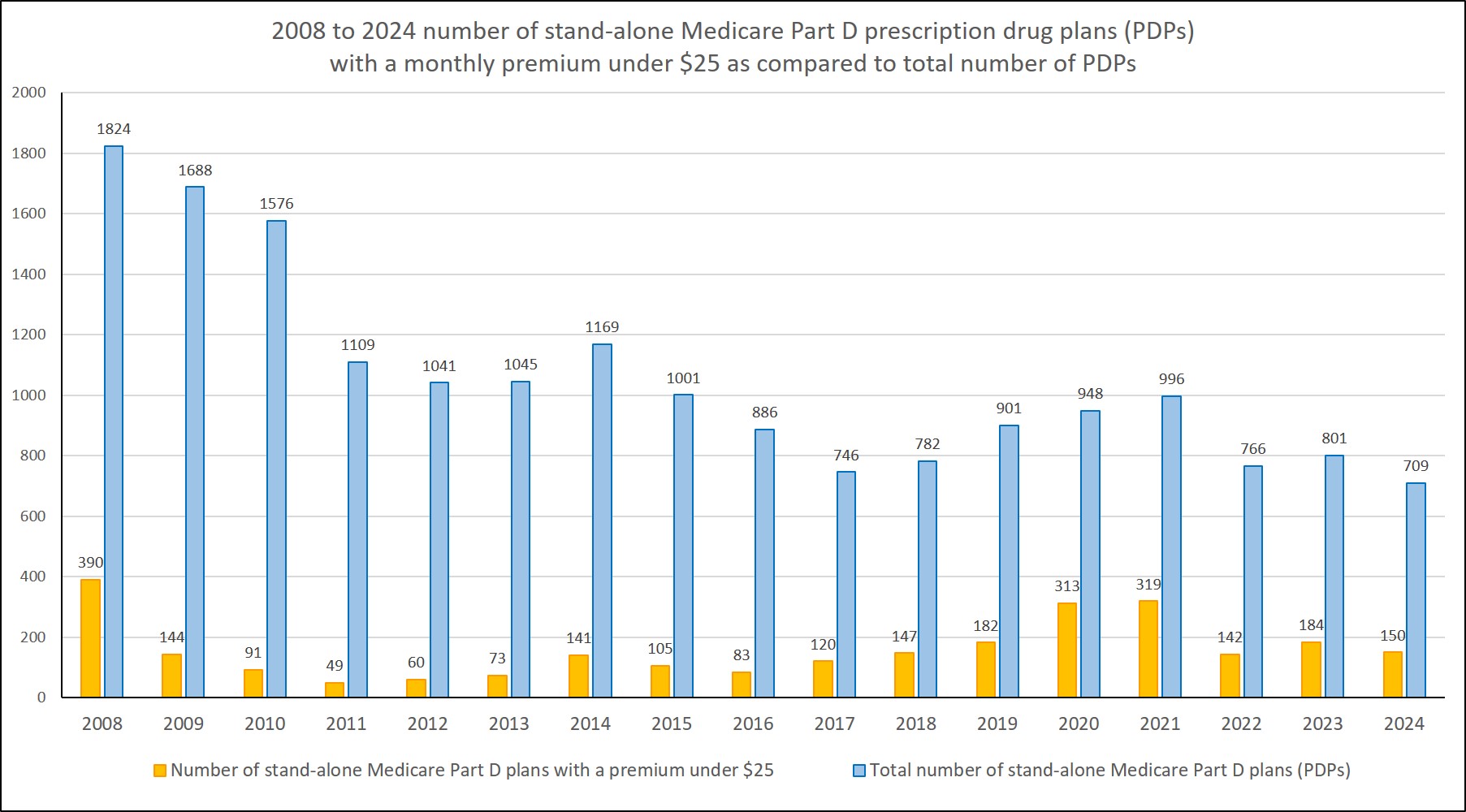

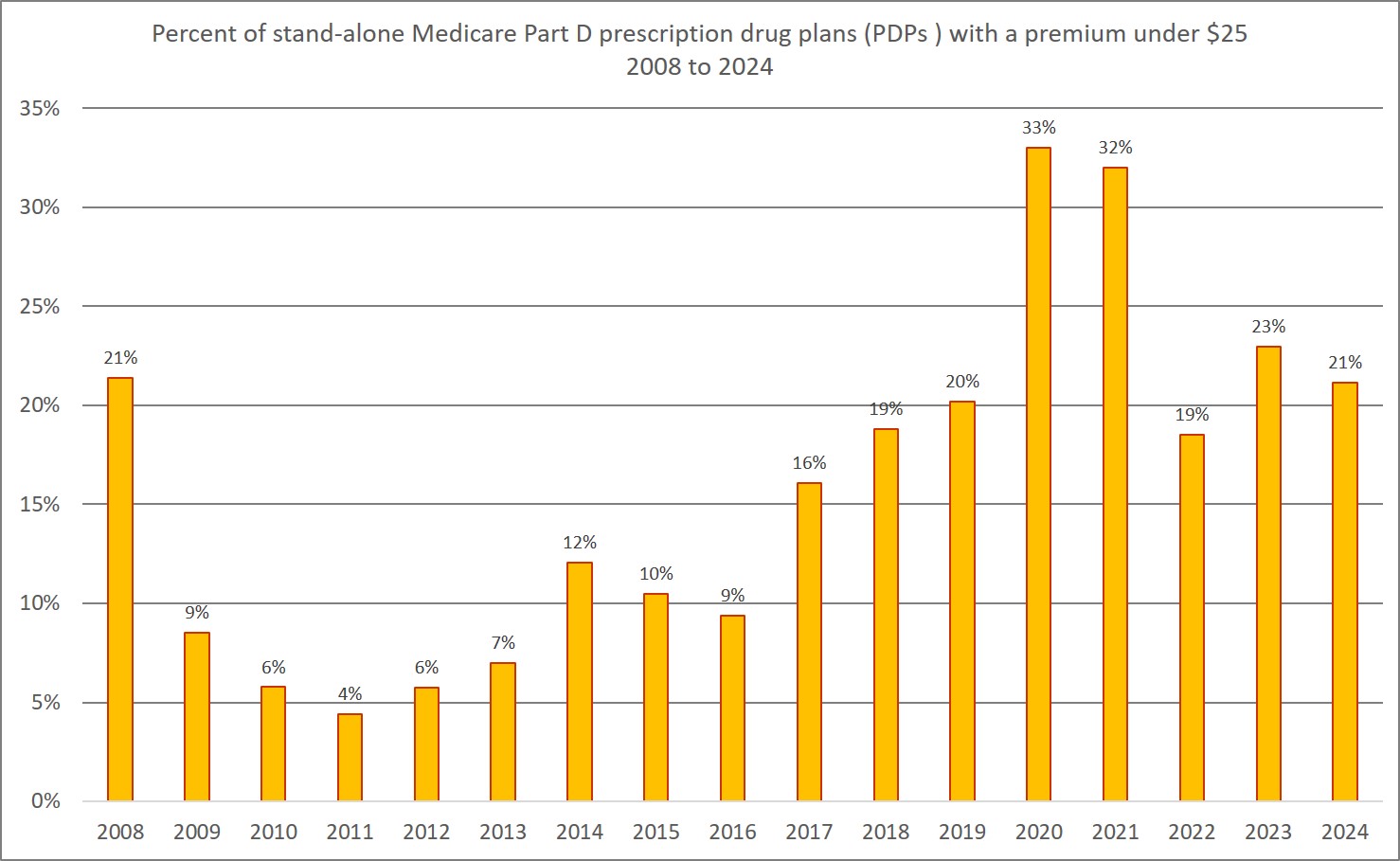

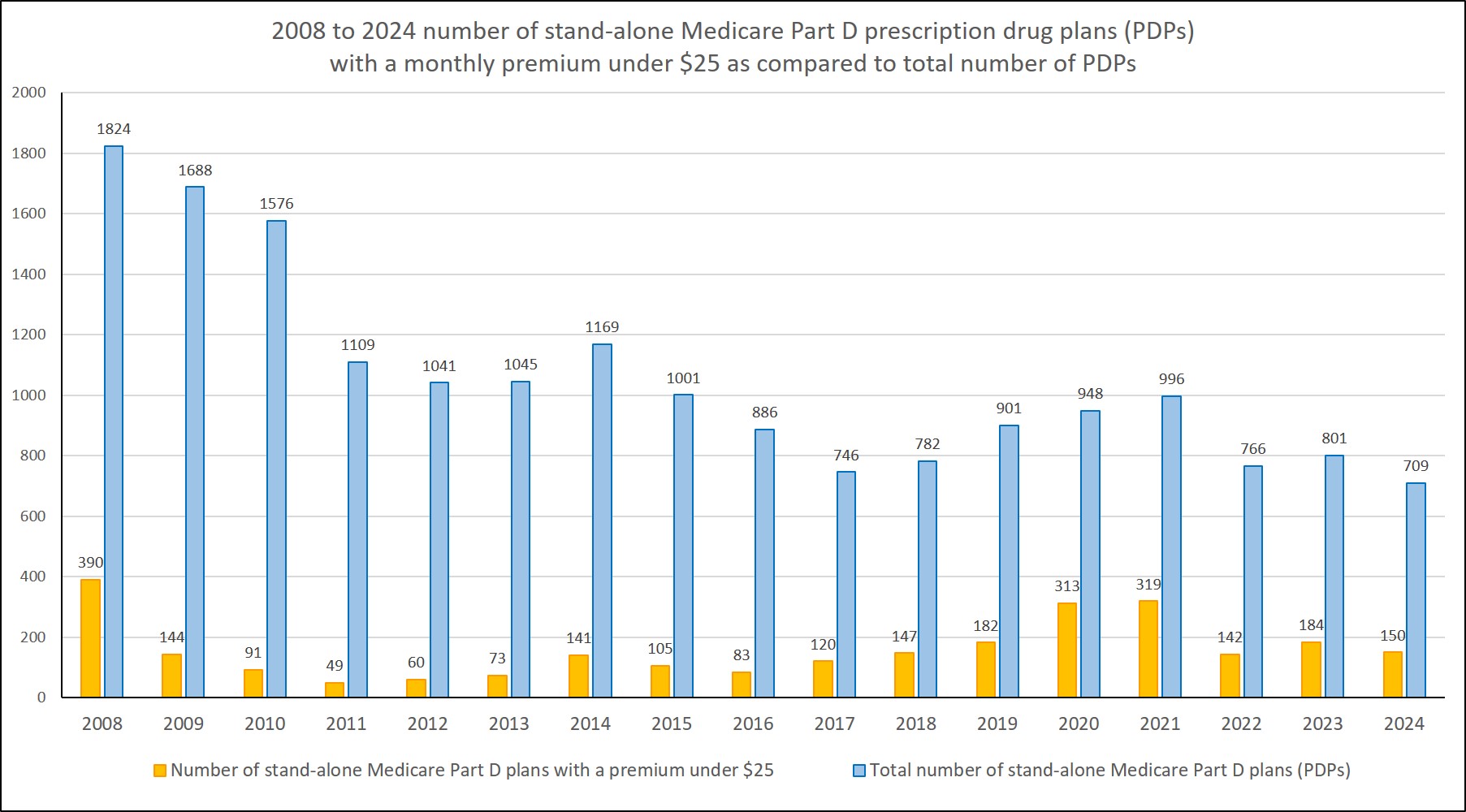

Our analysis of the 2024 PDP landscape also found a decrease in the number of PDPs with a premium under $25. Just over 21% of all stand-alone Medicare Part D plans will have a premium under $25 per month as compared to 23% of the 2023 PDPs with a premium under $25. For example, Medicare beneficiaries in Texas will find five (5) fewer 2024 Medicare Part D plans with premiums under $25 as compared to 2023. On a positive note, as we highlight in the next section, a Medicare Part D PDP with a premium of $0.50 or less is available in most states.

In addition, Medicare beneficiaries in Illinois and Texas will find that 23% of all 2024 Medicare Part D plans have premiums under $25. The chart below shows the total number of stand-alone Medicare Part D plans as compared to the number of PDPs across the country with a premium under $25.

Here are highlights of the 2024 stand-alone Medicare Part D PDP landscape from our PDP-Facts.com analysis:

(1) There will be 11.5% fewer 2024 stand-alone Medicare Part D plan options.

The total number of stand-alone 2024 Medicare Part D prescription drug plans across the country will decrease 11.5% to 709 plans from 801 PDPs currently offered in 2023 -- a loss of 92 plans. The average number of stand-alone 2024 Part D plans offered in each state is decreasing to 21 plans down from 24 plans per state in 2023.

Alabama and Tennessee will offer the most stand-alone 2024 Medicare Part D plan choices (24), the same number as offered in 2023.

New York will offer the smallest number of 2024 PDPs at 15 Medicare Part D plans.

Arizona will see the largest PDP decrease – losing seven (7) PDP options in 2024.

(2) The average 2024 stand-alone Medicare Part D premium will increase 21%.

In late-July, CMS forecasted a 1.8% decrease in the average Medicare Part D premium. CMS based their calculation on both stand-alone Medicare Part D PDPs and Medicare Advantage plans with drug coverage (MAPDs). Our preliminary analysis of only the stand-alone 2024 Medicare Part D PDPs indicates a 21% premium increase across all PDPs, based on current plan enrollment.

(3) As many as 73% of current 2023 Medicare Part D plan members (not considering LIS eligibility) may have increases in 2024 monthly premiums.

When the 2024 Part D PDP premiums are weighted by current 2023 Part D plan enrollment, we estimate that up to 73% of all Medicare Part D beneficiaries currently enrolled in a stand-alone 2023 Medicare Part D plan will see an average increase of $14.34 in their 2024 monthly premium -- unless they change coverage to a more affordable 2024 Medicare Part D or Medicare Advantage plan that includes prescription drug coverage (MAPD).

You can read more about changes to the Medicare Part D PDP premiums.

Important Extra Help reminder: If you are eligible for the Medicare Part D Low-Income Subsidy (LIS) and chose your own Part D plan in the past, you will receive a tan-colored notice from Medicare in early-November, informing you about your upcoming premium increase.

(4) Expect slightly fewer low-premium 2024 Medicare Part D plan options.

Our analysis of the 2024 PDP landscape also found a decrease in the number of PDPs with a premium under $25. Just over 21% of all stand-alone Medicare Part D plans will have a premium under $25 per month as compared to 23% of the 2023 PDPs with a premium under $25. For example, Medicare beneficiaries in Texas will find five (5) fewer 2024 Medicare Part D plans with premiums under $25 as compared to 2023. On a positive note, as we highlight in the next section, a Medicare Part D PDP with a premium of $0.50 or less is available in most states.

In addition, Medicare beneficiaries in Illinois and Texas will find that 23% of all 2024 Medicare Part D plans have premiums under $25. The chart below shows the total number of stand-alone Medicare Part D plans as compared to the number of PDPs across the country with a premium under $25.

(5) Lows and Highs: The lowest premium and highest premium stand-alone 2024 Medicare Part D plans.

In most states the lowest 2024 Part D premium will be the Wellcare Value Script (PDP) with a premium of $0.00 to $0.50. The lowest PDP premium in 2023 was the SilverScript SmartSaver (PDP) in Oregon and Washington State with a premium of $1.60 ($3.30 per month in 2024).

The 2024 Medicare Part D plan with the lowest monthly premium - and a $0 initial deductible - is the Missouri Blue MedicareRx Plus (PDP) plan, with a premium of $68.90. The Wellcare Medicare Rx Value Plus (PDP) is the lowest priced $0 deductible plan in most other states with a premium of about $79.

The 2024 Medicare Part D

plan with the most expensive premium is the Blue Rx Complete (PDP) in Pennsylvania and West

Virginia at

$195.10 per month.

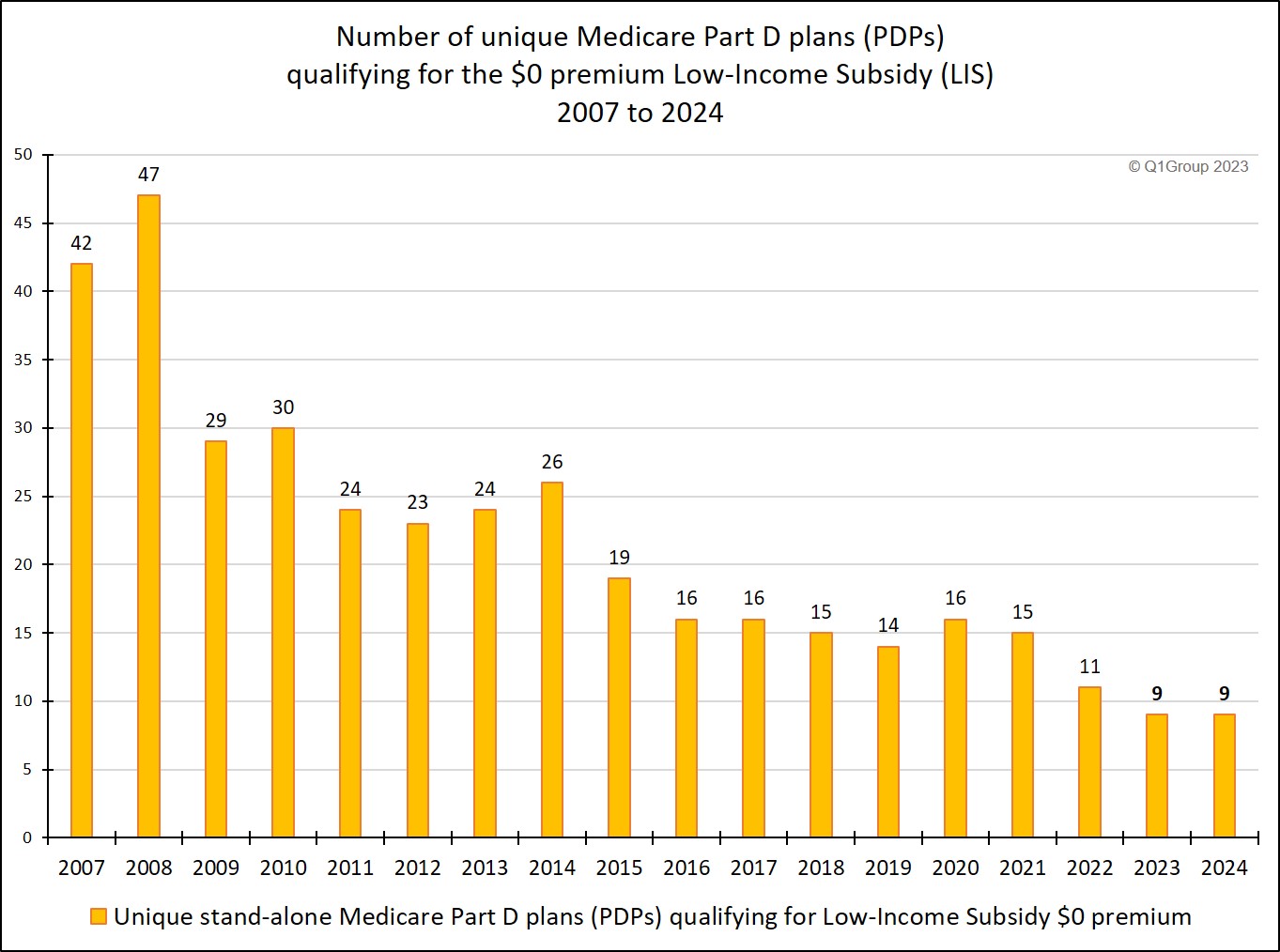

(6) Fewer 2024 Medicare Part D plans qualify for the LIS $0 premium.

There will be fewer 2024 Medicare Part D plans qualifying for the state’s Low-Income Subsidy (LIS) $0 benchmark premium across the country.

The states offering the smallest selection of $0 premium LIS plans are Florida, Illinois, Missouri, Nevada, New Jersey, New York, Ohio, and Texas – each with only two (2) $0 premium LIS plans in 2024. Wisconsin will offer the largest number of $0 premium LIS plans (7 plans).

You can click here to read more about $0 premium LIS plan availability and see a chart of how the average number of $0 LIS-qualifying Medicare Part D plans has changed since 2007.

(7) 85% of stand-alone 2024 Medicare Part D plans have an initial deductible.

As was true in 2023, most 2024 Medicare Part D plans will have an initial

deductible ranging from $100 to the 2024

standard initial deductible of $545.

In fact, about 85% of all 2024 stand-alone Medicare Part D PDPs will have some initial deductible - with the vast majority of these plans having a $545 initial deductible.

As an example, of the 21 plans available in Florida, only four 2024 stand-alone Medicare Part D plans will have a $0 initial deductible.

However, over 50% of 2024 Medicare Part D PDPs that include a deductible will exclude one or more low-costing drug tiers from the initial deductible.

In fact, about 85% of all 2024 stand-alone Medicare Part D PDPs will have some initial deductible - with the vast majority of these plans having a $545 initial deductible.

As an example, of the 21 plans available in Florida, only four 2024 stand-alone Medicare Part D plans will have a $0 initial deductible.

However, over 50% of 2024 Medicare Part D PDPs that include a deductible will exclude one or more low-costing drug tiers from the initial deductible.

(8) 29% of 2024 Medicare Part D plans will offer supplemental Donut Hole coverage.

The 2024 Donut Hole discount remains 75% for all formulary medications -- you pay 25% of retail for both brand-name and generic formulary medications purchased while in the Coverage Gap.

Even better, about 29% of all stand-alone 2024 Part D plans offer some level of additional gap coverage beyond the Donut Hole discount. For brand-name drug purchases in the Donut Hole, the 70% brand-name drug manufacturer’s Donut Hole discount is applied to this supplemental gap coverage.

(9) All 2024 Medicare Part D plans will offer insulin at a $35 (or less) copay.

Based on the Inflation Reduction Act, all 2024 stand-alone Medicare Part D prescription drug plans and Medicare Advantage plans with drug coverage (MAPDs) will offer all insulin found on the plan’s formulary for a copay of $35 (or less) through all phases of Part D coverage.

New in 2024, cost-sharing in the Catastrophic Coverage phase will be eliminated for all Medicare beneficiaries.

(10) All 2024 Medicare Part D plans will offer Part D vaccines at a $0 copay.

Also based on the Inflation Reduction Act, all 2024 stand-alone Medicare Part D prescription drug plans and Medicare Advantage plans with drug coverage (MAPDs) will offer $0 cost-sharing for vaccines that are recommended by the Advisory Committee on Immunization Practices (ACIP), such as Shingles and Pneumonia vaccines.

(11) Remember, all Medicare plans change each year.

You can review changes in Medicare plan features from 2023 to 2024 using our PDP-Compare.com/2024 or MA-Compare.com/2024.

- Your formulary (drug list) will change year-to-year, see

FormularyBrowser.com/2024 (updated as data is available)

- The 2024 standard deductible is increasing to $545, see PDP-Finder.com/2024 or MA-Finder.com/2024

- The 2024 initial coverage limit (Donut Hole entry) is increasing to $5,030

- The 2024 Total Out-of-Pocket (TrOOP) threshold is increasing to $8,000

- Beneficiary cost-sharing in the Catastrophic Coverage phase is eliminated.

Need an overview of stand-alone

Medicare Part D plans in your area?

If you would like to see an overview of your state’s Medicare Part D plan landscape, please use the following links to our interactive 2024 PDP-Facts: AK AL AR AZ CA CO CT DC DE FL GA HI IA ID IL IN KS KY LA MA MD ME MI MN MO MS MT NC ND NE NH NJ NM NV NY OH OK OR PA RI SC SD TN TX UT VA VT WA WI WV WY National Statistics.

Please note: The above information is from our Medicare Part D plan landscape summaries and based on stand-alone Medicare Part D prescription drug plans – and does not include the U.S. territories.

Question: Can we skip the numbers and just read about our state’s Medicare Part D plan changes?

Yes you can. We provide a written summary of how 2023 Medicare Part D plans are changing in 2024 for each state, just look for the "Summarized in Plan Text" link on our PDP-Facts.com state pages. For example, you can click here to read more about drug plan changes in Arizona, such as:

"Arizona 2024 Medicare Part D premium increases and decreases:

Of the 28 Medicare Part D plans available in Arizona for 2024, 6 plan(s) will lower their premiums and 20 will increase their premiums. Currently, 68.4% of Arizona residents enrolled in a stand-alone Medicare Part D plan are enrolled in one of the 20 plans with a premium increase. The average premium increase for members of these plans will be $6.80 per month."

What about 2024 Medicare Advantage plans?

The 2024 Medicare Advantage plan landscape summary will be presented in our next newsletter. A number of 2024 Medicare Advantage plans (MA/MAPD / MSA / SNP) may be available in your area and may include prescription drug coverage, along with Medicare Part A (hospitalization coverage), Medicare Part B (out-patient and physician coverage), and additional healthcare (and non-health-related) benefits.

You can use our Medicare Advantage plan finder (MA-Finder.com) for an overview of plans in your area (enter your ZIP to get started).

Q1Medicare®, Q1Rx®, and Q1Group® are registered Service Marks of Q1Group LLC and may not be used for any commercial purposes without the express authorization of Q1Group.

Copyright Q1Group LLC, Saint Augustine, Florida (2023)

If you would like to see an overview of your state’s Medicare Part D plan landscape, please use the following links to our interactive 2024 PDP-Facts: AK AL AR AZ CA CO CT DC DE FL GA HI IA ID IL IN KS KY LA MA MD ME MI MN MO MS MT NC ND NE NH NJ NM NV NY OH OK OR PA RI SC SD TN TX UT VA VT WA WI WV WY National Statistics.

Please note: The above information is from our Medicare Part D plan landscape summaries and based on stand-alone Medicare Part D prescription drug plans – and does not include the U.S. territories.

Question: Can we skip the numbers and just read about our state’s Medicare Part D plan changes?

Yes you can. We provide a written summary of how 2023 Medicare Part D plans are changing in 2024 for each state, just look for the "Summarized in Plan Text" link on our PDP-Facts.com state pages. For example, you can click here to read more about drug plan changes in Arizona, such as:

"Arizona 2024 Medicare Part D premium increases and decreases:

Of the 28 Medicare Part D plans available in Arizona for 2024, 6 plan(s) will lower their premiums and 20 will increase their premiums. Currently, 68.4% of Arizona residents enrolled in a stand-alone Medicare Part D plan are enrolled in one of the 20 plans with a premium increase. The average premium increase for members of these plans will be $6.80 per month."

What about 2024 Medicare Advantage plans?

The 2024 Medicare Advantage plan landscape summary will be presented in our next newsletter. A number of 2024 Medicare Advantage plans (MA/MAPD / MSA / SNP) may be available in your area and may include prescription drug coverage, along with Medicare Part A (hospitalization coverage), Medicare Part B (out-patient and physician coverage), and additional healthcare (and non-health-related) benefits.

You can use our Medicare Advantage plan finder (MA-Finder.com) for an overview of plans in your area (enter your ZIP to get started).

Q1Medicare®, Q1Rx®, and Q1Group® are registered Service Marks of Q1Group LLC and may not be used for any commercial purposes without the express authorization of Q1Group.

Copyright Q1Group LLC, Saint Augustine, Florida (2023)

News Categories

Have a Prescription Not Covered by Your Medicare Plan?

Prescription Discounts are

easy as 1-2-3

easy as 1-2-3

- Locate lowest price drug and pharmacy

- Show card at pharmacy

- Get instant savings!

Your drug discount card is available to you at no cost.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service