Special Enrollment Period for Service Area Reduction (SAR SEP): When your Medicare Part D or Medicare Advantage plan is cancelled or not offered next year.

If you are enrolled in a Medicare Advantage plan (MA or MAPD) or Medicare Part D plan (PDP) that is no longer offered next year (and you are not automatically "crosswalked" or transferred to another Medicare plan), you will be without Medicare plan coverage

starting January 1st - unless you enroll in another Medicare Advantage plan or Medicare Part D plan that is being offered for

the next plan year.

Question: What happens when my Medicare plan is discontinued next year?

If you are enrolled in a Medicare Advantage plan (MA or MAPD) that will be discontinued next year, you will be returned to your Original Medicare Part A and Medicare Part B coverage. And - if your discontinued Medicare Advantage plan included prescription drug coverage (MAPD), you will be without prescription coverage for the next year - again, unless you enroll in a different Medicare Advantage plan (MAPD) or select stand-alone Medicare Part D prescription drug plan (PDP).

Question: What happens when my Medicare plan is discontinued next year?

If you are enrolled in a Medicare Advantage plan (MA or MAPD) that will be discontinued next year, you will be returned to your Original Medicare Part A and Medicare Part B coverage. And - if your discontinued Medicare Advantage plan included prescription drug coverage (MAPD), you will be without prescription coverage for the next year - again, unless you enroll in a different Medicare Advantage plan (MAPD) or select stand-alone Medicare Part D prescription drug plan (PDP).

Question: How many people are usually affected by annual Medicare plan terminations?

About 1.3 million people are currently enrolled in non-renewing 2023 Medicare Part D or Medicare Advantage plans and may lose their Medicare plan coverage unless they choose to enroll in another 2024 Medicare Part D or Medicare Advantage plan.

In 2022, Almost 1.45 million people were enrolled in non-renewing 2022 Medicare Part D or Medicare Advantage plans and lost their Medicare plan coverage unless they chose a different 2023 Medicare Part D or Medicare Advantage plan during the AEP.

Important: You have two specific opportunities to join another Medicare plan when your Medicare plan is discontinued.

(1) AEP - You can join a new Medicare Part D or Medicare Advantage plan during the annual Open Enrollment Period (AEP or Annual Coordinated Election Period) that runs each year from October 15th through December 7th. If you join a new Medicare plan during the AEP, your coverage will begin January 1st.

(2) SEP - If you miss your annual enrollment opportunity (AEP), you will be granted a Special Enrollment Period (SEP) allowing you to join a Medicare Part D or Medicare Advantage plan outside of during the Annual Enrollment Period (AEP). Because your Medicare plan is not being offered next year, your Service Area Reduction Special Enrollment Period (SEP SAR) begins on December 8 and continues through the end of February.

Question: How do I use the SAR Special Enrollment Period to get Medicare plan coverage for next year?

Call a Medicare representative at 1-800-633-4227 and explain your situation (you were enrolled in a 2023 Medicare plan that is not offered in 2024, and you missed the AEP deadline, and you would like to use the SAR SEP to join a 2024 Medicare Part D or Medicare Advantage plan). A Medicare representative can help you find a Medicare plan that most economically covers your health and prescription needs and can process your enrollment into the plan using the SAR SEP.

Note: If you miss both the AEP and SAR SEP - you may be able to use another Special Enrollment Period to join a Medicare plan outside of the usual enrollment periods. To learn more you should contact a Medicare representative (1-800-Medicare) and ask about other opportunities to join a Medicare plan during the plan year.

Your Medicare plan enrollment becomes effective the first day of the month after enrollment. For example, if you use the SAR SEP and enroll on December 20th, you still will have Medicare plan coverage starting January 1st. But if you enroll into a new Medicare plan during February, your coverage begins on March 1st - and you will be without Medicare plan coverage for January and February.

The difference between Medicare plan mergers, plan consolidations, and plan terminations . . .

EXAMPLE #1 - Your Medicare Advantage plan is no longer offered next year

If you are enrolled in 2023 Medicare Advantage plan "ABC" and plan "ABC" is not offered in 2024 due to the plan's termination, you should choose a different Medicare Part D plan or Medicare Advantage plan during the annual Open Enrollment Period. But if you miss the December 7th AEP enrollment deadline, you will still be granted a Special Enrollment Period (SAR SEP) giving you more time to join a 2024 Medicare plan.

The SAR Special Enrollment Period starts December 8th and continues through the end of February with plan coverage starting the first day of the month after enrollment. If you do not join a Medicare plan before the end of the SAR SEP, you will be without Medicare Part D or Medicare Advantage plan coverage for the remainder of the year - unless you can take advantage of another Special Enrollment Period.

EXAMPLE #2 - Your Medicare Advantage plan is being merged into another plan next year

You are enrolled in 2023 Medicare Advantage plan "ABC" and "ABC" plan is being consolidated or merged into 2024 Medicare Advantage plan "XYZ". If you don't want to be enrolled in plan "XYZ" for 2024, you will need change your Medicare plan during the annual Open Enrollment Period (October 15th through December 7th), otherwise you will automatically be "crosswalked", that is moved to the 2024 "XYZ"Medicare Advantage plan.

If you miss the December 7th AEP enrollment deadline, you will have coverage through Medicare Advantage plan "XYZ" for 2024, unless you can find some other Special Enrollment Period that applies to you. But the Service Area Reduction Special Enrollment Period (SAR SEP) is not available to you.

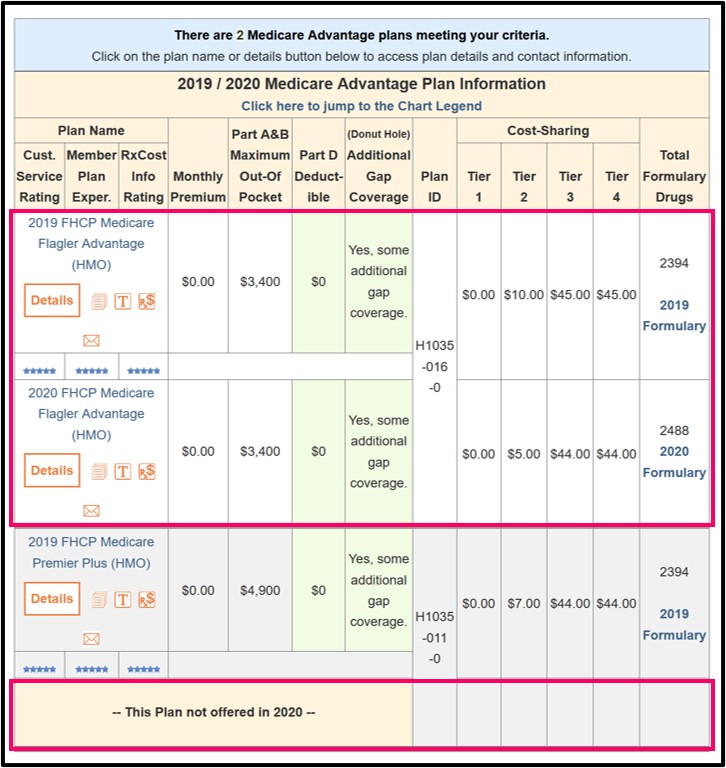

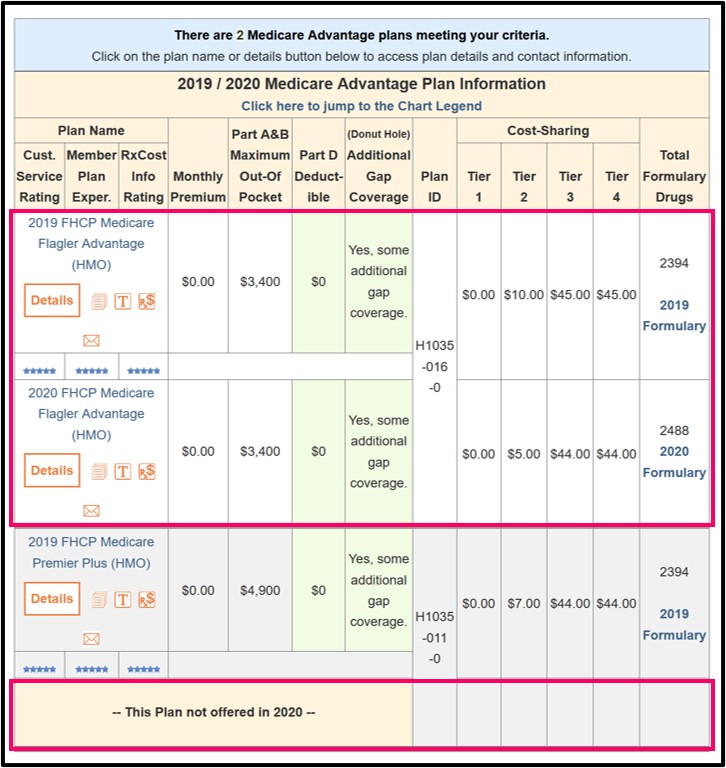

Important: Annual Medicare Part D and Medicare Advantage plan changes and plan crosswalks (reassignments) can be viewed in our PDP-Compare and MA-Compare tools.

These Q1Medicare tools highlight changes in Medicare plan features from one plan year to the next and can be accessed directly at PDP-Compare.com and MA-Compare.com.

Tip: As a short-cut to Medicare Part D plans, you can see plans in your state by following the link with your state code: for example: PDP-Compare.com/FL. For Medicare Advantage plans, following the MA-Compare link with your ZIP code: For example: MA-Compare.com/90001.

Call a Medicare representative at 1-800-633-4227 and explain your situation (you were enrolled in a 2023 Medicare plan that is not offered in 2024, and you missed the AEP deadline, and you would like to use the SAR SEP to join a 2024 Medicare Part D or Medicare Advantage plan). A Medicare representative can help you find a Medicare plan that most economically covers your health and prescription needs and can process your enrollment into the plan using the SAR SEP.

Note: If you miss both the AEP and SAR SEP - you may be able to use another Special Enrollment Period to join a Medicare plan outside of the usual enrollment periods. To learn more you should contact a Medicare representative (1-800-Medicare) and ask about other opportunities to join a Medicare plan during the plan year.

Your Medicare plan enrollment becomes effective the first day of the month after enrollment. For example, if you use the SAR SEP and enroll on December 20th, you still will have Medicare plan coverage starting January 1st. But if you enroll into a new Medicare plan during February, your coverage begins on March 1st - and you will be without Medicare plan coverage for January and February.

The difference between Medicare plan mergers, plan consolidations, and plan terminations . . .

EXAMPLE #1 - Your Medicare Advantage plan is no longer offered next year

If you are enrolled in 2023 Medicare Advantage plan "ABC" and plan "ABC" is not offered in 2024 due to the plan's termination, you should choose a different Medicare Part D plan or Medicare Advantage plan during the annual Open Enrollment Period. But if you miss the December 7th AEP enrollment deadline, you will still be granted a Special Enrollment Period (SAR SEP) giving you more time to join a 2024 Medicare plan.

The SAR Special Enrollment Period starts December 8th and continues through the end of February with plan coverage starting the first day of the month after enrollment. If you do not join a Medicare plan before the end of the SAR SEP, you will be without Medicare Part D or Medicare Advantage plan coverage for the remainder of the year - unless you can take advantage of another Special Enrollment Period.

EXAMPLE #2 - Your Medicare Advantage plan is being merged into another plan next year

You are enrolled in 2023 Medicare Advantage plan "ABC" and "ABC" plan is being consolidated or merged into 2024 Medicare Advantage plan "XYZ". If you don't want to be enrolled in plan "XYZ" for 2024, you will need change your Medicare plan during the annual Open Enrollment Period (October 15th through December 7th), otherwise you will automatically be "crosswalked", that is moved to the 2024 "XYZ"Medicare Advantage plan.

If you miss the December 7th AEP enrollment deadline, you will have coverage through Medicare Advantage plan "XYZ" for 2024, unless you can find some other Special Enrollment Period that applies to you. But the Service Area Reduction Special Enrollment Period (SAR SEP) is not available to you.

Important: Annual Medicare Part D and Medicare Advantage plan changes and plan crosswalks (reassignments) can be viewed in our PDP-Compare and MA-Compare tools.

These Q1Medicare tools highlight changes in Medicare plan features from one plan year to the next and can be accessed directly at PDP-Compare.com and MA-Compare.com.

Tip: As a short-cut to Medicare Part D plans, you can see plans in your state by following the link with your state code: for example: PDP-Compare.com/FL. For Medicare Advantage plans, following the MA-Compare link with your ZIP code: For example: MA-Compare.com/90001.

Browse FAQ Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service